South African Rand Cheers Dollar Fall but Upside Limited as Valuation Risks Lurk On Path Ahead

- Written by: James Skinner

Image © Adobe Images

- GBP/ZAR spot rate at time of writing: 20.90

- Bank transfer rate (indicative guide): 20.47-20.62

- FX specialist providers (indicative guide): 20.90-21.03

- More information on FX specialist rates here

The Rand advanced widely on Tuesday as voting began in the 2020 U.S. presidential election and investors bet confidently on an opposition victory, although whatever the outcome, upside for the South African currency is said to be limited amid ongoing declines in its fundamental value.

Rands were bought in exchange for most major developed and emerging market currencies, while stocks rose and the Dollar sunk as voting began in an election that's pivotal to the outlook for all assets.

"The local currency is currently trading at its best levels since March 2020, as a weaker USD, SARB bond activity and yield-seeking behaviour have seen the rand gain momentum," says Bianca Botes, an executive director at Peregrine Treasury Solutions. "From a technical perspective, we can set our sights on the R15.90/$ mark for now, with potential for a move towards R15.75, while rand weakness is expected to be capped at R16.50. The momentum will, however, be largely determined by the US election."

This was with the market continuing to view opposition candidate Joe Biden as a shoo-in for the White House and the Democratic Party as the likely victor in fiercely contested battles for both houses of Congress.

Above: Rand performance against major counterparts in month (20 trading days) to Tuesday. Source: Pound Sterling Live.

The popular view is that a Democrat-led White House would be likely to spend bigger than Republicans, further widening the U.S. budget deficit in the process and helping to sink the Dollar as a result.

A Biden presidency is seen as less likely to engage in trade conflict with China and the European Union, making that outcome more friendly and favourable for the global economy than a second innings of President Donald Trump.

"Consensus says Biden sweep. My gut tells me, not so fast. I still see highest odds scenario one of a contested/narrow Biden win overall, but damn it’s going to be long night," says Steen Jackobsen, chief investment officer at Saxo Bank.

The opposition does also however, have plans for higher taxes and more onerous regulations in some areas, meaning it's potentially a burden for the economic recovery and risk assets like stocks further down the line.

"In the last four hours we've seen significant support for Donald Trump on our US election market, both in terms of stakes and individual bets. In that period, 58% of money staked has been for Donald Trump, while he's also accrued 64% of the bets placed," says Callum Wilson, a spokesperson for Oddschecker.

Above: USD/ZAR shown at 4-hour intervals alongside Pound-to-Rand rate (yellow line, left axis).

"Pennsylvania is regarded by many experts to be the most crucial state for Joe Biden to win, and while the Democrats have been favourites in that market for a while, their position has weakened. The Republicans have been cut to as short as 13/10 this morning, with the Democrats drifting to 11/20," Wilson adds.

Investors have given short-shrift to the idea of a surprise victory for President Trump. As a result, the Dollar could rise sharply as other currencies fall in the event that Trump clinches the White House a second time.

Polling stations will close in some parts of the U.S. during the late evening hours on Tuesday while in other parts, it'll be the early hours of Europe's Wednesday morning before ballots begin to be counted.

"A contested election and spates of rioting would be an very unwelcome outcome, but one that has been widely touted. The huge number of votes already cast vindicate surveys that suggest this is an election which matters to the electorate more than most. In addition, the possibility of time lags to count postal votes, Trump’s concerns about electoral fraud and increased levels of hardship and joblessness could all stir civil unrest. On such an outcome the USD would likely be bid higher," says Jane Foley, a senior FX strategist at Rabobank. "Even on a Blue wave, the covid-19 crisis suggest that there could be a limit to how far risk appetite can be boosted and how far the USD can fall."

Results are expected for some individual states early on Wednesday but key swing states like Pennsylvania may not confirm theirs days after the ballot given an unprecedented number of postal votes and decision to allow those postmarked on election day to be counted in subsequent days.

Above: USD/ZAR shown at daily intervals alongside Pound-to-Rand rate (yellow line, left axis).

Delayed results could leave currencies and other markets cloaked in uncertainty for days, which might favour a Dollar rebound and weakness in the Rand.

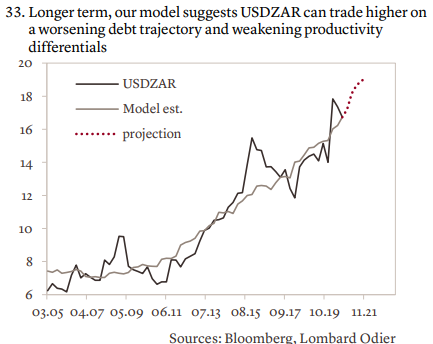

"ZAR is in our group of fragile EM currencies. That said, spot has been heavier than we assumed. We believe a key reason for this is the improvement in the country's balance of payments, driven by a move to a trade surplus given a sharp decline in imports. This could potentially continue for some time, preventing ZAR from depreciating," says Kiran Kowshik, an emerging market currency strategist at Lombard Odier. "However, once this adjustment is mature, we believe USDZAR will re-align to fundamentals that point to a trend rise in fair value from 16.80 currently to near 19.0 on a two-year view."

The Rand was at its highest level against the Dollar since March 10 and before the liquidity crisis that prompted the Federal Reserve (Fed) to pump an unprecedented amount of Dollars into the financial markets.

But with the greenback having what some see as only limited downside left to play out, while the Rand remains dogged by many old and now-familiar headwinds, some analysts are skeptical of suggestions USD/ZAR could fall much further.

"The fair value is driven by weakening productivity growth and higher debt levels," Kowshik says. "We think a 15.50-to-19.0 range remains appropriate for USDZAR based on our fair value estimates. While a stronger China is positive for many emerging markets, South Africa's share of total Chinese imports continues to decline, with the country having lost market share to other countries. (Australia, Indonesia, Brazil and Russia.) This suggests the marginal benefit from a Chinese recovery will be lower for the ZAR."

Above: Lombard Odier graph showing USD/ZAR alongisde fair value estimate and forecast.