South African Rand Volatility Seen Picking Up but Further Gains Favoured by Analysts by Year-end

- Written by: James Skinner

Image © Adobe Images

- GBP/ZAR spot rate at time of writing: 21.77

- Bank transfer rate (indicative guide): 21.00-21.16

- FX specialist providers (indicative guide): 21.44-21.57

- More information on FX specialist rates here

The Rand continued its recovery off September lows on Tuesday and is still widely expected to clock up further gains before year-end although volatility could increase over the coming days as investors digest the first of three U.S. election debates and its possible implications for the November 03 ballot.

South Africa’s Rand recovered its footing after an earlier wobble having opened the session around 17.0 against the Dollar, before whip-sawing almost 20 cents either side of that marker in a demonstration of the volatility that analysts have warned could proliferate over the coming days.

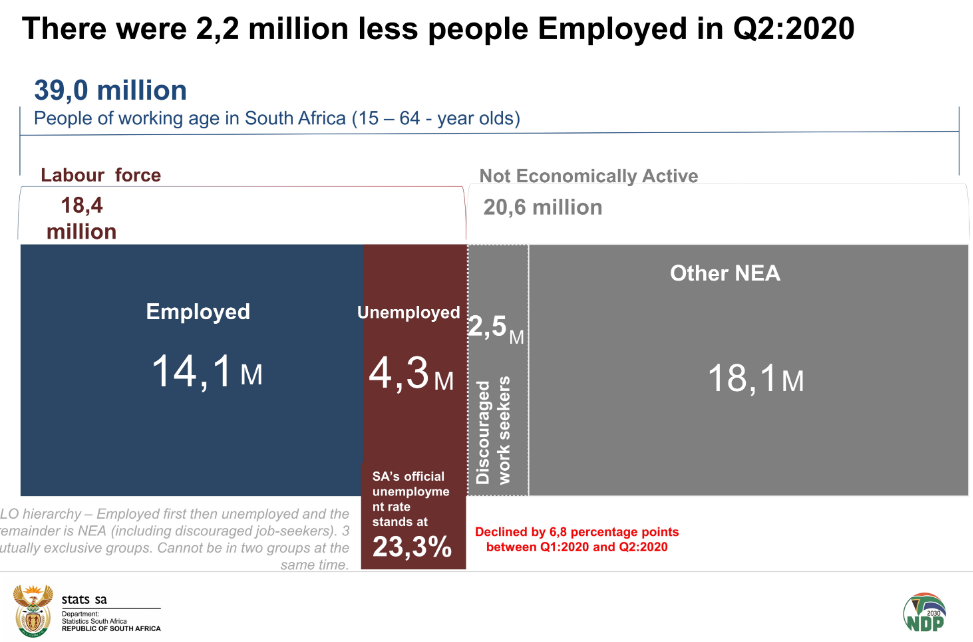

Earlier volatility came alongside the second quarter unemployment report while gains built latterly alongside falls in international oil prices. South Africa's jobless rate fell from 30.1% to 23.3% in the second-quarter, although Statistics South Africa said that "does not include discouraged work seekers."

“This large-scale reclassification, mostly due to the fallout of Covid-19, has introduced major distortions in the series that will take months to fix. But the reality is that South Africa's labor market has not improved at all and is, in fact, in much worse state today — as highlighted by the larger number of economically inactive people — than it was in the first three months of the year,” says Cristian Maggio, head of emerging markets strategy at TD Securities.

The falling unemployment rate disguised some 2.2 million coronavirus-related job losses that were not classified as such due to quirks of how officials define unemployment. Similar is true of many developed countries, which still purport boom era unemployment rates but are all facing millions of job losses.

Unemployment data came ahead of steep falls in oil prices, which are supportive for currencies of oil-importing countries and may have had to do with Libyan barrels returning to the market.

“While the opens are very similar, the rand see-sawed between 17 and 17.20 to the dollar yesterday and could continue to see heightened volatility without direction,” says Siobhan Redford, an economist at Rand Merchant Bank, who looks for USD/ZAR to trade in a 16.00-to-17.50 over the final quarter.

Tuesday's volatility also came ahead of the first U.S. election debate that will see President Donald Trump go head-to-head with opposition candidate Joe Biden of the Democratic Party during what will be the early hours of Wednesday morning in both London and Johannesburg.

Both are set to face inquisition over their records in present and past offices as well as their plans for addressing some of Americans’ priorities.

Above: USD/ZAR rate shown at 4-hour intervals alongside S&P 500 futures (green line, left axis).

"USD/ZAR is trading back above key support at 16.3613/3434, made up of the June and July lows, having dipped to 16.0838, last week," says Axel Rudolph, a senior technical analyst at Commerzbank. "Were this level to be slipped through, though, the March 13 low at 16.0205 and also the March 2 high at 15.8588 would be eyed. Further potential support can be found between the 15.2149 March low and the 15.0355 January high."

Biden enters with a healthy lead over the incumbent at the national level, albeit one that has narrowed in so-called swing states, but the candidate is viewed as slightly gaffe-prone while the incumbent has performed strongly in prior debates and has a record for boisterousness.

“Lots of election-outcome-based USD predictions are coming out of the woodwork today but we wouldn’t attempt to play this game, either tonight or going into November. FX option traders are not pricing in any meaningful event risk,” says Eric Bregar, head of FX strategy at Exchange Bank of Canada.

Many analysts say neither of the debates should matter much for the election outcome given many Americans are believed to have already made up their minds, although if they impact appetite for stocks they could also have a short-lived impact on the Rand. The currency has always been sensitive to the direction of global markets and more so amid the pandemic, although GBP/ZAR has better reflected the S&P 500 in recent weeks than USD/ZAR has.

“It appears that there is still some hope on the negotiating table that a Brexit deal could be reached, and it seems clear that the uncertainty surrounding a deal will become less so by the middle of October. Further, on the other side of the Atlantic, discussions on a new stimulus bill for the US are continuing and could be making some headway. The passing of a new fiscal stimulus bill would probably be welcomed by US and global markets during what is gearing up to be a rather uncertain fourth quarter,” says RMB’s Redford.

Above: Pound-to-Rand rate shown at 4-hour intervals alongside S&P 500 futures (green line, left axis).

The Pound-to-Rand rate has often risen and fallen with the S&P 500 when the Brexit talks are under the spotlight as they have been this week, with little more than a fortnight to go until the self-imposed October 15 deadline for a trade accord although there have been indications as well as speculation that compromises could be in the pipeline.

U.S. stock futures were down more than half a percent Tuesday and so too was GBP/ZAR but if Wednesday’s tv debate casts one candidate or the other as a clear frontrunner, or if Washington makes progress in agreeing another fiscal support package later in the week, recoveries for both could be seen.

However, Goldman Sachs forecasts a further prolonged recovery for the Rand in the final quarter, which is expected to pull GBP/ZAR down from 21.74 to 20.18 by year-end while dragging USD/ZAR from 16.92 to 15.80.

“Both the Rand and Ruble appear to feature more room to run, with the ZAR standing out as deeply undervalued on standard metrics,”says Kamakshya Trivedi, chief emerging markets macro strategist at Goldman Sachs. “Given significant domestic risks, however, including South Africa’s October mid-term budget announcement for the Rand, and a combination of still-volatile political headwinds and slowly-fading macroeconomic tailwinds for the Ruble, the key question for each currency is whether high global betas can (eventually) trump domestic headwinds. On this front, we are optimists; with Chinese data – to which ZAR is sensitive – suggesting a continued recovery.”

Above: USD/ZAR rate shown at daily intervals alongside Pound-to-Rand rate (green line, left axis).