South African Rand Rides Out Global Bond Rout but Risks a Reckoning with SARB Later in 2021

- Written by: James Skinner

Image © GovernmentZA

- GBP/ZAR spot rate at time of writing: 20.88

- Bank transfer rate (indicative guide): 20.08-20.23

- FX specialist providers (indicative guide): 20.50-20.66

- More information on FX specialist rates here

The Rand outperformed Thursday and may remain on its front foot if Commerzbank is right that the South African unit will weather any further turbulence in the bond market, although the South African Reserve Bank (SARB) could still weigh on the currency later in 2021, according to BofA Global Research.

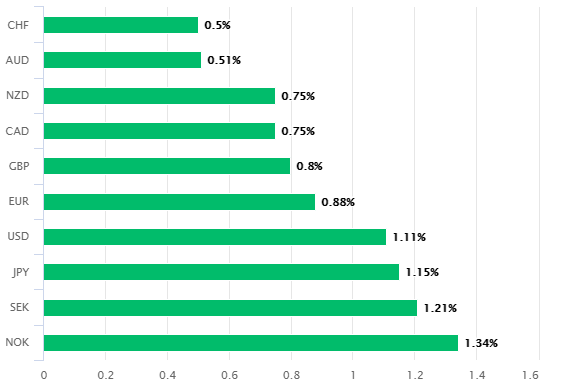

South Africa's Rand rose against all of its major developed and emerging market rivals except the Brazilian Real on Thursday as the Dollar, American bond yields and safe-haven currencies like the Japanese Yen declined broadly, with this combination sending the Pound-to-Rand rate -0.45% lower to 20.88.

This was as Washington's latest support package for companies and households, which includes provision for cheques of up to $1,400 to be sent to qualifying households and has been dubbed the 'American Rescue Plan', made its way to President Joe Biden's desk.

Price action also followed a large U.S. government bond auction that went without hitch despite fears of lacklustre demand, which were rooted in market perceptions of the outlook for Federal Reserve (Fed) interest rates.

This helped the Rand overlook lower-than-expected mining and manufacturing production data for January where mining output fell by -6.2% for the year to month-end, according to Statistics South Africa, while consensus looked for only a -1.9% decline. Manufacturing fell -3.4% when consensus eyed a -1% fall.

"The rise in yields is attributed mostly to the liquidity effect of tapering on US bond markets rather than the prospect of higher US policy rates. As long as US rate hikes remain far in the future, which is our base case, we are unlikely to see significant US dollar strength which in turn should help keep EM FX weakness against USD contained," says Thu Lan Nguyen, an analyst at Commerzbank.

Above: South African Rand performance against major currencies on Thursday. Source: Pound Sterling Live.

"The market has already priced in a more optimistic economic outlook and with that an eventual Fed tapering to a large extent. This by itself already argues for a more moderate reaction of EM currencies to an actual tapering announcement. But there is more," Nguyen writes in a research note.

USD/ZAR fell back below the 15.0 handle on Thursday and GBP/ZAR beneath 21.0 as the Rand extended a now-week-long from near three-month lows seen in early March and at the height of global bond market rout that gathered momentum in Washington and other capitals during February, leading government yields and financing costs to rise so fast the moves briefly toppled stock and commodity markets while lifting the U.S. Dollar against most other developed and emerging market currencies.

The whole affair was reminiscent of the infamous 2013 'taper tantrum' that lifted American bond yields before derailing stocks and commodities with even more gusto than was the case this time. That was after the Fed said it would eventually need to 'take the punch bowl away' by ending its post-financial crisis quantitative easing programme, opening an episode that had global consequences that many feared would be even worse for currencies and bonds of emerging market economies like South Africa.

"First of all, it turned out that Emerging Markets at large were not as vulnerable to a wind-down of global liquidity as feared. That is we did not see a collapse of Emerging Market economies and/or currencies," writes Tatha Ghose, a Commerzbank colleague of Nguyen's, referring to the 2013 taper tantrum. "Secondly, the assumption that tapering would equal the beginning of a normalization process which included US policy rate hikes turned out to be wrong. Rather it took another 14 months after the end of the QE program before the Fed started to hike its Fed Funds rate."

This time things are different and there are reasons for why the Rand could be more resilient. Not least of all that the preceding crisis was not a credit crisis that sent capital running for the hills, but a health crisis with economic implications which have been managed with the assistance of central banks.

Above: USD/ZAR shown at daily intervals with GBP/ZAR (yellow) and 10-year South African government bond yield.

Commerzank says this means the Rand is unlikely to see more than moderate and temporary losses if debt markets fall apart again and still forecasts USD/ZAR will end the year around 14.50, after averaging 15.0 during the coming quarters. Others are less optimistic however.

"The South African Reserve Bank (SARB) should stay on hold but with an increasingly hawkish tone, watching core rates, ZAR and fiscal risks. Markets price 105bp hikes in the next 12 months," says Jure Jeric, a cross asset strategist at BofA Global Research, who's a seller of the Rand. "The core rates volatility makes EM FX vulnerable and ZAR is among the most vulnerable currencies given its bellwether status alongside fiscal execution risks."

Jeric sees investors being disappointed by the SARB later this year with adverse consequences for the Rand given market expectations for more than 100 basis points of interest rate rises to be announced over the coming quarters. BofA Global Research forecasts suggest the SARB will eventually decide to leave its cash rate unchanged, which could upset the Rand if and when it eventually dawns on the market. Jeric and the BofA team are sellers in anticipation of a USD/ZAR rally to 16.55 up ahead.

The SARB's quarterly projection model most recently indicated that 50 points of rate rises could be necessary before year-end, although two of six SARB rate setters actually voted cut rates further at the same meeting, leaving muddy waters in their wake in terms of the outlook.

The model could eventually drop its recommendation, or delay the advocated date of implementation, as it recognises difficulties that still lay ahead of the economy. The SARB expects South Africa's economy to grow 3.6% in 2021, although this would only begin to reverse 2020 's -7% fall.

"ZAR's main vulnerability in an environment of elevated global rates volatility is the very high foreign ownership of the local bond market. Real money investors (foreign) are very overweight SAGBs (in absolute terms)," Jeric says. "There is scope for a vicious cycle between weaker FX, tightening domestic financial conditions and growth expectations. Finally, higher bond yields interact negatively with the fiscal plan which we continue to see as vulnerable (i.e. execution risks). In addition, technicals are also supportive of weaker rand. A double bottom pattern is forming supported by RSI divergence, a bullish MACD cross and bases in other USD/EM charts."

Above: USD/ZAR shown at weekly intervals with technical indicators and analysis. Source: Bofa Global Research