EUR/JPY To Rally Higher On Diverging Money-Supply, Albeit With Sizeable Risks Attached

- EUR/JPY is forecast to rise from diverging money-supplies as ECB withdraws and BOJ extends QE

- Recent comments from BOJ's Kuroda suggest no alleviation of policy divergence

- Considerable risk to bullish scenario from Italy upsetting fabric of Eurozone

© Andrey Popov, Adobe Stock

One of the few currencies the Euro seems to be performing relatively well against, despite rising political risks in Italy, is the Yen.

The strong performance has been linked to changes in the difference in money supply between the two currencies' economies.

The money supply in the Euro-area is shrinking whereas in Japan it is increasing.

Money supply is simply the amount of money in the real economy - or cash floating around in the financial system.

In the Eurozone, it has been decreasing because the European Central Bank (ECB) has cut down the amount of quantitative easing (QE) it undertakes, which involves it in purchasing bonds from financial institutions and banks to increase liquidity in the system.

The money supply in Japan, in contrast, has been rising from continued large-scale QE conducted by the Bank of Japan (BOJ) - the difference is now reaching record proportions and is causing the Euro to appreciate versus the Yen - with the Euro rising from 'scarcity' value.

"Europe’s monetary base continues to be significantly smaller because even as the ECB eases, it’s not buying assets like the BOJ,” says Yuji Kameoka, an analyst at Daiwa Securities in Tokyo.

Kameoka predicts the EUR/JPY exchange rate will rise to 147.00 on the back of diverging money supply, from a current spot rate of 130.75.

The latest comments from the governor of the BOJ, Haruhiko Kuroda, on Tuesday morning are unlikely to change the outlook.

Kuroda was characteristically dovish in his speech - which means in favour of keeping QE at present levels and interest rates ultra-low - neither of which will help the Yen or reduce money-supply. He said that he didn't think the time was right to reduce QE and that it had been helping to raise wages and inflation towards the BOJ's target of 2.0% which is still way off.

He cautioned against speculating when the BOJ might end QE, saying the Bank would first wait for prices to pick up before "telegraphing" an exit.

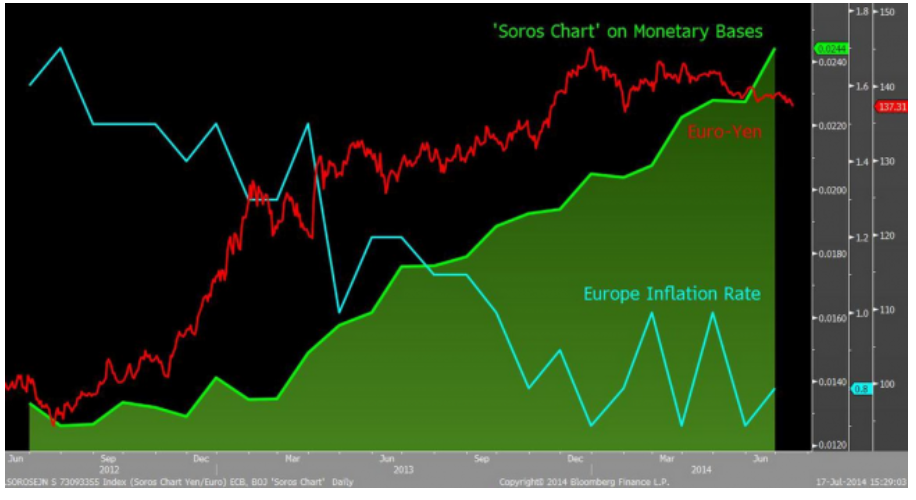

Liveforex's Eamonn Sheridan highlights a report from Bloomberg which bears a "Soros Chart" which graphically compares the money-supply divergence between the two countries, as well as the Eurozone inflation rate and EUR/JPY (see below).

(Image courtesy of Liveforex.com)

The reason it is called a 'Soros Chart' is that legendary investor George Soros once successfully predicted the Yen would weaken in the 1990s due to the country's burgeoning money-supply.

It was in the 1990s that the Japanese central bank pioneered the use of QE after the economy suffered from widespread deflation following a collapse in asset prices.

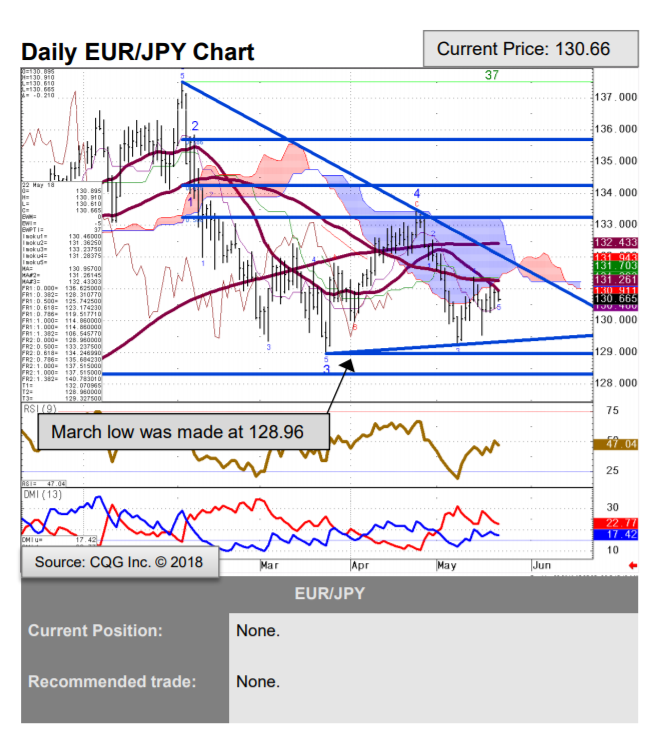

From a technical perspective, the EUR/JPY pair remains 'offered' - which means bearish - as long as it is stuck below the 55-day moving average (MA), which appears to be capping its gains, according to Karen Jones, an analyst at Commerzbank.

"EUR/JPY remains capped by the initial resistance at 130.95/131.26 (20 and 55-day ma) it will need to overcome this to alleviate immediate downside pressure," she says.

For Jones, the 55-day MA is an important level; akin to the importance other analysts attribute to the 50-day MA.

(Image courtesy of Commerzbank)

Large moving averages have a tendency to present the exchange rate with obstacles to trend development as they are levels where there tends to be increased buying and selling, due to their popularity, which can lead prices to stall or even reverse.

A break above 131.28 would be necessary to achieve a more bullish outlook for the pair in line with the bullish fundamental analysis provided by the aforementioned money supply analysis.

Trader's should beware of jumping into long Euro-Yen bets, however, as the rise in political risk from the emergence of a Euroskeptic coalition in Italy, the Eurozone's third-largest economy, could present a potential spoiler to the bullish EUR/JPY forecast.

Intensifying political and economic risk in Europe would lead to a fall in the Euro and potentially a rise in the Yen at the same time from increasing safe-haven flows, which could cause a volatile ripsaw down - not up - in the exchange rate, suggesting not irrelevant bearish risks to the outlook as well.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.