South African Rand Seeks Retest of 2021 Highs after SARB Signals Ease with Rally

- Written by: James Skinner

- ZAR eyes retest of earlier highs after SARB

- SARB upgrades forecasts, acknowledges ZAR rally

- Economic recovery & oil prices seen stoking CPI risks

- But ZAR rally helps constrain inflation

Image © Adobe Images

- GBP/ZAR reference rates at publication:

- Spot: 19.78

- Bank transfer rates (indicative guide): 18.00-18.20

- Transfer specialist rates (indicative): 19.60-19.64

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The Rand outperformed on Thursday after the South African Reserve Bank signalled ease with the currency’s 2021 rally when staying a steady policy course for the month of May, leading USD/ZAR to dive bomb the 14.0 handle as the South African unit appeared to set its sights on new highs.

South Africa’s Rand pushed an already retreating Dollar even further back on Thursday, leading it to outperform all major developed market currencies in the process while also giving stiff competition to the Polish Zloty which had otherwise cleared the currency market board of all opposition heading toward the final session of the week.

The Rand accelerated after the South African Reserve Bank (SARB) upgraded its 2021 economic growth forecast and shaved a fraction off of its inflation forecast for the current year before warning that risks to consumer prices are tilted to the upside.

Inflation risks are why the SARB’s quarterly projection model continued to advocate a 25 basis point increase to the bank’s benchmark interest rate in each of the second and fourth quarters, which would take the cash rate up from 3.5% to 4% by year-end.

“The SARB model sees the key rate at 4.07% by end 2021 and at 5.02% at the end of 2022. The rand strengthens slightly after the SARB decision with USD/ZAR trading at 14.00,” says Mathias Van der Jeugt, head of research at KBC Markets in Brussels.

Above: USD/ZAR shown at hourly intervals alongside GBP/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The cash rate was left unchanged on Thursday following a unanimous decision by the monetary policy committee although the prospect of inflation rising further above the 4% midpoint of the SARB’s 3%-to-6% target this year or next was enough to keep the bank’s model advocating interest rate rises.

Inflation rose from 3.2% to 4.4% in April but could rise further in the months ahead due to a mixture of statistical base effects, movements in oil prices and an anticipated South African economic recovery, which would risk drawing interest rate rises from the SARB, although the bank recognised on Thursday that the Rand’s steamrolling 2021 rally has been helping to reign in those upside inflation risks in recent months by reducing the cost of imported goods.

“Going forward, a stronger exchange rate, ongoing moderation of unit labour costs, and sustained economic slack are expected to offset higher electricity and food price inflation, keeping the headline inflation forecast relatively stable,” says Governor Lesetja Kganyago in the SARB’s May monetary policy statement.

“Expectations of future inflation have broadly stabilised at around 4% for 2021 and 4.2% for 2022,” he said.

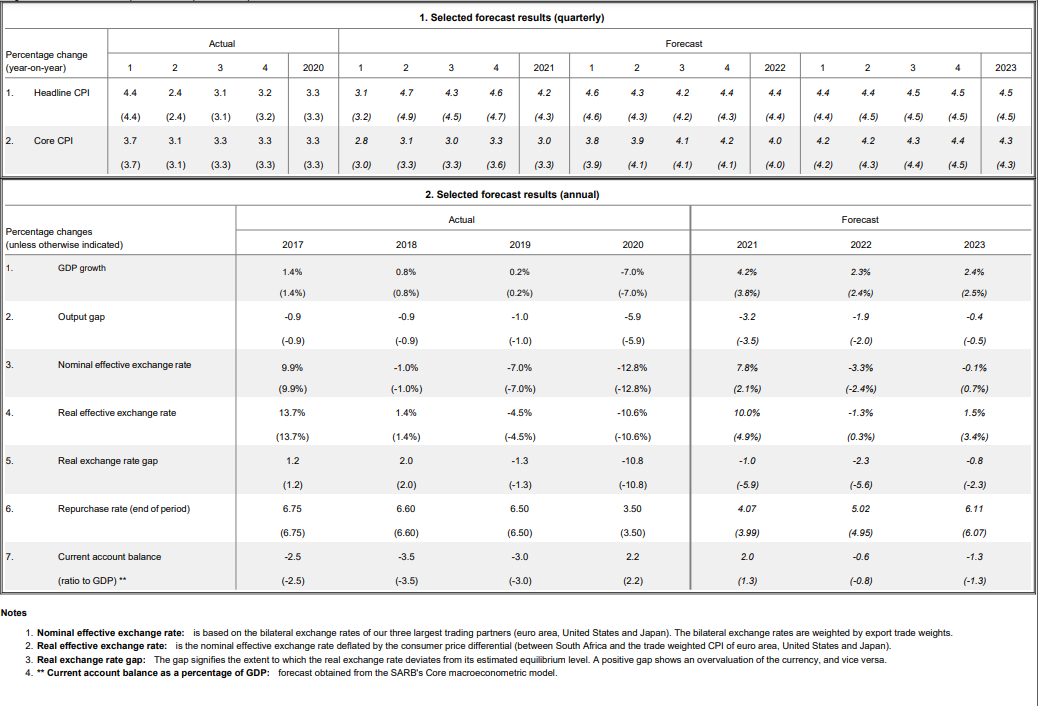

Above: South African Reserve Bank forecasts, May 2021.

The Reserve Bank now expects South Africa’s economy to grow by 4.2% this year, up from 3.8% at the time of the April policy statement and partially reversing a 7% decline seen in 2020, although growth in 2022 and 2023 was seen around 10 basis points weaker in each year than previously.

The main inflation rate was seen coming in around 4.2% for this year, down from 4.3% in the prior meeting with expectations for 2022 and 2023 left unchanged at 4.4% and 4.5% respectively.

“The overall risks to the inflation outlook appear to be to the upside,” the statement warned.

Meanwhile, SARB rate setters revised up their expectations for the South African Rand compared to major trade-partner currencies with the nominal-effective-exchange-rate or trade-weighted exchange rate seen coming in 7.8% higher for 2021.

SARB forecasts suggest the bank also anticipates that the Rand will only give back a small portion of that gain in 2022 and subsequent years whereas back in April the trade-weighted Rand was expected to rise by only 2.1% this year before falling by a larger -2.4% next year.

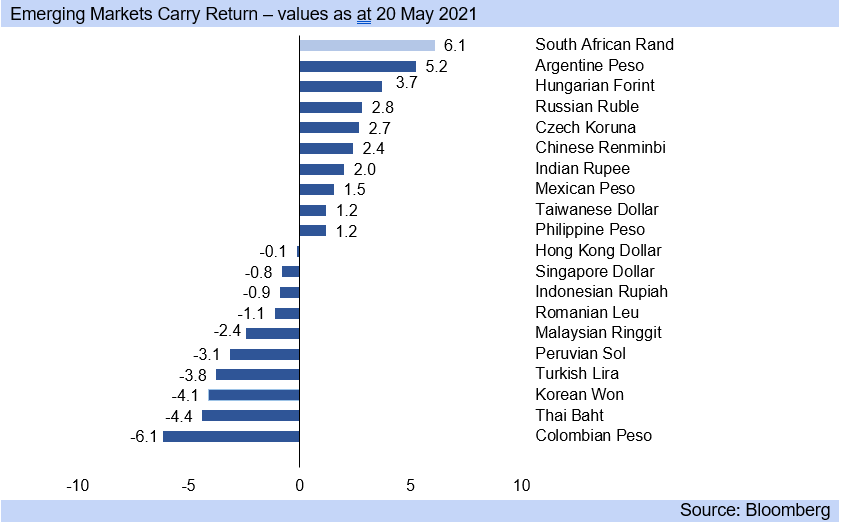

Above: Investec graph showing incremental returns earned by investors in emerging market bonds.

“Risk-on sentiment in global financial markets has been a key driver of the rand’s appreciation, as have the strength of commodity prices in the current boom, but SA itself is showing some progress, albeit slow, on structural reform and the outlook has brightened,” says Annabel Bishop, chief economist at Investec.

The commodity-sensitive Rand has outperformed all of its largest developed and emerging market currencies over multiple horizons this year, aided by an improvement in domestic infection trends that has enabled the economy to reopen and operate with lesser hindrance.

Meanwhile, the Rand’s ‘fair value’ or underlying fundamental value perceived by commercial bank financial models has risen sharply as a result, although it could soon benefit from further domestic and fundamental tailwinds if South Africa’s political leaders are able to make progress with domestic structural economic reforms.

"The repair and resolution of SA’s main structural challenges and constraints to strong economic growth remains key, including limitations on electricity and water supply and SA’s transport systems and onerous bureaucracy. However, quicker reforms will quicken growth,” Bishop says.

“SA could see an even faster economic growth trajectory out to 2026, and higher levels of employment and incomes, if it achieves Vulindlela quickly, instead of the slow pace of implementation since 2018,” adds Bishop.

Above: USD/ZAR shown at monthly intervals with Fibonacci retracements of 2018 uptrend, 2011 trendline and GBP/ZAR.