Yen Recovers on Suzuki's Intervention Threats

- Written by: Sam Coventry

Image © Adobe Stock

The Japanese Yen recovered from multi-month lows against the Dollar after fresh threats of currency market intervention were made by the head of the country's finance ministry as it becomes clear concerns over the currency's fall are growing.

Japanese Finance Minister Shunichi Suzuki said Tuesday he is "closely watching FX moves with a great sense of urgency."

The Yen recouped previous losses as investors took money off the table for fear of being caught on the wrong end of any intervention.

Suzuki said he "won't rule out any steps to respond to disorderly FX moves."

"If JPY were to depreciate further, it is quite possible that there will be further interventions," says analyst You-Na Park-Heger at Commerzbank.

Earlier, the Japanese Yen extended its run of losses as the broad U.S. Dollar hit its highest levels of the year at 149.15 USD/JPY. The pair has since recovered to 148.9670.

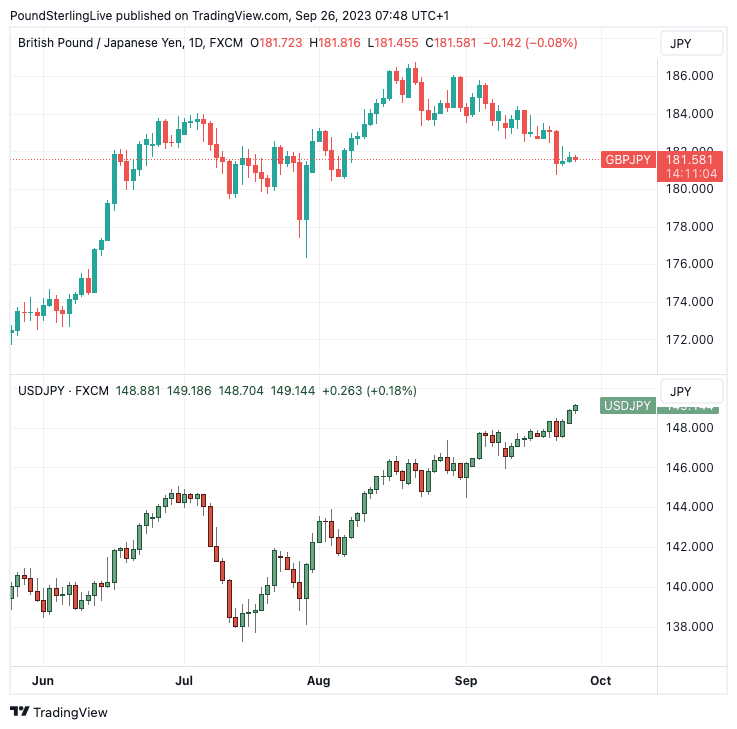

The Pound to Yen rate meanwhile continues to struggle at 181.5190 amidst ongoing pressures on Sterling following the Bank of England's decision last week to keep interest rates unchanged.

Above: Pound-Yen (top) is off its 2023 highs but Dollar-Yen printed a fresh best ahead of Suzuki's comments

Despite the latest developments, analysts at Commerzbank don't see a material change in fortunes for the Yen as it will remain hamstrung by Japan's low bond yield environment.

The Dollar remains on the offensive, finding support from rising U.S. bond yields which are a symptom of solid issuance by the U.S. Treasury and the Federal Reserve's commitment to keeping interest rates high for an extended period.

Global bond yields are moving higher as a result and painting a gloomy picture of the outlook for the global economy, thus benefiting safe havens such as the Greenback.

Typically the safe haven Yen would be expected to benefit, but it appears the Bank of Japan's outlier status as a result of maintaining ultra-low rates is weighing.

The Bank of Japan on Friday offered no hint it was ready to change policy when delivering its September policy decision, resulting in further Yen weakness.

Bank of Japan governor Kazuo Ueda on Monday meanwhile said more patience was required.

"Only a few weeks ago Ueda had brought the possibility of ending the zero-rate policy into play if prices and wages were to move in the right direction. By doing so he had kindled the expectation that the Japanese central bankers might initiate a reversal of their monetary policy over the coming months," says Park-Heger.

"Perhaps Ueda was unaware of the expectations this would fuel. Since then, the BoJ has been trying to stifle such expectations. This has led to USD-JPY approaching the 150 mark again, a development officials have been trying to avoid as there have been attempts for months now to weaken the downside pressure on JPY with the help of verbal interventions, as again this morning by the finance minister," she adds.

Commerzbank says that were JPY to depreciate further, it is quite possible that there will be further interventions.

"These are unlikely to have much of an effect though. Since the BoJ does not want to move away from its ultra-expansionary monetary policy despite comparatively high inflation rates, a weaker JPY seems fundamentally justified," says Park-Heger.

She says a weaker USD would improve the situation for the Bank of Japan, but at present the market seems to be betting on a stronger USD.

"The solid US economy and hawkish comments by Fed members support USD at present. Everything all told there is a lot pointing towards higher levels in USD-JPY," says Park-Heger.