Demand for Japanese Yen will Only Increase as end-March Approaches

The Yen's solid run is likely to extend through March as corporates look to convert funds before the end of the fiscal year.

Japanese corporates keen to portray a clean bill of health at the end of fiscal year (31 March) are expected to repatriate cash from foreign sources over the course of the coming month, which should keep the currency's period of appreciation alive.

"Japanese corporates will likely want to convert funds to yen with the end of the fiscal year approaching," says Minori Uchida an analyst with MUFG in a report which details why the Japanese bank is bullish on the currency.

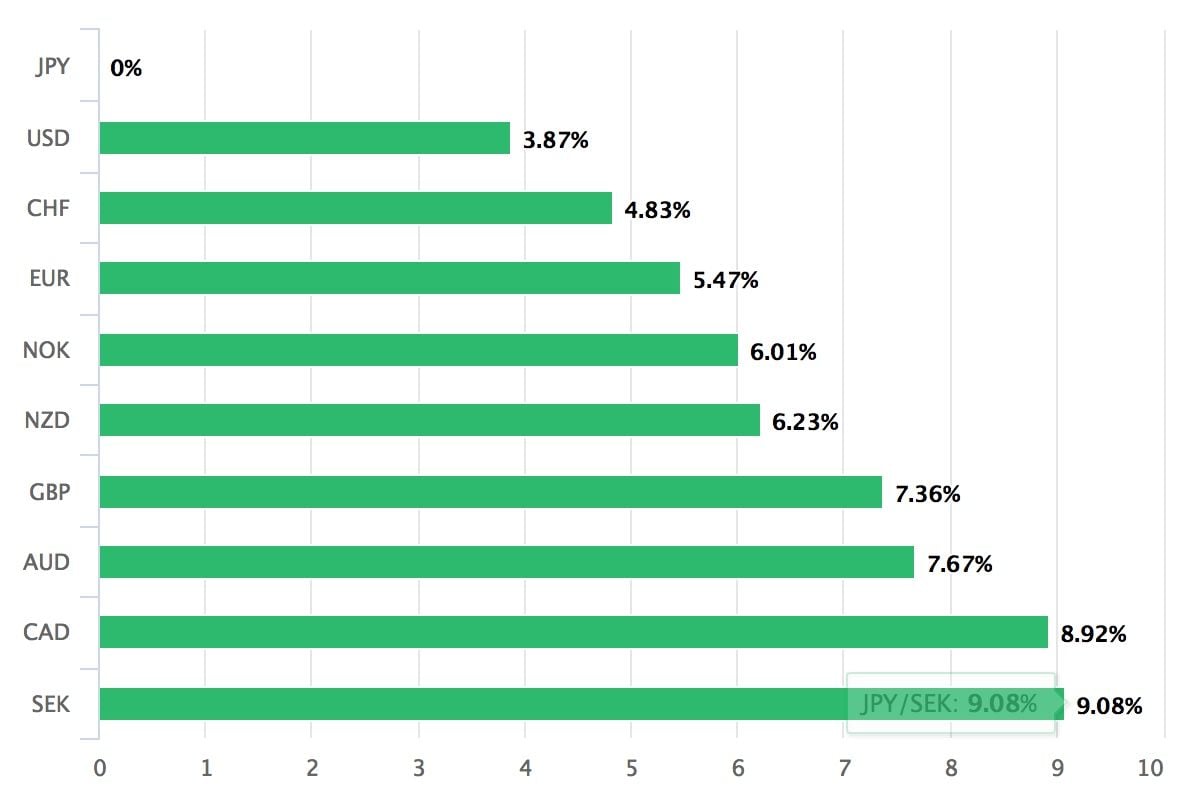

The call comes as the Yen is seen as the best performing major global currency over the course of the past trading month with analysts pointing to multiple sources for this outperformance.

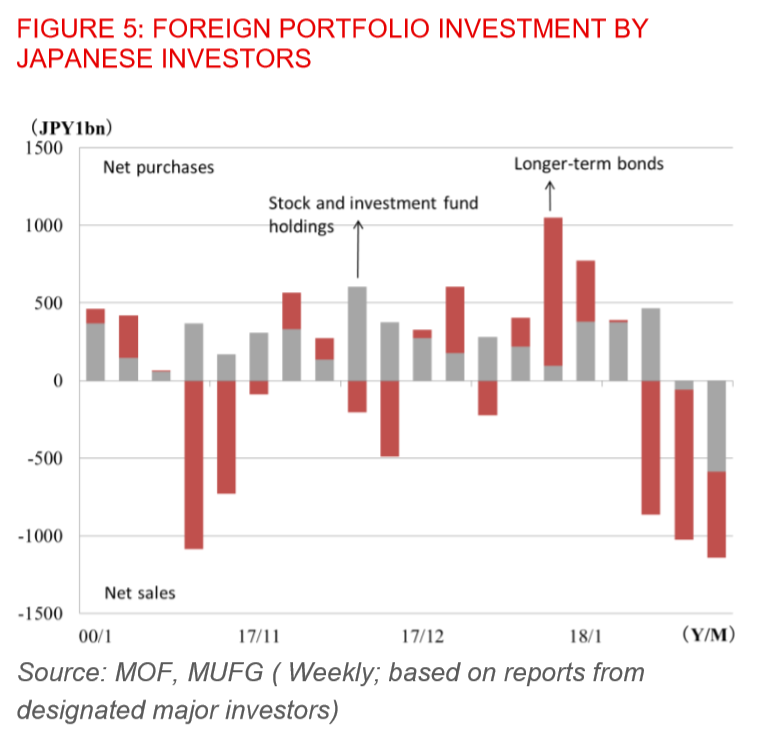

MUFG reckon Japanese fund managers will also step up the repatriation of dividends from foreign-owned shares ahead of year-end - especially if they fear the trend for a stronger yen continues.

"Primary income surplus tends to rise from high dividend repatriation in February and March," says Uchida who adds Japanese investors may also refrain from making too many foreign investments as the end of the fiscal year approaches.

Indeed, studies confirm a favourite destination for Japanese investors - US Treasury bonds - are not as attractive as they had been in the past which should diminish flows from Yen into Dollars.

"We think they (investors) will refrain from nonessential investment in foreign securities in the near term considering numerous factors could still hurt UST supply/demand and since the end of the fiscal year is approaching," says the MUFG research analyst.

One factor which might offset Yen demand, however, is continued flat inflation expectations.

Uchida does not think wages will go up by much this year despite pressure from the government on corporates to raise their wages.

The reason: the strengthening Yen which will become a headwind to export growth.

"In particular, the Yen's strength to date this year is likely to leave many companies concerned about the outlook, meaning they will probably be reluctant to commit to any wage increase that would raise overall personnel costs," says the analyst.

Lower inflation is likely to keep the Bank of Japan (BOJ) on the defensive and not lead to higher interest rates for a long time (despite Kuroda's speech earmarking 2019 as a time for monetary policy to tighten in Japan).

Rising interest rates are a fuel for currency appreciation because they increase inflows from investors seeking somewhere profitable to park their money, and vice-versa for lower interest rates. Therefore, a static BoJ might offset some JPY strength.

Yet despite this potential counter-force, the Yen is expected by MUFG to rise against most counterparts.

Indeed, there are signs that the speculative market is changing from net short to net long the yen, and this is also seen as a positive predictor, as more speculators are likely to jump on the bandwagon.

"The overall picture suggests that the Yen still faces strong upside pressure," says MUFG's Uchida, adding, "yen cross rates could be hurt if both the yen and dollar continue to firm. EUR/JPY and GBP/JPY have fallen sharply from YTD highs of 137.50 and above 156.50 (both on February 2) to below 131 and 149 respectively."

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.