Japan's Yen Picks The Positives Buried In Latest Wage Data

- Written by: Sam Coventry

Image © Adobe Stock

The Japanese Yen has had a tough start to 2024 but will consolidate and avoid a repeat of 2023's weakness as the Bank of Japan remains set to exit its Negative Interest Rate Policy (NIRP).

This is according to analysts following the release of wage data for December that suggests the conditions for an exit from NIRP will be met.

Japanese December wage growth came in at 1.0% year-on-year, up from 0.7% in November but below the 1.3% expected.

Despite the disappointment, a 2.0% rise in full-time workers' base pay was also recorded, which, if maintained, opens the door to rate hikes.

"The analyst community was able to find some underlying strength in the data underneath the hood," says W. Brad Bechtel, Global Head of FX at Jefferies.

Policymakers at the Bank of Japan in January cited improved wages and the prospect of the upcoming wage negotiation round as offering a window to allow it to raise interest rates.

Economists at HSBC expect the BoJ to officially remove its Yield Curve Control policy by the end of the first quarter and then exit NIRP in the second quarter, raising the rate on the policy-rate balance to 0.00% from -0.10%.

"The JPY has been the worst-performing currency in G10 FX so far this year (-5.1% vs the USD), but we look for consolidation ahead," says Clyde Wardle, a strategist at HSBC.

The next big test for the Yen will be the outcome of Shunto wage rounds a little over one month from now, which should offer greater clarity on whether the BoJ can raise rates.

"The prevailing view is that there is still plenty of momentum in wages and that will keep the BoJ on track from a move from NIRP to ZIRP sometime in the March/April time frame," says Bechtel.

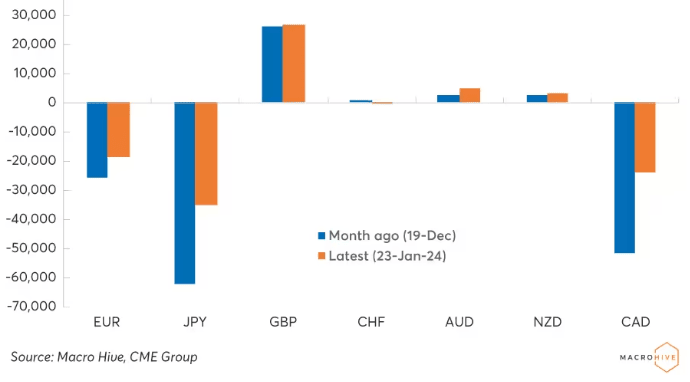

Above: Leveraged funds remain bearish JPY. Chart: Open interest, the net number of contracts (longs minus shorts), for leveraged funds.

Separately, an analysis of global futures markets by Macro Hive reveals investors see the Dollar-Yen downside as more likely than the upside.

Analysing CME Group data on option strikes, Macro Hive says there is net demand for Dollar-Yen calls from 146 to 152, with more at 154.

However, net demand quickly weakens thereafter.

"In contrast, there are bigger clusters of downside demand between 135 and 145, with the standout bearish position at 139. That is a 6% decline from current levels," says Bilal Hafeez, head of research at Macro Hive.

He suggests this indicates that the Dollar-Yen upside is probably limited to 152-154, given the sensitivity of Japanese officials to sustained yen weakness and the possibility of FX intervention (certainly verbal and perhaps by buying JPY).