Pound-Yen Outlook: Possible Mini-Recovery After Exhaustion

Image © Adobe Stock

- GBP/JPY has fallen steeply as buyers flock to the safe-haven Yen

- GBP/JPY could fall further although there are conflicting bullish recovery signs

- The main release for the Pound is wage and inflation data; for the Yen trade data

The GBP/JPY pair has weakened substantially falling from 144 to 140 in a only a week.

The Yen strengthened on a combination of safe-haven flows from the Turkey crisis, improved economic data and increasing expectations the Bank of Japan is preparing to dismantle stimulus policy and raise interest rates.

The Pound, meanwhile, has been pressured lower due to 'no-deal' Brexit fears, however, on Friday these eased after rumours spread that the European Council is preparing to offer a major compromise in an attempt to broker a trade deal and avoid a cliff-edge Brexit.

The negative double whammy explains why GBP/JPY fell so heavily and the Pound ended the week able to purchase four whole Yen less then it started.

The Yen is also the most undervalued G10 currency according to both REER and PPP valuation methods. This it is prone to drifting higher as markets attempt to correct the misprice.

Whilst it is difficult to time a recovery due to distorted value, it does normally occur eventually. It could even be happening now.

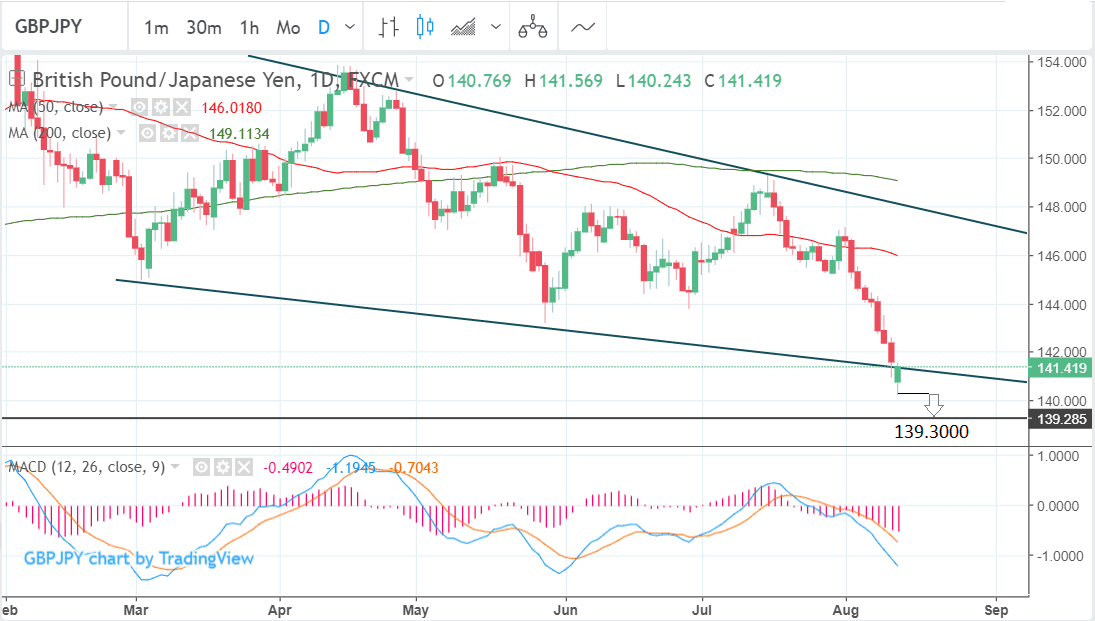

From a technical perspective the GBP/JPY pair looks vulnerable to a further sell-off though not immediately.

The pair has broken below the underside of the falling wedge pattern formed since the beginning of the year.

The break below the lower boundary could signal a deeper breakout lower to a target at the 139.30 lows 2017 lows, assuming the exchange rate breaks below the 140.24 lows.

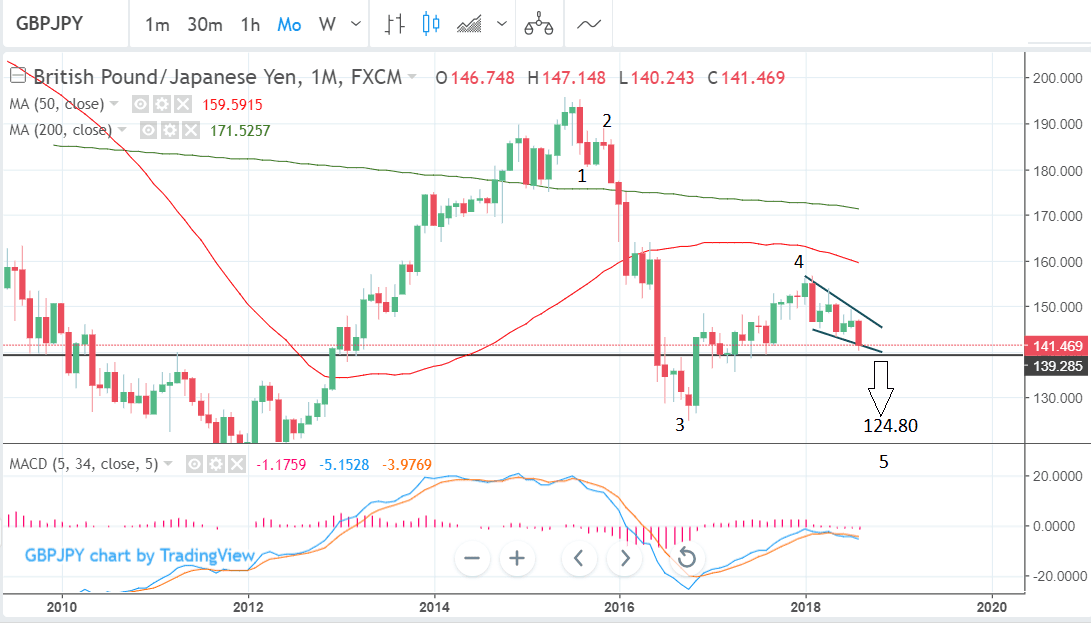

This is supported by the longer-term bearish trend and the possibility that the pair may be unfolding in the 5th Elliot wave lower, which is expected to reach at least as low as wave 3 at 124.80.

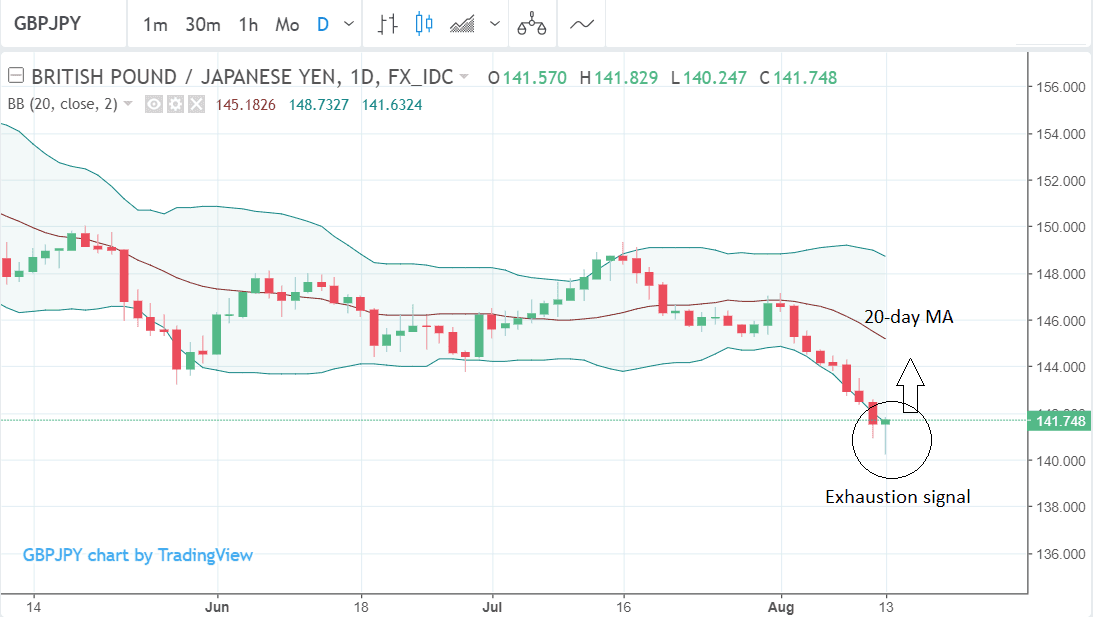

Yet there is also compelling contrasting evidence which suggests the pair may actually rebound, at least in the short-term.

Monday's strong recovery has now formed a hammer or dragonfly doji candlestick pattern both of which bullish signs should they hold their shape by the end of the day.

The pair has also undershot of the lower Bollinger Band on the daily chart during their Monday's volatile sell-off and this is a strong sign the exchange rate is oversold and due a substantial bounce.

How far the pair rebounds is not clear but based on past set-ups it will probably recover to at least the 20-day MA at around 145.

The combination of the long, bullish candle and the long undershoot of the lower Bollinger produces a high probability bullish, short-term buy set-up, which cautions us from taking an overly bearish stance straight away, nevertheless, longer-term the signs still look bearish.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Japanese Yen: What to Watch this Week

The two major releases for the Yen in the week ahead are industrial production and the trade balance.

The trade balance is expected to show a deficit of -50bn Yen in July when it is released on Thursday, August 16, at 00.50 B.S.T. This would contrast with the 753bn surplus of June, and could weigh on the currency.

The other major release is Industrial Production, which is forecast to show a -2.1% fall in July when it is released on Tuesday at 05.30.

The Yen is also likely to be susceptible to movements from global risk flows, especially those associated with the crisis in Turkey and the US-Sino trade war. An increase in risk aversion would be supportive.

Further gains are possible from rhetoric on interest rates which has shown a clear bias to arguing from tighter policy and higher interest rates eventually once stimulus has been removed. Further talk on these subjects from BOJ or ex-BOJ officials could further impact the Yen.

Sterling: What to Watch this Week

Brexit headlines could be on tap over the next week with EU/UK negotiations resuming on Monday and recent media stories have reported a conditional willingness on the part of EU leaders to accept Theresa May’s plan to aim for a free trade zone in goods, which could be discussed at a special EU Summit in Salzburg next month.

We note this to be one reason why downside damage to Sterling could have been worse.

"This could help to stem further Sterling selling pressure," says George Brown, an analyst with Investec.

We will keep an eye out for any media set-pieces from the main negotiators.

On the calendar, the Pound has three main data releases in the week ahead, the first of which is wage and employment data for July, out on Tuesday, August 14 at 9.30 B.S.T.

Current expectations are for average earnings to come out at 2.5% - the same as in June; and for the unemployment rate to also remain the same at 4.2%.

The next major release is inflation data, also for July, out on Wednesday at the same time. Headline CPI is expected to show a 2.5% rise compared to the same time a year ago, but a -0.1% fall compared to the previous month of June. Core inflation which excludes volatile food and fuel components is forecast to show a 1.9% rise compared to a year ago.

"If inflation turns out to be more robust than expected, then this will fuel speculation over further rate hikes from the Bank of England," says a note from brokers Actionforex.

The inference is that this could also support the Pound since higher interest rates tend to increase foreign capital inflows due to the higher return promised.

"Inflation may rise more sharply in the coming months as the weakness in the exchange rate will likely push up import costs. If the pound’s weakness persistence then in the long-term this should help to boost exports, assuming Britain will strike a good deal with the EU. So whichever way you look at it, sterling will probably make a good comeback in the longer term outlook," add Actionforex.

The final major release for the Pound is retail sales in July out on Thursday, also at 9.30.

Broad, headline retail sales are forecast to show a 2.9% rise compared to a year ago and 0.2% compared to the previous month of June (month-on-month).

Core retail sales, which excludes auto sales and fuel is forecast to rise 2.8% on a yearly basis and 0.2% month-on-month.

Despite the important data on schedule in the week ahead its important to note that broader political and macro themes may be more dominant.

The Pound shrugged off a recent interest rate hike by the Bank of England and fell on Brexit fears anyway, and on Friday it was more moved by Turkish themes than domestic data which was positive, as macro themes dominated its main counterparts and somewhat overshadowed the data.

Domestic economic numbers released on Friday showed GDP expanding by 0.4% quarter-over-quarter in Q2 and construction output surging 1.4% month-over-month in June.

The data had little impact on Sterling which was instead focussed on external drivers like broad-based Dollar strength and the Euro's Turkish-generated woes.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here