Yen Rises on Safety Inflows After Italian Risks Mount

- Yen has gained from increased safe-haven demand amidst increasing Italian political risks

- USD/JPY has reached key lows and bears could struggle to push it much further

- GBP/JPY is more vulnerable to further weakness, however

© Chris Titze Imaging, Adobe Stock

The Yen is currently trading at 108.93 to the Dollar and 144.55 to the Pound on the interbank market, having gained over half a percent in value versus the Pound and 0.44% versus the Dollar on the Tuesday.

The currency is the strongest in the G10 having risen because of an increase in safe-haven demand as a result of fears about the impact on financial markets of political uncertainty in Italy.

"The yen strengthened a little more against the dollar, dropping below 109.00 as a result of geopolitical effects. The April unemployment reading (confirmed at 2.5%) left the exchange rate unaffected," says Luca Mezzomo, head of macroeconomic analysis at Intesa Sanpaolo.

Dollar-weakness from declining interest rate expectations, which had been fairly elevated, also lent support to the Yen.

Investors had expected the US Federal Reserve to increase interest rates at a rate of 0.25% a quarter, which is much faster than anywhere else in the G10. Higher interest rates tend to appreciate the local currency as they lead to increased inflows from foreign investors seeking somewhere lucrative to park their money.

The fall in US treasury bond yields was symbolic of declining interest rate expectations as they are a measure of compensation for rising inflation which tends to be tracked interest rates.

"JPY got a boost from the mix of Italian political uncertainty and lower UST yields. JPY to stay supported, though we may see some modest reversal in USD/JPY upwards on Friday in response to the solid US labour market report," says Peter Krpata, FX strategist at ING bank.

The next question is that assuming the Yen has more in it, how much higher will it go?

Clearly, the crisis in Italy is unlikely to go away overnight, yet at the moment there is no way of telling how much it will affect financial markets in general outside of Italy. At first, only Italian bond markets were affected with very little contagion, but that changed when it became more likely the crisis in Italy could potentially lead to the country's withdrawal from the Eurozone.

Although President Mattarella vetoed the election of the coalition's choice of anti-Euro finance minister and elected an interim technocrat government instead, the move has been widely seen as unpopular and if there is another election, as now looks likely, the coalition is expected to increase its majority.

The caretaker government is trying to pass a budget but it is unlikely to succeed and "the likeliest outcome by far is a no-confidence vote, with the new government only staying in office for day-to-day affairs, and new elections being held at the end of September or early in October," says Mezzomo.

"This scenario is of concern to investors, who fear a landslide victory of the sovereignist front – implying the risk of an easing of fiscal discipline, credit rating downgrades, and even an exit from the monetary union," he adds.

Clearly, longer-term the Yen may gain from an extended period of uncertainty.

Technical Analysis

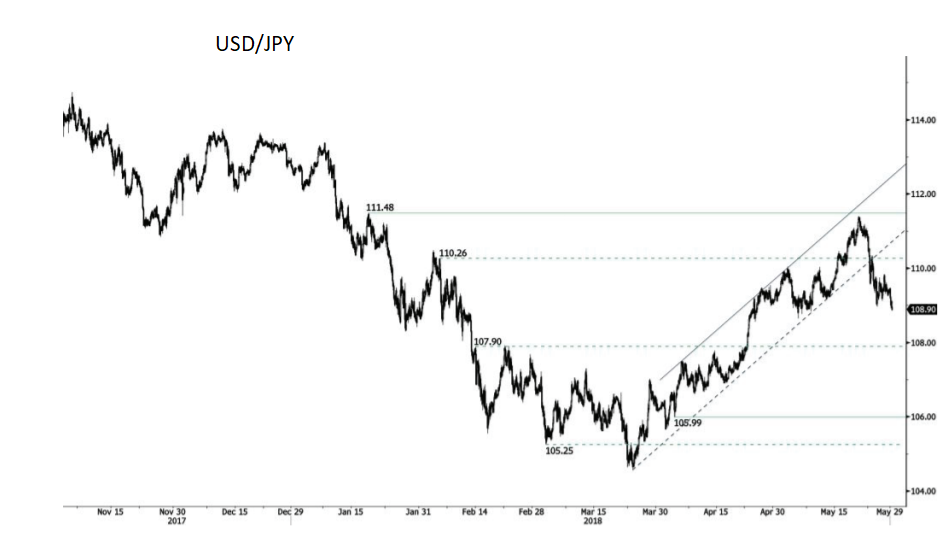

Purely from a technical viewpoint, that is from an analysis of charts, price action, and indicators, USD/JPY is not yet looking as bearish as the commentary and Italy- doomsayers appear to be saying.

"The technical structure suggests short-term sideways trading moves," says Peter Rosenstreich, head of market strategy at Swissquote.

We would go even further and suggest the medium-term uptrend remains intact and although we set a high bar for a continuation higher because of the recent bout of Italian-related weakness, we still think, on balance, there is a risk of more upside.

Our chart analysis suggests that the pull-back from the May 21 highs could be just that - a pull-back - and the pair could be about to turn around and go higher.

The three-wave zig-zag shape of the pattern is one clue supporting this thesis as it looks like an abc pattern which is only ever corrective in the dominant trend, not a sign of reversal.

Another reason we see a risk of a recovery is that the exchange rate has fallen to just above a key level in the form of the 50-day moving average (MA) at 108.23. The MA is likely to prevent further downside as large MA's often repulse prices even when they are trending quite strongly. This is because they are popular indicators and therefore attract more-than-average activity from investors who often make decisions to buy or sell depending on where the MA is relative to price.

"We favor a long-term bearish bias. Support remains at 101.20 (09/11/2016 low). A gradual rise toward the major resistance at 125.86 (05/06/2015 high) seems unlikely," says Rosentstriech.

GBP/JPY

The GBP/JPY chart is more bearish than USD/JPY as the exchange rate has now already established a short-term downtrend after rolling over following the February highs.

It has also broken out of a rising channel, establishing a provisional downside target in the process at 141.30 based on the golden ratio (0.618) of the height of the pattern extrapolated down from the point of the breakout.

A break below the current 143.19 lows would provide confirmation of the continuation lower.

Another reason to possibly expect more downside is seen on the weekly chart, which stretched out shows the evolution of a bearish unfinished Elliot Wave.

These are five wave patterns which move up and down in cycles of differing degrees. It's possible to read an unfinished Elliot Wave into GBP/JPY, which may have started way back at the June 2015 highs in the 190s.

We have labeled the wave count on the chart below, and it appears that the current move down has a strong chance of being a 5th wave, which means there is a high chance of it falling all the way down to the 124.00 October 2016 lows.

The way the MACD on a special 5,31,5 setting made a definite trough low at the same time as wave 3 in October 2016 and then moved back above the zero-line during the formation of a 'complex' wave 4 adds further corroboration to the possibility we are in fact looking at an evolving 5-wave structure.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.