GBP/JPY Outlook: Moving Lower as Pound Depreciates

- GBP/JPY falls within descending channel after trendline break

- More downside potentially to 142.00 expected

- Main release for both currencies is second quarter GDP data on Friday

The Pound is already down 0.20% versus the Yen at the start of the new trading week with one Pound buying 144.29 Japanese Yen at the time of writing, on the interbank market.

Pound Sterling is under pressure at the start of the new week, in sympathy with growing fears for a 'no deal' Brexit and the technical downward trend that has been alive since April.

Headlines pushing Sterling lower pertain to the chances of a 'no Brexit' deal with UK Trade Secretary Liam Fox telling the media at the weekend that the prospects of a 'no deal' outcome are now at 60%.

Sentiment soured against Sterling at the cloes of the prior week on comments from Bank of England Governor Mark Carney suggesting risks of a no-deal were now "uncomfortably high" in an interview on the BBC Radio 4 Today programme last Friday.

Analysts views of the Yen, meanwhile, are mixed. Some see the Bank of Japan's (BOJs) decision to relinquish a degree of control over yield curve targeting as a step towards tightening, and therefore favourably for the Yen, whilst other's saw the accompanying rhetoric as extremely dovish and, therefore, negative for the currency.

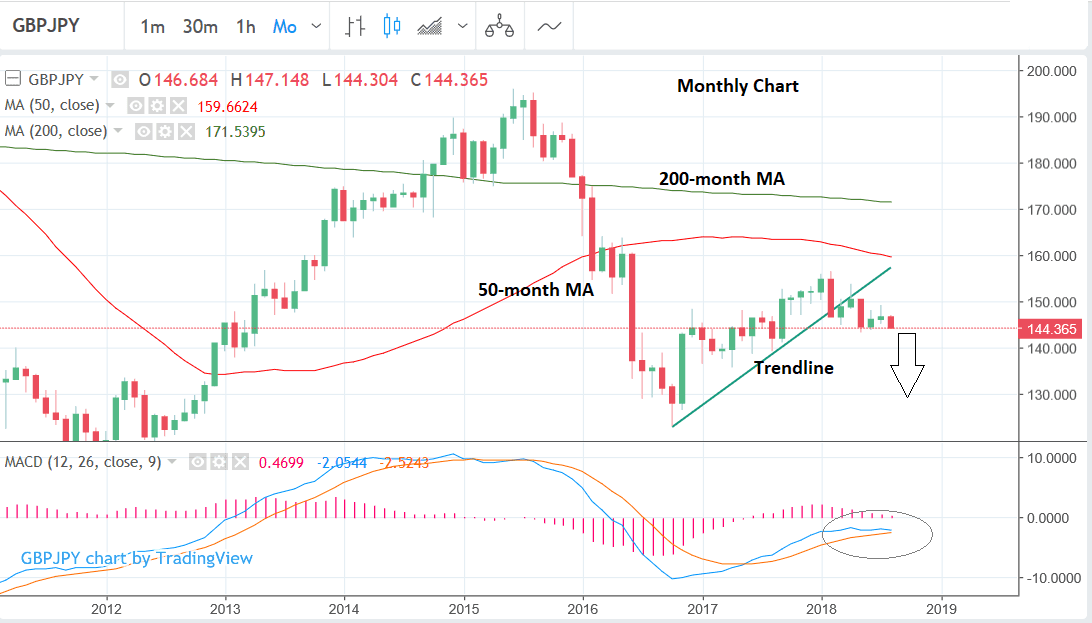

From a technical perspective, the long-term chart supports more Pound weakness and Yen strength.

The monthly chart is showing the exchange rate having broken below a long-term trendline drawn from the October 2016 lows. A break below a trendline is a very bearish signal and prices are now expected to continue falling from here.

The MACD momentum study in the lower pane also looks bearish as it appears like it is about to cross below its signal line.

A fall in MACD supports the expectation that the underlying asset will also weaken.

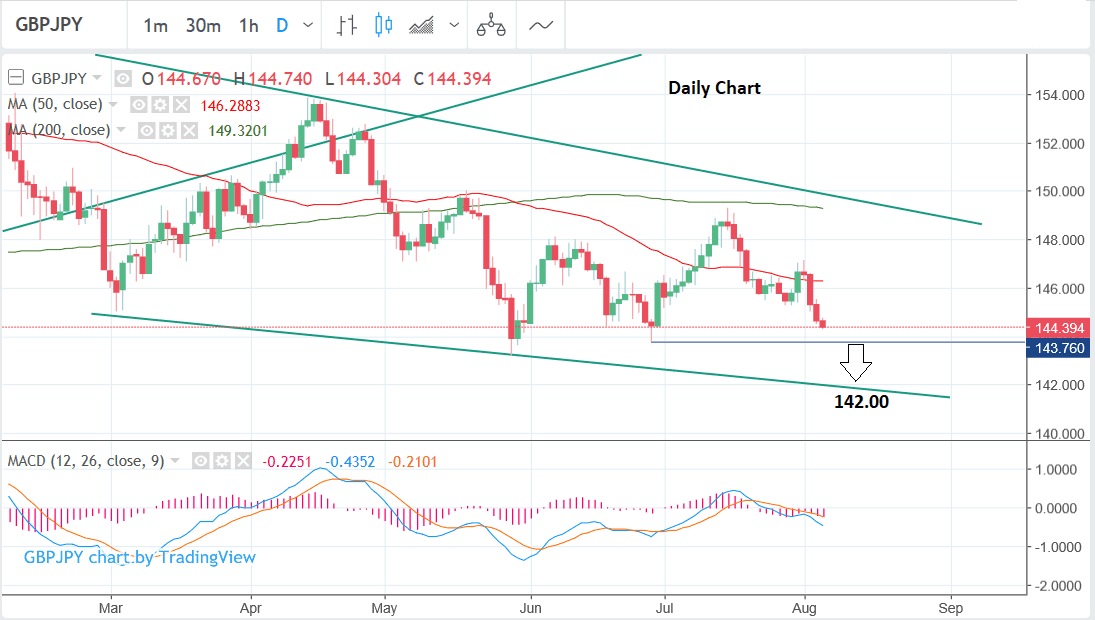

The weekly chart shows the pair falling in a descending channel after the trendline break, further supporting a bearish outlook. The chart suggests a probable sell-off down to the lower line of the descending channel at circa 142.

The daily chart shows the same descending channel as is on the weekly chart only in more detail.

The June lows at 143.77 are likely to provide support and impede the downtrend so we would be looking for a clear break below them signalled by a move below 143.50 to provide confirmation of a continuation down to the target at the lower channel line, at 142.00.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to Watch for the Yen this Week

The main release for the Yen in the week ahead is Japanese second quarter GDP data which is out at 00.15 B.S.T on Friday, August 10.

GDP is expected to show 0.3% growth in Q2 compared to Q1 and 1.4% from the same time in the previous year. If both these predictions come to be true then they will represent a considerable improvement from the negative results in the previous periods.

Nine hours after the Japanese release comes UK second quarter GDP data at 9.30, offering traders a rare opportunity to compare the two stats on the same day. If the results differ markedly it will probably cause GBP/JPY some volatility. Higher GDP is positive for currencies as it shows a healthy economy which is attractive to foreign investors.

"If GDP readings from these nations turn out to be stronger then the yen and pound could benefit, especially in light of the BoJ’s tweaking of QE purchases which has resulted in JGB yields rising and the BoE’s rate hike this week," says Fawad Razaqzada, an analyst with Forex.com.

Another key release for the Yen is the current account on Wednesday at 00.50, which is expected to show little change, falling to 1.84tr Yen in June from 1.85tr in May.

Household Spending is out at 00.30 on Tuesday, and is forecast to show a 1.7% rise in June but a -1.2% fall compared to a year ago.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here