Pound-South African Rand Pointed Higher, but Beware Short-Term Ceiling

- GBP/ZAR upside momentum firmly intact

- Buts head against 23.50 resistance

- Time for economic reform is now says Thomson Reuters analyst

Above: Cape Town in lockdown. Image © Adobe Images

- GBP/ZAR market rate: 23.34

- UK bank transfer rates (indicative): 22.52-22.68

- UK FX specialist transfer rates (indicative): 22.35-23.12 >> more information

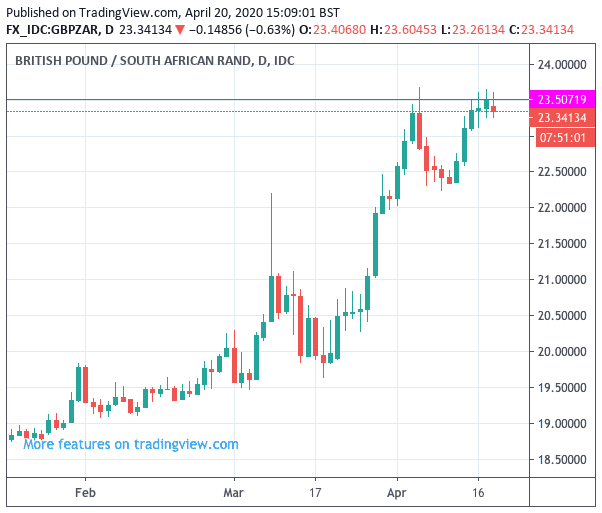

The Pound-to-Rand exchange rate remains engaged in a solid trend of appreciation, however we note that a substantial area of resistance on the exchange rate's charts could pose some near-term headwinds to further gains by Sterling.

The UK currency has already risen 11% against the Rand over the course of the past month, with the coronavirus pandemic and domestic economic concerns tanking the Rand, sending GBP/ZAR to a one-month high of 23.66.

However the pair has not been able to close above 23.50 with multiple attempts to do so all ultimately failing, suggesting this could be a temporary high-water mark.

With GBP/ZAR quoted at 23.35 at the current time, and falling on the day, we would imagine that some consolidation below 23.50 is therefore likely in the short-term.

Above: GBP/ZAR daily chart

Momentum is nevertheless ultimately positive and we don't yet see any suggestion - at least from a technical stance - to suggest the rally in the pair is over.

On the daily chart the Relative Strength Index reads at 69, where a reading of 70 and over is considered to be a sign of a financial asset being overbought. Therefore, on this basis we would not be overly concerned that the GBP/ZAR exchange rate is technically too expensive.

However, from a fundamental perspective, one big name suggests the Rand might be significantly undervalued following its deep decline in 2020.

"The Rand now screens as ‘severely’ undervalued based on the experience of past sell-offs (such as the GFC)," says Zach Pandl, Co-Head of Global FX, Rates and EM Strategy at Goldman Sachs.

Weakness in the South African Rand in 2020 leaves the currency 20% down against the British Pound, 25% down against the U.S. Dollar and 23% down against the Euro.

Above: The majority of ZAR's losses in 2020 have occured over teh course of the past month.

However, we note that currencies can trade for extended periods at undervalued and overvalued levels and this observation does not therefore suggest that a sizeable recovery is underway.

For the Rand to find its feet once more we would look for a more decisive end to the global coronavirus pandemic, that would allow for global trade to begin flowing once more which would in turn aid South Africa's economy.

But for a more sustained bout of appreciation to develop global investors will be looking for signs of notable domestic political and economic reform, noting the country's economy was already in trouble before the outbreak of the covid-19 crisis.

"Investors are focused on the deteriorating economic outlook. South African President Cyril Ramaphosa now has little choice but to bring about radical change. The time for big decisions is now as the economic outlook darkens," says Peter Stoneham, an options analyst at Thomson Reuters.

Stoneham notes high-level talks have been held within the National Economic Development Council and the trade unions, and the government is being urged to use the full spectrum of measures available to keep the country afloat.

"However, time is running out and rating agencies have factored in a marked weakening of economic performance and deteriorating finances," says Stoneham.

The South African economy is expected to contract significantly this year with the South African Reserve Bank forecasting a 2020 contraction of 6.1%, the International Monetary Fund sees -5.8% and Moody's a 2.5% downswing.

"It is possible the contraction could be nearer 10%, far outstripping the post-2008 financial crisis drop," says Stoneham.