The Yen is Rising Despite Evidence to the Contrary

© DragonImages, Adobe Stock

The USD/JPY pair is studiously ignoring the usual signals and falling, meanwhile, the Yen is rising across the board.

The recent surge in US Treasury bond yields would normally signal a rise in the US Dollar versus the Yen exchnage rate.

Rising yields normally reflect rising interest rate expectations which is manna from heaven for investors who tend to push money into countries where interest rates are rising and they can expect a higher return.

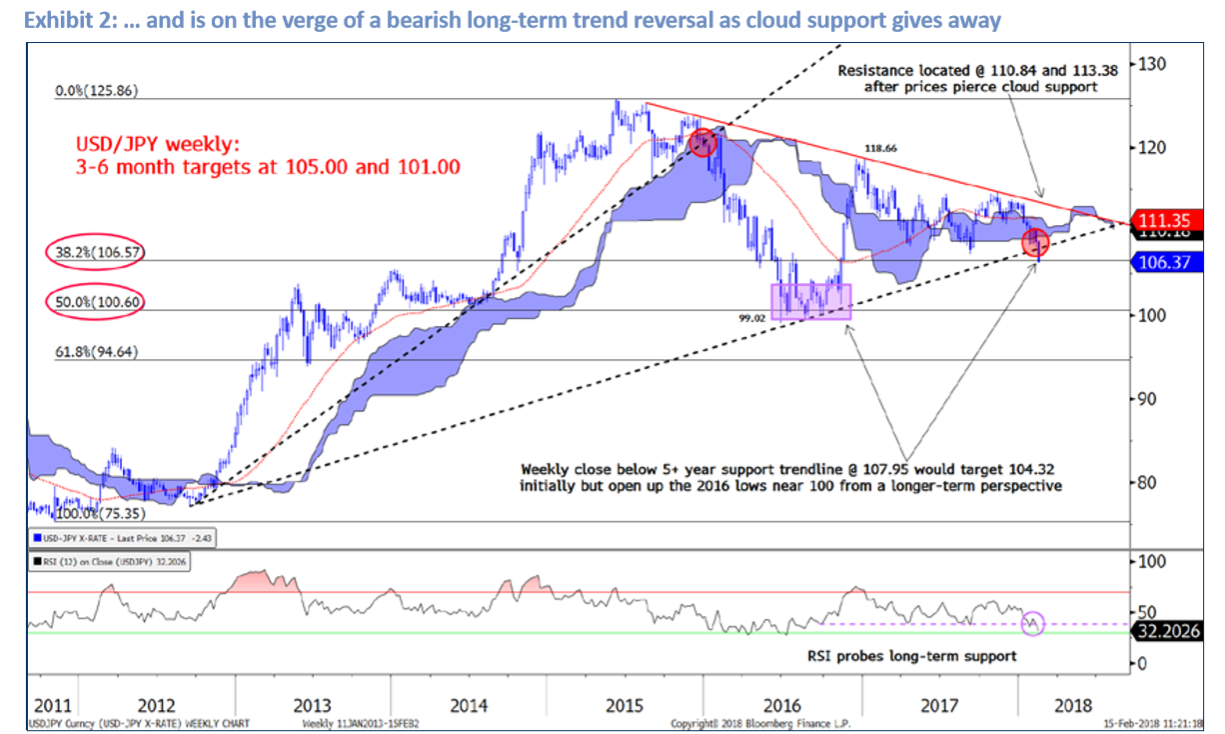

Yet as can be seen from widening crocodile jaws on the chart below, which compares US-JP yield differentials and the USD/JPY exchange rate, the old relationship has broken down.

A further atypical development with the USD/JPY pair is the Yen's strength in the face of global growth. Normally investors would expect the opposite, which is for the Yen to fall when risk appetite is strong because of its safe-haven credentials.

It's not just against the Dollar - the Japanese currency is rising versus the Euro, the Canadian Dollar, and the Pound too.

The Japanese real effective exchange rate (REER) which is the currency versus a basket of counterparts has been on the rise since November 2017.

Against the Pound, it is poised to break higher too, with GBP/JPY at the brink of breaking down below a major trendline which would herald a new bearish phase for the currency pair. Given similar trendlines have been breached in other Yen crosses, GBP/JPY is expected to follow suit - it's only a matter of time.

The main underlying reason for the Yen's strength is that the investors now seem to think the Bank of Japan (BOJ) is going to end its quantitative easing (QE) programme.

QE tends to dampen a currency so ending it would be positive for the Yen.

If the BOJ then were to raise interest rates too, as some expect, then that would be even better for the Yen as higher interest rates tend to draw greater inflows of foreign capital due to the promise of higher returns.

The different pairs also have their own idiosyncratic factors, but none so much as USD/JPY.

The Dollar and the Yen

USD/JPY's uncoupling from interest rate differentials which would normally favour the US Dollar over the Yen has got analysts thinking about what could be driving the pair instead.

One interesting explanation is that Trump's tax cuts have put more money in US consumer's pockets which they will probably spend on, amongst other things, Japanese imports, of which the US imports a great deal, thereby further increasing demand for those imports and driving up the Yen in the process.

The US is at full 'capacity' - everyone has a job and companies have filled most of their vacant desk space with productive employees, so the argument is that a tax cut is going to give everyone a surplus of money which they will invariably spend on imports.

"When an economy is stimulated at full employment the only way to absorb domestic demand is higher imports. Under conservative assumptions the US twin deficit is set to deteriorate by well over 3% of GDP over the next two years," says Deutsche Bank strategist George Saravelos.

All the extra tax giveaways and increased US spending on military and domestic programmes are going to have to be financed from somewhere, and the usual way is by selling US treasury bonds (T-bonds), however, the Japanese are unlikely to be the dominant buyers of US debt as they might have been in the past.

"Japanese real money investors like pension funds, fearing the impact that a faster pace of tightening from the Fed may have on US yields, may instead be deploying assets in other DM jurisdictions like Australia, where the RBA has remained more dovish," says Morgan Stanley strategist Hans Redeker.

Without the offsetting inflow of Japanese money in the form or Treasury purchases, the USD/JPY is becoming an increasingly one-sided trade.

Recent influxes of Chinese tourists combined with the loss of interest for US T-bonds have also supported the Yen, according to Deutsche Bank's George Saravelos:

"But the Japanese basic balance has also shot up to a 4% surplus in recent years helped by a big improvement in the services balance (Chinese tourists) and a collapse of Japanese inflows into the US: treasuries simply do not provide enough duration compensation anymore."

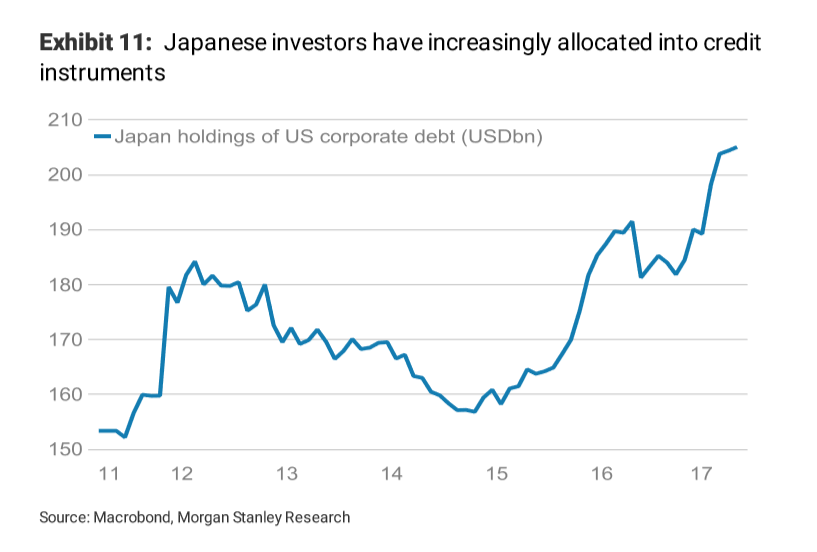

One further final reason for the falling USD/JPY is that QE has led Japanese investment funds to change the composition of their funds.

Whereas before they would hold a significant amount of low-risk sovereign debt they have now had to diversify due to the central banks buying up most of the sovereign issuance, and pushing the price up in the process.

Japanese pension funds and the like, have stocked up on alternative types of credit risk instead, such as corporate debt.

The downside is that these higher risk assets are less resilient to rising inflation expectations and interest rates and so the Japanese have been busy selling this credit risk, which is mainly Dollar-denominated - which has meant a de facto selling of the US Dollar.

"QE globally has pushed investors to take on more risk. Traditional holders of sovereign debt have been increasing their duration and, importantly, increasingly allocating into credit instruments (Exhibit 11). The result of this shift is that rising yields have a more acute impact on investors' P&L given their greater exposure to duration and credit risk when compared to a more conservatively structured sovereign debt portfolio. The implication here is that pressures in this environment to reduce risk are higher," says Morgan Stanley's Redeker.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.