Japanese Yen Rises After Wage data Surprise and BOJ Tightening Rumours Drive Outlook

Image © Adobe Stock

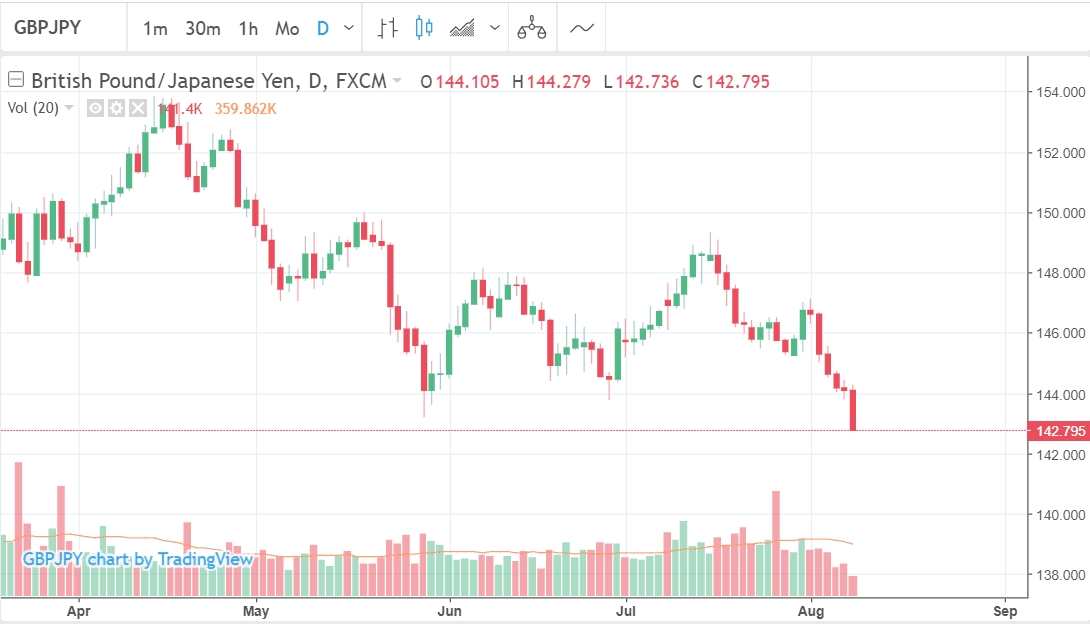

- Yen up 0.90% versus Pound and higher against all majors

- Jump in wages in June a big reason for rise

- Rumours BOJ planned to announce interest rate rises earlier in year a further driver

The Yen is stronger across foreign exchange markets today after positive wage data and reports the Bank of Japan (BOJ) considered raising rates earlier in the year provided a boost.

The currency also found a bid on higher-than-expected wage data which raised hopes the country might be exiting its spiral of deflation.

JPY is up 0.68% versus the US Dollar at 110.93, at the time of writing, up 0.90% versus GBP to 142.79, and up 0.43% versus the Euro to 128.63.

Rumours suggest the BOJ shelved a plan to raise interest rates earlier in the year, because, "market turbulence pulled the rug from under an announcement of an increase," according to Leika Kihara, a correspondent for Reuters.

"The bank then hoped to signal higher rates in July and raise them in September, but weak inflation data scuttled that idea too," says Kihara, adding: "Neither plan was made public."

Nevertheless, the fact the BoJ had planned to roll back its ultra-accomodative approach and embrace a tighter policy programme has been enough to send the Yen higher.

Higher interest rates are positive for a currency as they attract greater foreign capital inflows drawn by the promise of higher returns.

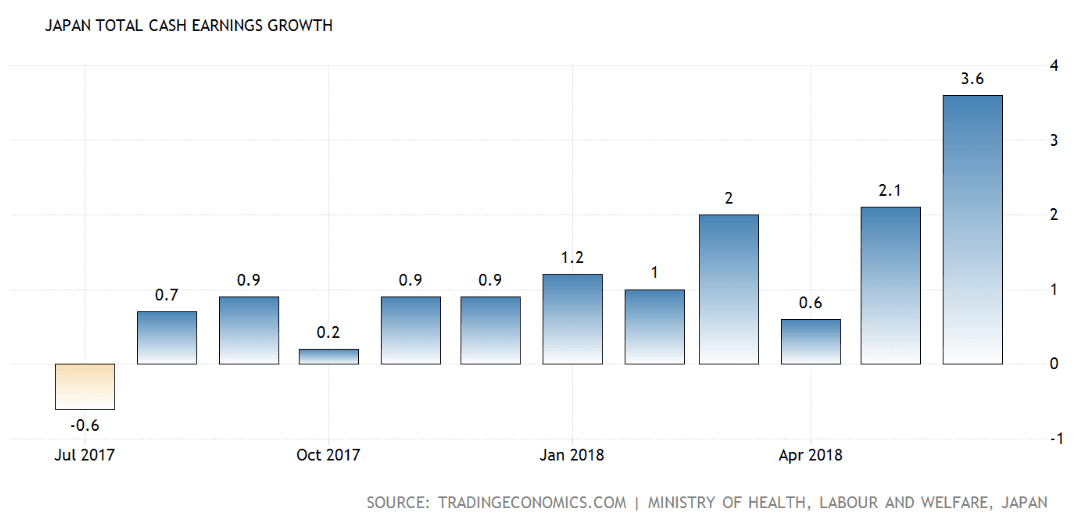

The other factor leading the Yen higher was wage data out on Tuesday, which showed earnings catapulting higher by 3.6% in June compared to the same time in 2017.

This was much higher than the previous 2.1% rise in May which itself was considered quite promising, and beat the 1.7% expected.

The shock rise in the data suggests higher wages could put pressure on inflation and push it higher, forcing the central bank to raise interest rates and head off an potential spike in inflation.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Deputy Banker Intent on Change

The mastermind of the BOJ's plan to dismantle accommodation and the person behind the interest rate rumours is said to be Masayoshi Amamiya, the deputy governor of the BOJ, and the previous architect of the BOJ's easing policy.

"The man leading the BOJ away from its programme of unprecedented asset-buying and low or negative interest rates is the man who largely crafted the measures in the first place, bank deputy governor Masayoshi Amamiya," says Kihara.

"The career central banker’s latest creation - a mechanism for unwinding much of his previous work - has been quietly under development for almost a year," says the reporter.

In the end the central bank adopted more subtle means of tightening by allowing more flexibility in their Yield Curve Control (YCC) scheme.

YCC involved the targeted manipulation of longer-term government bond rates to ensure a steeper curve. The measure was successful in helping Japanese bank profitability which had been suffering due to margin erosion from extremely low, long-term interest rates.

Internal sources suggest the increased flexibility was a 'compromise' policy between BOJ governor Haruhiko Kuroda and his more hawkish deputy Amamiya.

Moreover Kuroda's comments that the BOJ would be keeping interest rates low for an extended period of time were seen as a sop to "appease doves on the policy board."

Sources from within the BOJ suggest a shift in power may be taking place which means days are numbered for doves.

"The latest steps marked a major turning point for Kuroda’s stimulus programme,” a source said to Reuters, “the reflationists have become a minority, which means the BOJ is turning more hawkish,” it added.

Amamiya, who largely crafted Kuroda’s initially successful “shock-and-awe” campaign, may also now be more mindful of his own legacy, insiders say.

Unwinding stimulus is generally considered more difficult than implementing it. Raising rates too rapidly can lead to a spike in the currency which can cause problems for exporters; leaving it too long before raising, however, can cause inflationary risks.

The BOJ is likely to continue its extremely subtle 'glacier-like' approach to unwinding stimulus, according to another strategist familiar with the subject.

"They (the BOJ) have been making iterative shifts over last few two years although very quietly," says Steven Major, managing director fixed income research at HSBC.

"The amount of flow that has been deployed to a maintain the JGBs in the range they were in was about 5/8ths of the original 80tr they (the BOJ) announced, they have also been backing away from the 20 and 30-year because at the initial announcement they said they were going to buy 10 and 20 year bonds but in the end they only bought 10-years'," says Major.

The BOJ is likely to continue with its slow and subtle style, suggesting any appreciation in the Yen may be equally measured.

"Over the last year it (the yield curve) has steepened on average about 2 basis points a month, which is gentle move. That's perfect"

"What they don't want is disruption: if the curve steepens too quickly and JGB's fall in price they will get a massive flow of money back into Japan, the yen will strengthen and the policy will have backfired. At this pace they can manage the yield curve normalisation and the currency," says Major.

"It is so slow, its a snails pace, two basis points a month.. We could be sitting here in a year's time and the same chart will only have moved a handful of basis points," adds the strategist.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here