South African Rand Unravels as Lockdown Speculation Swirls

- Written by: James Skinner

- ZAR hits bottom of bucket on fears of new lockdown.

- Ramaphosa set to address country on Wednesday

- Infections, deaths mount as new strain proliferates.

- Vaccine rollout sped up but effectivenesss uncertain.

Image © Government of South Africa, reproduced under CC licensing

- GBP/ZAR spot rate at time of writing: 20.27

- Bank transfer rate (indicative guide): 19.56-19.71

- FX specialist providers (indicative guide): 19.97-20.13

- More information on FX specialist rates here

The South African Rand was unravelling on Tuesday and remained the worst performing major emerging market currency for the week amid speculation suggesting President Cyril Ramaphosa could announce a new national shutdown later this week.

South Africa's Rand was lower against all major developed and emerging market rivals for the session as well as the recent week on Tuesday as local press reported that President Cyril Ramaphosa is expected to address the nation on Wednesday night.

Speculation is that he could announce an intention to return South Africa to a more stringent form of 'lockdown' after new coronavirus infections and deaths both threatened to set new record highs this week, and as uncertainty remained over the scale of the challenge posed by a new, more infectious variant of the disease in South Africa.

"While the rollout plan is a very positive move, concerns will centre on government’s ability to deliver, particularly in the logistics chain given the low temperature the vaccines need to be kept at, and so Eskom’s ability to deliver consistent electricity supply a key worry too," says Annabel Bishop, chief economist at Investec.

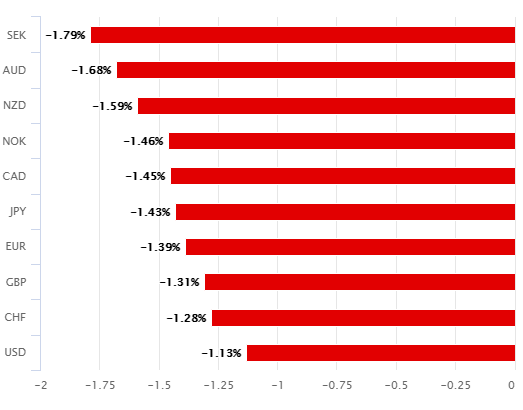

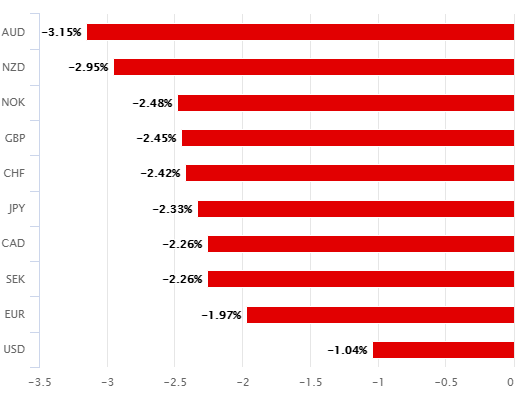

Above: Rand's performance against major currencies Tuesday (left) and for the week (right).

The new strain of coronavirus detected in South Africa, currently referred to as 501.V2, is more infectious than other variants and may even be resistant to the vaccines which being rolled out in Europe, North America and now South Africa too. Government scientists are investigating what implications it will have for the effectiveness of existing vaccines, while also hedging their bets by attempting to bring forward the procurement of as many doses as possible.

Health Minister Dr Zweli Mkhize said on Sunday the government hopes to have some doses available as early as February where before South Africa wasn't expected to take delivery the vaccine until nearer to mid-year. An accelerated vaccine rollout is essential for minimising the time spent under lock and key by the already-fragile economy.

Already, and just last week, the country and economy was moved to "an adjusted Level 3," of a five-stage alert system under which indoor and outdoor gatherings have been banned, a night time curfew has been imposed and mask wearing is mandatory in public. Supposedly non-essential businesses are required to close from 20:00 while the "sale and transportation" of alcohol is banned, with South Africans facing fines and possible imprisonment for noncompliance.

"It is absolutely vital that SA does roll out vaccinations successfully, and as quickly as possible, as the country will attract little FDI without it, while lockdowns continue in attempts to control the spread of Covid-19 but damage economic activity, business and consumer confidence," Investec's Bishop says.

Above: USD/ZAR shown at weekly intervals with 200-week average and Fibonacci retracements of 2015 uptrend.

The Rand was an outperformer in late 2020 as a Dollar sell-off and fledgling economic recovery drew international investors toward the country's comparatively high bond yields, but the resurgent virus and resulting containment measures have seen the currency go from hero to zero in recent weeks.

Given the extent of the Rand's recent gains, any announcement of a fresh lockdown later this week could see the South African currency sell-off further. Previously USD/ZAR had been attempting to break beneath an important level of technical support around 14.50 on the charts although recent weeks have seen the exchange rate turn higher.

"USD/ZAR has been trading in a tight range above its 14.5044 December trough over the past few weeks. Between this level and the 200 week and 55 month moving averages at 14.4264/3563 we expect the cross to at least short-term stabilise," says Axel Rudolph, a senior technical analyst for currencies, commodities and bonds at Commerzbank. "Minor resistance sits between the 14.8799 December 9 low and the 14.9119 December 21 high and more resistance at the 15.4966/7362 November 12 and 30 highs. Strong resistance comes in between the June and October lows at 16.0838/3613."

Rudolph says Rand's uptrend is likely to remain intact so long as USD/ZAR continues to trade below 16.49, a level not seen since mid-October.

Above: GBP/ZAR shown at weekly intervals.

The nascent USD/ZAR rebound has also helped to lift the Pound-to-Rand rate back above the 20.0 level in recent days, despite a widespread underperformance by the Pound against other major currencies.

Sterling was lower against all major rivals Tuesday after the UK was placed back into 'lockdown' overnight in response to its own new, more infectious strain of coronavirus, which has ensured that the British currency got little respite after UK and EU leaders agreed terms of the future relationship last month.

"Following a pick-up in cases in late December, covid-19 trends (and associated restrictions) are once again weighing on markets. The UK is currently faring the worst – cases in England and Ireland are rising at a very rapid rate," says Imogen Bachra, a European rates strategist at Natwest Markets. "Most other Western European countries look to be past the peak of the second wave, but there are clear concerns about (a) the new, more-transmissible, virus strain and (b) a pick-up in cases following the festive period."

Speculation ahead of what is now the UK's third national shutdown ensured global markets got off to a shaky start during the first trading session of 2021 on Monday as investors weighed the disruption that it might yet cause in other countries and economies. The shutdown is expected to weigh heavily on the UK's services-dominated economy in the first quarter, following a year in which many economists expect GDP to have contracted by more than -10%.