South African Rand Topples as Risk Aversion Pervades after U.S. Election Timetable Thrown in Doubt

- Written by: James Skinner

-ZAR slides against all bar MXN, RUB as majors strengthen.

-As President Trump contracts virus, risk aversion pervades.

-ZAR may have topped out early on in rollercoaster quarter.

Image © Adobe Images

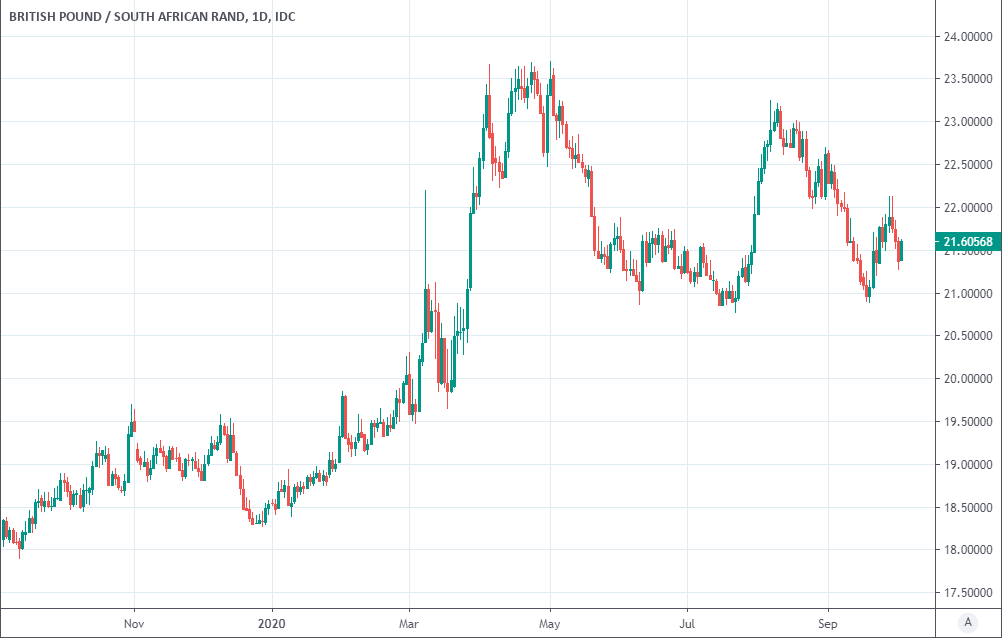

- GBP/ZAR spot rate at time of writing: 21.56

- Bank transfer rate (indicative guide): 20.80-20.95

- FX specialist providers (indicative guide): 21.23-21.36

- More information on FX specialist rates here

The Rand was in retreat from all major developed and emerging market rivals on Friday as investors flocked to safe-haven assets after President Donald Trump confirmed he’s contracted the coronavirus.

South Africa’s Rand clocked up a small advance over the Mexican Peso and Russian Rouble in the final session of the week but was otherwise universally lower as investors turned cautious and risk assets fell after President Trump and his wife Melania Trump entered quarantine in the White House.

The world and its markets now face an uneasy wait of unknown duration to hear if the 74-year old White House incumbent develops symptoms associated with the pneumonia-inducing disease after testing positive for it barely more than a month out from the U.S. election.

“Any normal person will hope that the First Couple and their family remain healthy. However, the path of the election campaign will inevitably change and uncertainty has obviously increased. I suspect Vice-President Pence gets more attention, and the VP debate with senator Kamala Harris in Utah on Wednesday will be a much higher profile event,” says Kit Juckes, chief FX strategist at Societe Generale. “For the FX market, there are a few points worth making. Firstly, we think a Trump win is more dollar-supportive than a Biden win, given trade policies and the focus of fiscal policy. Speculators are short dollars, partly because they think a Biden win is more likely. On that basis, increased pre-vote uncertainty is likely to help the dollar. “

Above: South African Rand performance against major currencies on Friday. Source: Pound Sterling Live.

A 10-day isolation period could suffice to ensure the November 03 ballot still goes ahead, although providing that Trump remains symptom free and the opposition Democratic Party camp retains a clean bill of health. Both he and the Democrats’ Joe Biden debated for 90 minutes on Wednesday and although this was a socially distanced debate, it’s not yet clear whether they or members of their teams who might also be infected came close enough to risk transmission.

“ZAR is a bigger mover, tracking the S&P futures move. Spot is seen at 16.73 at the time of writing. Note today the ANC will meet to discuss a draft economic recovery plan before it is submitted to the cabinet for approval. The meeting starts at 10am local time,” says Kurran Tailor, a strategist at CitiFX.

In the interim, uncertainty and risk aversion pervade, boosting the Dollar against many currencies and weighing on emerging markets at the beginning of what promises to be a rollercoaster final quarter. October is set to be dominated by questions of what the November 03 election outcome will be and could mean for geopolitics as well as the global economy. But it also brings the final chapter of the Brexit process, which might have an impact on the Euro and by implication, emerging market currencies like the Rand.

South Africa’s Rand has rallied earlier in the week even after the U.S. Dollar strengthened as investors celebrated stronger-than-expected PMI surveys and a positive surprise in the number of new vehicle sales, which both rose amid September’s reopening of the economy.

Above: USD/ZAR rate shown at daily intervals.

“It signals that the economy is gathering pace due to the gradual easing of restrictions,” says Elisabeth Andreae, an analyst at Commerzbank, of the week's data. “We assume that the further economic recovery over the coming months will continue to depend on the development of the pandemic and will be rather bumpy as a result, in particular as further support from monetary or fiscal policy seems unlikely, and will in fact probably come to an end.”

South Africa moved to Alert Level 1 last month, leading to a relaxation of the restrictions on everyday activity and the reopening of national borders to visitors from the outside world after mid-July declines in the number of new coronavirus infections detected each day were sustained through September.

The reopening gave the Rand a boost last month but October will see investor appetite tested by the latest medium-term budget update, which markets will scrutinise closely for new commitments that have a credible chance of reigning in the budget deficit and growth in the national debt pile.

Uncertainty about what the budget might reveal might, when combined with global developments and some analyst forecasts, mean the South African Rand has topped out for the time being.

"Our forecasts assume a gradual trend higher in USD/ZAR in the medium-term, though it is important to highlight that our skeptical view on reforms/fiscal consolidation is not out of consensus and this suggests that the hurdle for ZAR-positive surprises is low in the event the government succeeds or makes progress at a quicker pace than expected. If the external backdrop shows a significant turnaround (i.e. risk-on), that would pose a downside risk to our forecast profile," says Daria Parkhomenko, a strategist at RBC Capital Markets, who looks for USD/ZAR to end the year at 17.30 and for the Pound-to-Rand rate to finish around 22.14, both being higher than Friday’s levels.

Above: Pound-to-Rand rate shown at daily intervals.