Yen's Downward Spiral Looks Intact: XM.com

Image © Adobe Images

By Marios Hadjikyriacos, Senior Investment Analyst at XM.com. An original of this article can be found here.

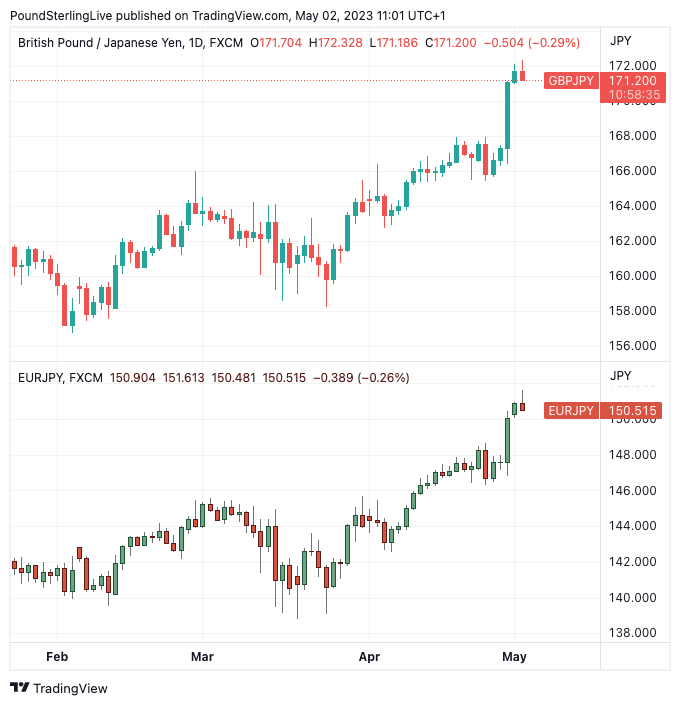

The Japanese yen has taken heavy damage lately, hitting a fresh 15-year low against the euro this week.

Momentum in euro/yen has been quite impressive, with the pair breaching the 150 psychological region with some force to extend the incredible post-pandemic trend.

At the heart of the yen’s downfall lies a classic case of central banks moving in opposite directions.

With the Bank of Japan refusing to tighten policy while most other major central banks have been raising interest rates at warp speed, rate differentials continue to widen against the yen.

In essence, the yen is acting like an escape valve as capital flows out of Japan, searching for higher returns abroad.

Its losses against the euro have been especially bruising because the Eurozone has turned into an attractive investment destination, with the ECB rolling out a series of rapid-fire rate increases and local stock markets hovering near record highs.

Above: GBP/JPY (top) and EUR/JPY). Consider setting a free FX rate alert to better time your payment requirements, please see here.

Unless there’s another round of FX intervention, there isn’t much on the immediate horizon that can stop the yen’s downward spiral.

The Bank of Japan does not meet again until mid-June and risk sentiment has stabilised with the banking episode fading into the rear-view mirror, further sapping demand for the safe-haven yen.

Over in Australia, the Reserve Bank stunned investors earlier today by rolling out a surprise rate increase, resuming the tightening cycle it paused last month.

Ahead of this event, market pricing assigned less than a 15% probability for the RBA to raise rates, but policymakers had other thoughts.

The RBA stressed that inflation is still far too high and kept the door open for more action if needed, although policymakers were careful to dial down their tightening bias.

Markets currently see about a 50% chance for one final rate increase by the summer.

In the FX market, this surprise boosted the Australian dollar.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

That said, it is questionable whether there is scope for this rally to continue considering the sharp decline in iron ore prices and the deterioration in Chinese business surveys released over the weekend, both of which paint a gloomier picture for Australia’s export-heavy economy.

In other news, US regulators engineered a deal on Monday whereby JPMorgan Chase will absorb the assets of troubled First Republic Bank, calming concerns about any further contagion in the sector.

The deal helped spread some cheer, lifting US yields and the dollar in the process, with some help from an encouraging ISM manufacturing survey too.

Stock markets were pretty much flat on Monday, paying little attention to Treasury Secretary Yellen who warned the US government might run out of cash by early June without a debt ceiling deal.

The only market segment that has cared about this risk so far are short-term Treasury yields, but that might change as the ‘x-date’ draws closer.

On the earnings front, the show will continue today with Pfizer, AMD, Starbucks, and Uber releasing their quarterly results.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |