Yen a Strategic Buy as Moritomo Scandal Starts to Put Questions on Prime Minister Abe's Tenure

- The Moritomo scandal is fueling a rise in the Yen

- Trade war fears are further supporting the Japanese currency

- China trade frailties weighing on Australian Dollar - AUD/JPY the perfect short?

© moonrise, Adobe Stock

The Japanese Yen is being tipped to extend its recent good run by a number of strategists who see profits to be gained from betting on such an extension.

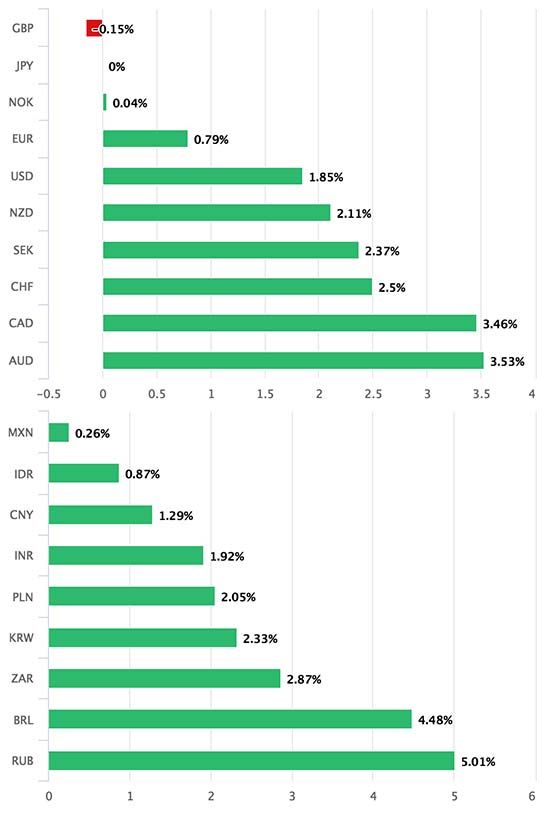

The Yen is the second-best performing major currency month-to-date with only Pound Sterling outperforming.

The reason the Yen is rising is twofold: first, a scandal involving the prime minister called the 'Moritomo scandal' has resurfaced and worsened, and second risk appetite is waning and investors are becoming fearful again as the possibility of trade wars threatens to knock global economic growth rates lower.

Above: The Yen has outperformed in the month-to-date.

The Moritomo affair involves land the government supposedly sold off dirt-cheap to an individual connected to Abe who operates an educational company called Moritomo Gakuen who wants to build a school on it.

Although Abe and his wife were finally exonerated of any wrongdoing in 2017 the scandal has resurfaced again because it has emerged that key documents used in the initial investigation were doctored by a ministry of finance official, who later committed suicide out of shame. The fact documents used in the investigation were doctored, and more specifically in a way which obscured Abe and his wife's names, is causing fresh ripples.

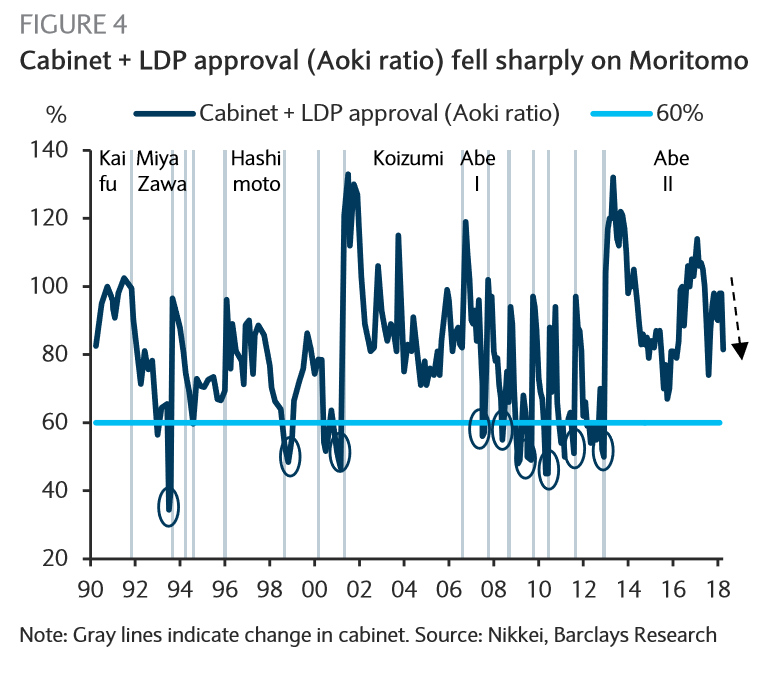

Abe's approval ratings are pfalling and whilst for most currencies political instability would be considered negative, things are not always what they seem with the Yen - this is a currency which rose after Fukushima - and the Yen is rising on this scandal.

The reason it is driving the Yen higher is that the scandal threatens Prime Minister Shinzo Abe's position, and if he resigns, his economic strategy, known as 'Abenomics', will go with him.

One of the key principles of Abenomics involves creating easy monetary conditions by keeping interest rates low, but low-interest rates also weaken the Yen by making Japan a less attractive place for foreign investors to park their money.

Remove Abe, however, and markets are betting you remove the cap on interest rates, which in turn would encourage a stronger Yen.

Yen a Buy

Strategists with Barclays reckon there are some potential gains to be had in betting on a rise in the Yen going forward, "in Japan, the resurfacing of the Moritomo scandal - involving altered documents about an MoF land sale - is suggesting a risk of further JPY appreciation says Barclays analyst Shinichiro Kadota.

And, expressing Yen upside is best achieved via a bet against the Australian Dollar noting the asymmetrical relationship to risk enjoyed by JPY and AUD.

"Sino-US trade war concerns could weigh on a high-beta currency such as AUD, particularly given its late-cycle domestic dynamics and expected moderation in Australia’s terms of trade (Metals Special Report: Iron ore: The clock is ticking, 8 March 2018). On the other hand, JPY could benefit from safe-haven flows and domestic political scandals point to a risk of further JPY appreciation," says Kadota.

The upshot is that AUD/JPY is fast becoming a popular currency pair to bet on going down. Barclays, recommend shorting it from its current level down to 78.00 (current spot price 81.20), with a stop-loss at 83.14.

But they are not the only ones, trading instructors Trade With Precision (TWP) also highlight the AUD/JPY pair as providing the opportunity for a short-trade.

"AUDJPY has now reversed into a downtrend on the daily, weekly and the monthly timeframes. Last week it also broke lower through the monthly level of around 82.5 to close the week below it with a strong selling candle," says TWP.

Rather than entering the market straight away, however, TWP recommend waiting for the pair to retrace marginally into a 'sell zone' between the 10 and 20 day moving averages. Once there, they look for the formation of a bearish candlestick pattern for confirmation the downtrend is going to resume and at that point enter their short trade.

"The market is currently overextended from its MAs and a pullback to test this level from below could see the market back in the sell-zone," they say, adding, "We will be looking for the formation of a small bearish candle rejecting this level for a potential trade setup."

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.