Japanese Yen Building Bullish Fan Club But Fed Risk Looms Ahead

- Written by: James Skinner

"While the recent deterioration in business surveys represents a downside risk to Q1 growth, we believe business surveys are currently overstating the weakness in the real economy" - Goldman Sachs.

Image © Adobe Stock

The Japanese Yen was an outperformer ahead of the weekend and has continued to build a growing fan club of bullish followers in recent trade but with a possibly-hawkish Federal Reserve (Fed) interest rate decision just around the corner, the currency may be at risk of a setback next week.

Japanese exchange rates rallied on Friday after inflation rose further than was expected in Tokyo for the month of January and in an outcome that is widely seen as heralding another step up in the national inflation rates when those are announced toward the end of February.

"Today’s strong rise in the Tokyo CPI for January adds to the case for a start to the process of unwinding ultra‑loose monetary policy," says Kristina Clifton, a senior economist and currency strategist at Commonwealth Bank of Australia.

"Speculation that the BoJ will start to normalise monetary policy in the coming months will keep USD/JPY under pressure in our view," she adds.

Clifton and colleagues say rising inflation and continuing speculation about Bank of Japan (BoJ) monetary policy are likely to offset the typical adverse effects of the further quantitative easing the bank is carrying out in order to maintain the Yield Curve Control programme.

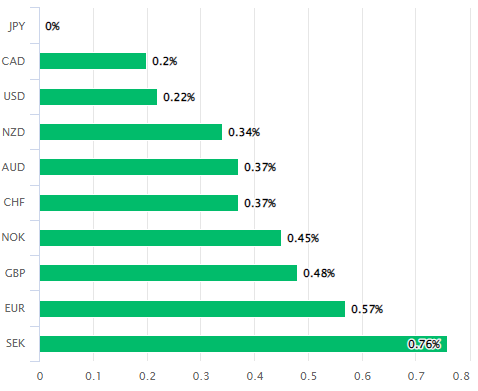

Above: Japanese Yen performance relative to G10 and G20 counterparts on Friday. Source: Pound Sterling Live.

The BoJ has maintained a commitment to buy unlimited amounts of Japanese government bonds in order to enforce the 0.5% upper limit imposed on the 10-year yield as part of the Yield Curve Control programme, and has frequently intervened to that effect throughout January.

"The prevailing view remains that inflation is starting to stall out around the world (although Australia hinted at the opposite this week) and if inflation is indeed stalling then the BoJ may not actually have time to get to the normalization process on rates," warns Brad Bechtel, global head of FX at Jefferies.

"JPY crosses are stabilizing at the higher end of the ranges they have held recently as we come into the close of January. We'll see how things trade when the Lunar New Year holidays are over next week and more Asian traders are sitting in their seats. CNH will be a focus then," Bechtel adds.

While the Yen rose against all counterparts in the G20 grouping on Friday, it was underperformer for the week overall and is known to be susceptible to increases in recently-docile U.S. government bond yields and next week's Federal Reserve Decision might be an upside risk for U.S. borrowing costs.

This after numerous Federal Open Market Committee members acknowledged an apparent slowing of the U.S. economy in public remarks made throughout January but also warned that further increases in interest rates are still likely to be necessary in the months ahead.

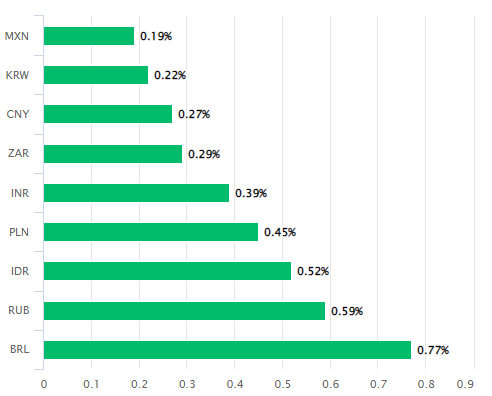

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

"While the recent deterioration in business surveys represents a downside risk to Q1 growth, we believe business surveys are currently overstating the weakness in the real economy," writes Spencer Hill, CFA and a senior economist at Goldman Sachs, in research briefing this week.

"Survey data do not provide a perfect read on growth, and they are particularly error-prone when business sentiment is euphoric or depressed," he adds.

While there has been no shortage of poor economic figures emerging from the U.S. in recent weeks, Thursday's initial estimate of final quarter GDP was far stronger than many economists anticipated and many official indicators suggest the labour market remains resilient.

This and December's uptick in the monthly pace of inflation are both among reasons for why the Fed might yet take borrowing costs above the 5% level that financial markets have priced-in as the likely peak for the months ahead.

To the extent that this is the message coming from next Wednesday's policy statement and press conference, it could have bullish implications for U.S. bond yields, the Dollar and USD/JPY over the coming week.

Above: USD/JPY shown at daily intervals with selected U.S. bond yields. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.