Pound-Yen Hits 8-year High Following Soft Japanese Inflation Figure

- Written by: Gary Howes

Image © Adobe Stock

The Japanese Yen was softer across the board after Japan reported inflation numbers that offered little incentive for the Bank of Japan to exit its Negative Interest Rate Policy (NIRP).

Inflation fell from 2.8% to 2.6% year-on-year in December, while the core reading fell from 2.5% y/y to 2.3.

"In Japan, CPI continues to decelerate," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho. "These numbers make a major policy change in January very unlikely."

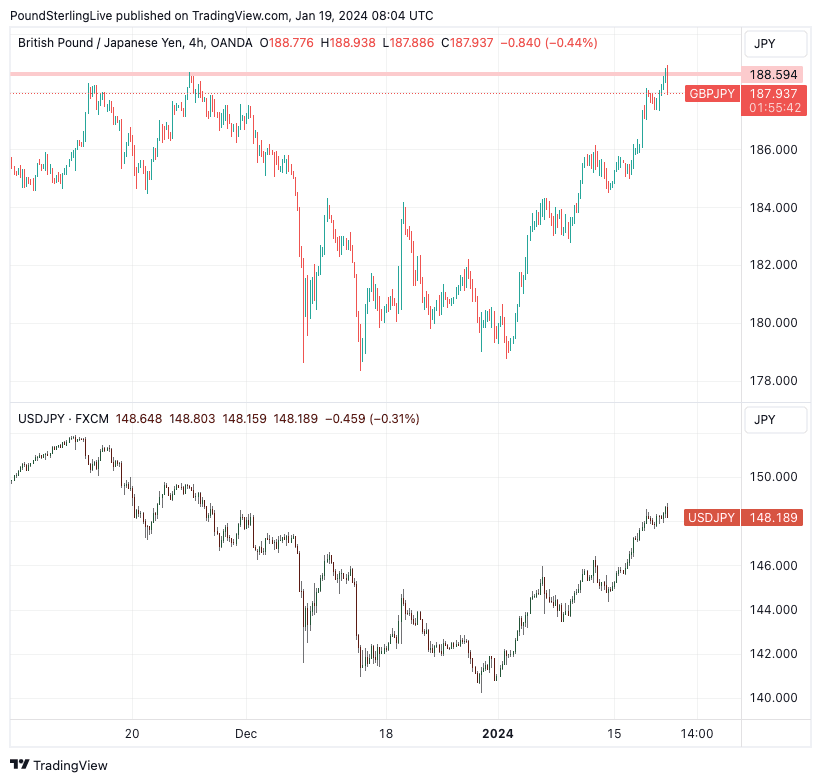

The Pound to Yen exchange rate rose to its highest level in eight years at 188.93 following the inflation numbers, while the Dollar-Yen rose to 148.27.

Above: Pound-Yen and Dollar-Yen (lower panel) at four-hour intervals. Track JPY with your custom rate alerts. Set Up Here.

The Japanese Yen surged into the end of 2023 amidst indications the Bank of Japan was readying to exit the NIRP, but this rally also reflected rising bets for interest rate cuts at other major central banks.

2024 is a story of these rate cut bets being pared, boosting the likes of the Pound, Euro and Dollar while the earthquake in Japan and these inflation figures question any imminent exit from NIRP.

The Yen is understandably back under pressure.

"To add on top of the sluggish data seen lately, the BoJ rhetoric has been cautious to not fuel any rate-change expectations and the 1 January earthquake likely adds to the desire to be patient for now," says Gomez-Liechti.

Mizuho says April is now the firm favourite for a policy change.

"Market participants have been pushing back expectations for the BoJ’s exit from negative rates. It is highly unlikely now that the BoJ will raise rates and/or exit YCC at next week’s BoJ policy meeting. We have pushed back our BoJ rate hike call to the April policy meeting," says Lee Hardman, analyst at MUFG.

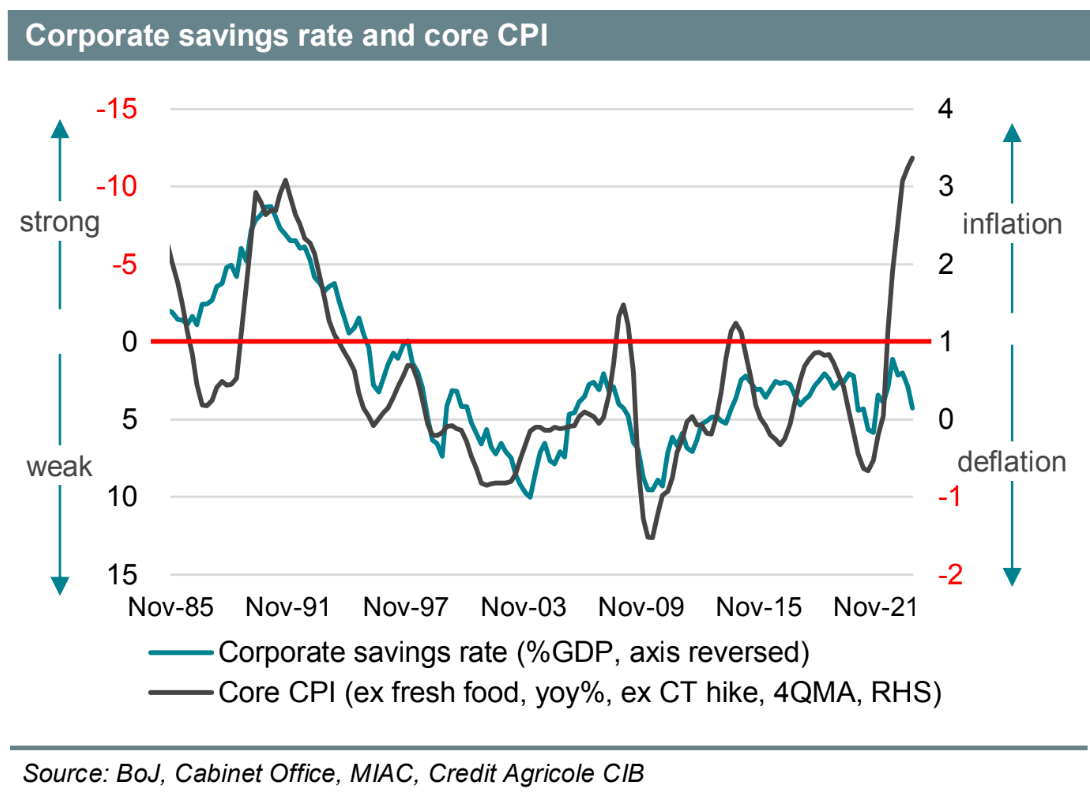

Takuji Aida, Chief Economist for Japan at Crédit Agricole says inflation is not running at the high level the central bank expected when it revised up its CPI forecast back in October. "The likelihood that the BoJ is pushed to tighten policy due to strong inflationary pressures remaining on the economy has likely decreased."

"With energy prices declining, we expect the BoJ to revise down its core CPI forecast from 2.8% to around 2.5% when the next outlook report is released at the January monetary policy meeting," he says.

According to Aida, structural deflationary pressure will likely suppress domestic demand and push core-core CPI far below 2% in 2025.

Crédit Agricole says Japan's soft inflation can be attributed to excessive savings by the country's corporations, and it will only be in 2025 when the next cyclical recovery of the global economy materialises that inflationary pressure will likely strengthen.

He says any shift in Bank of Japan policy - i.e. raising interest rates - could undermine the return to sustained inflation in 2025.

"A key reason for Japan’s deflation and stagnating growth is likely due to businesses saving excessively. Since the collapse of the economic bubble of the late 1980s/early 1990s, corporates have become increasingly backward-looking, which led them to strengthen restructuring and debt reduction moves. As a result, the corporate savings rate turned positive and has continued to rise. Over-saving (underspending) by corporates destroyed aggregate demand and strengthened structural deflationary pressures. This lingering structural deflationary pressure on the economy indicates that the economy is not in a state where one can foresee it completely exiting from deflation." - Crédit Agricole.