Yen Losing its Bullish Slant against Improving Pound

Image © Adobe Stock

- Pound renews short-term uptrend versus the Yen after positive Barnier comments on negotiations

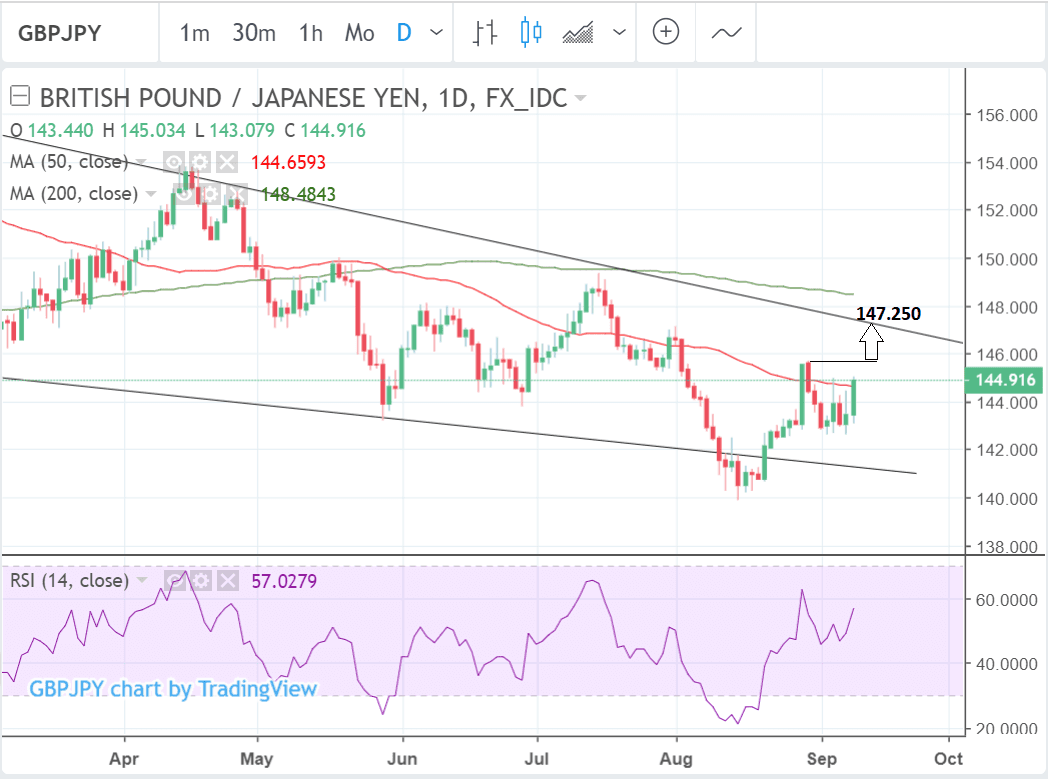

- GBP/JPY now attacking 50-day MA

- For the Yen, global risk sentiment is main driver this week

The Pound-to-Yen exchange rate is trading over 1.0% at 144.78 at the start of the new week after Michel Barnier said he thought getting a Brexit deal in 6-8 weeks was "realistic".

Barnier's comments make it even less likely the UK will tumble out of the EU without a deal next spring and this supported the Pound which is seen to be shedding some of the 'no deal' fears it assumed in August.

A flight for safety out of Sterling saw the Yen benefit through the mid-year period thanks to its status as a leading safe-haven assets.

The September recovery in the GBP/JPY pair has reached the level of the 50-day moving average (MA) at 144.65 which it is trading marginally above at the time of writing, at 144.78.

The strong moving up has changed the complexion of the charts and lent them a bullish tenor.

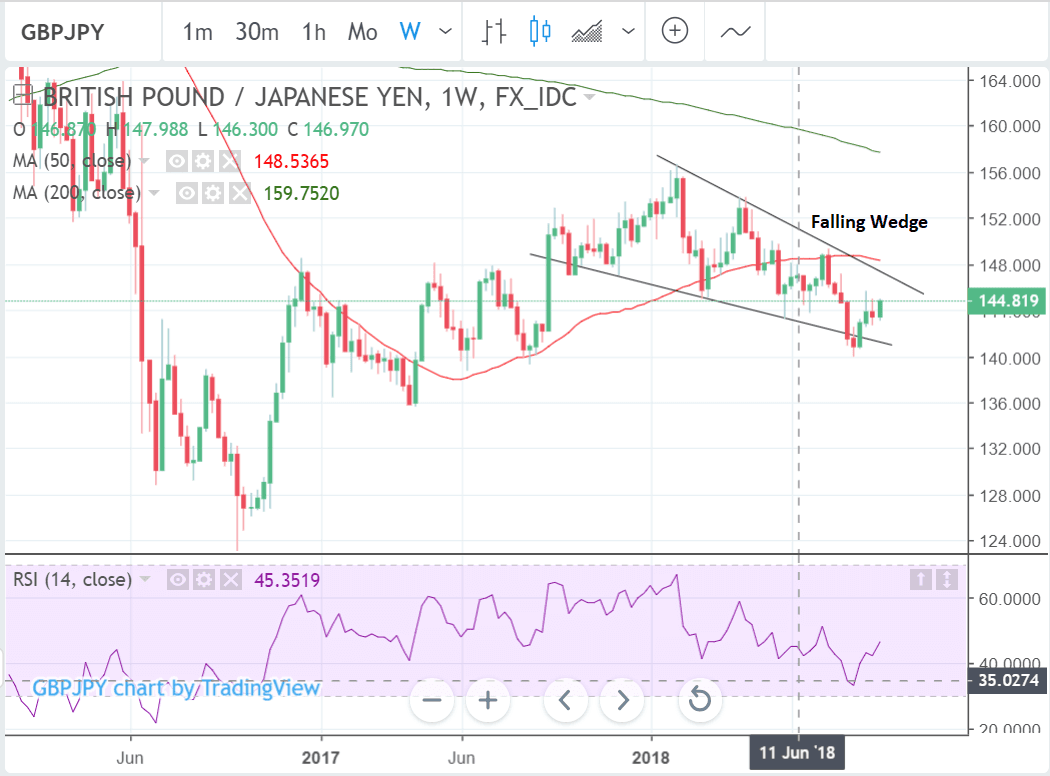

We now see more upside as probable wither a break above the 145.69 August 30 highs confirming a breach of the 50-day MA and more upside to a target at 147.25 at the upper border of the falling wedge pattern.

The falling wedge looks bullish to us and favours and eventual upside breakout in line with fading no-deal Brexit concerns as negotiators continue making progress.

The Japanese Yen: What to Watch

One of the main data releases for the Japanese Yen is already out on Monday in the form of the Economy watchers business sentiment survey, which rose to a higher-than-expected 48.7 from 46.6 in July, as well as surpassing expectations of 47.2.

The survey gathers responses from business that directly service consumers such as hairdressers and tax drivers.

A more positive result would normally be marginally supportive of the Yen but today it was overshadowed by positive Brexit headlines supporting the Pound.

The next release for Japan is the change in M2 money stock which is expected to show a 3.0% rise when it is released out at 19.50 B.S.T on Monday.

Then later there is also an auction of 30-year Japanese government bonds at 23.45. The impact from these two releases, however, is likely to muted and they are not regarded as especially market-moving.

The Yen is sensitive to global risk appetite because it is a safe-haven currency so it is likely to gain support during times of extreme uncertainty and crisis. If the US imposes higher duties on China or targets Japan for a trade war next, the Yen is likely to gain as a result, most probably (or mixed in the later).

Earlier on Monday morning Japanese prime minister Shinzo Abe said trade fights "do not benefit anyone" in regards to the threat of the US starting one with Tokyo.

Recent comments from the governor of the Bank of Japan (BOJ) failed to support the Yen after he said the economy required continued easy monetary conditions from the BOJ to keep growth on track. Easy monetary conditions are negative for the currency, however.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here