Japanese Yen Nears New Millennium Low after BoJ Eggs On Bearish Market

- Written by: James Skinner

“For prices to rise as projected and further toward 2 percent in a stable manner, it is necessary to create a virtuous cycle that generates synergy between wage increases and price rises…the Bank will take a strong stance on continuing with monetary easing, in that it will provide a macroeconomic environment where wages are likely to increase so that the rise in inflation expectations and changes in the tolerance of price rises -- which have started to be seen recently -- will lead to sustained inflation.”

© European Central Bank, reproduced under CC licensing

The Japanese Yen fell toward levels rarely seen thus far in the new millennium this week after the Bank of Japan (BoJ) appeared to egg on a bearish currency market by doubling down on its commitment to pursuing a long-elusive inflation target through the use of stimulatory monetary policy.

Japan’s currency enjoyed a period of stability during the recently elapsed month of May but the early morning of June has given way to renewed pressure upon the Yen, which fell to its lowest level against the Dollar since 2002 on Tuesday.

Tuesday’s losses lifted USD/JPY to within a short distance of highs last seen in 1998, which marked an approximate end to a five-year period in which direct intervention became a frequent occurrence as state authorities sought to slow the currency’s decline.

“The ratio of export to import prices has never been worse, and the C/A is running at an underlying deficit, indicative of a FEER valuation that is closer to fair in value, IF the current import price structure sticks. Similarly, Japan is also running at the bottom of an international league table on changes to terms of trade,” says Alan Ruskin, a macro strategist at Deutsche Bank.

Many analysts say the Yen's losses are increasingly driven by a deteriorating money flow picture being painted by rising or otherwise elevated commodity prices that are driving the trade deficit further in the wrong direction, although BoJ Governor Haruhiko Kuroda disagreed with that assessment this Monday.

Above: USD/JPY shown at daily intervals alongside spread or gap between 10-year U.S. and Japanese government bond yields. Click image for more detailed inspection.

Above: USD/JPY shown at daily intervals alongside spread or gap between 10-year U.S. and Japanese government bond yields. Click image for more detailed inspection.

“It should be noted that the main cause of the recent deterioration in Japan's terms of trade is a rise in commodity prices in U.S. dollar terms, which boosts only import prices, and not the depreciation of the yen, which increases both export and import prices in yen terms and therefore is generally neutral to the terms of trade,” Governor Haruhiko Kuroda told the 2022 Kisaragi-kai meeting.

“In any event, since Japan's economy has been under downward pressure from the income side due to rising commodity prices, it is necessary to mitigate this negative impact by continuing to conduct monetary easing,” he also said in the speech made from Tokyo on Monday.

Regardless of the effect that commodity prices may or may not be having on the Yen, some analysts have been encouraged to view the rally in commodities and fall in “the terms of trade” ratio as being drivers of the Yen’s losses and in part due to recent stability in the Japanese government bond market.

The inference is that with Japanese government bond prices being well supported and yields contained beneath the upper limit of the BoJ’s target band, the BoJ’s policy has not been the dominant driver of the Yen’s declines.

“There are a couple of noteworthy differences between this week's bout of JPY weakness and the last bout of JPY weakness that we saw at the tail end of April,” writes Greg Anderson, global head of FX strategy at BMO Capital Markets, in a Friday market commentary.

“First, 10Y JGB yields aren't at the BoJ's ceiling, so the BoJ is not buying JGBs to defend its yield curve control mechanism. This somewhat absolves Kuroda and the BoJ from any direct blame for yen weakness,” Anderson added.

Above: Japanese 10-year government bond yield shown at daily intervals and alongside U.S. 10-year yield. Click image for more detailed inspection.

Above: Japanese 10-year government bond yield shown at daily intervals and alongside U.S. 10-year yield. Click image for more detailed inspection.

Governor Kuroda offered a different prospective explanation for that stability just this week, however, and one that would not preclude recent and ongoing Yen losses from being a central bank monetary policy story.

“The total amount purchased is not significantly higher than in the past, and there continue to be no bids submitted for fixed-rate purchase operations since May," he said of the 10-year bond market on Monday.

"I think this is due in part to the "stock effect" attributable to the past JGB purchases, another reason seems to be that the "announcement effect," or the effect of the Bank having announced that it will purchase an unlimited amount of JGBs through fixed-rate purchase operations if 10-year JGB yields exceed 0.25 percent, has had a significant influence on the formation of market participants' expectations,” the governer then surmmised.

"At any rate, 10-year JGB yields have been stable at low levels under yield curve control, and I consider that this has sustained accommodative funding conditions, such as for CP, corporate bonds, and bank lending, and in turn firmly supported Japan's economic activity," he added in conclusion.

The above remarks were made alongside others that set out why the BoJ intends to continue with its expansionary policy, which involves the creation of new money to buy up government bonds with a view to keeping financing costs low and financial conditions accommodative across the economy.

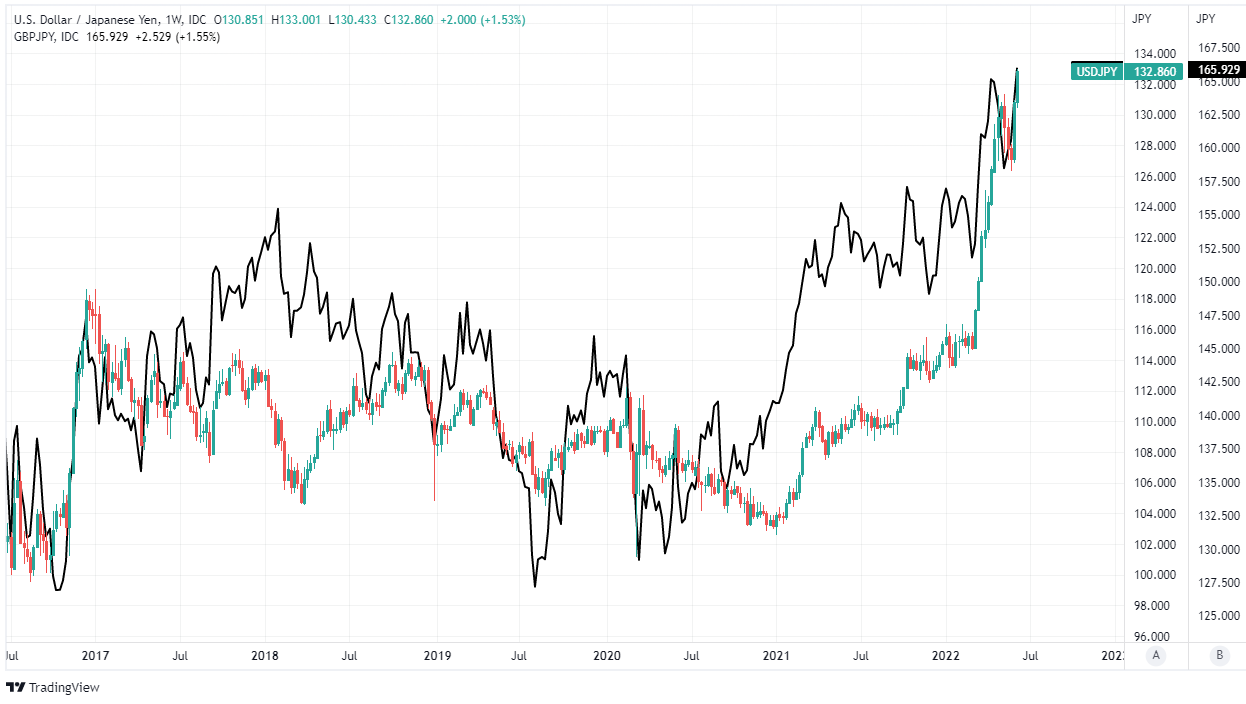

Above: USD/JPY shown at weekly intervals alongside GBP/JPY. Click image for more detailed inspection.

Above: USD/JPY shown at weekly intervals alongside GBP/JPY. Click image for more detailed inspection.

The BoJ’s policy is aimed at sustainably attaining a long-elusive target of 2% inflation but has come at an increasing cost to the Yen in recent months during which other central banks have stepped up the pace at which they’re withdrawing monetary policy support from their own economies.

“Japan's real GDP has not yet recovered to the pre-pandemic level,” Governor Kuroda explained on Monday before noting that “real GDP for Japan remained 2.7 percent below the pre-pandemic level,” at the end of the first quarter.

Depressed levels of private consumption and weak business investment were cited as the main reasons for a lacklustre economic recovery that is exacerbating the squeeze on household incomes and ensuring that a sustainable attainment of the inflation target remains a distant prospect.

All of this is necessitating a continued period of monetary stimulus.

“I believe that the issue of whether wages will clearly increase and service prices will overcome long-standing zero inflation holds the key to achieving the price stability target of 2 percent in Japan in a sustainable and stable manner,” the governor said on Monday this week.

“The primary reason for being unable to achieve the price stability target of 2 percent, despite the fact that the Bank has carried out large-scale monetary easing for over nine years, is that this "zero percent anchoring" of inflation expectations -- in other words, "zero-inflation norm" -- has been extremely persistent,” he later added in a further highly pertinent remark.

The full text of the BoJ Governor’s speech can be accessed here.

Above: USD/JPY shown at monthly intervals alongside GBP/JPY. Click image for more detailed inspection.