Japanese Yen in Fresh Advance

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

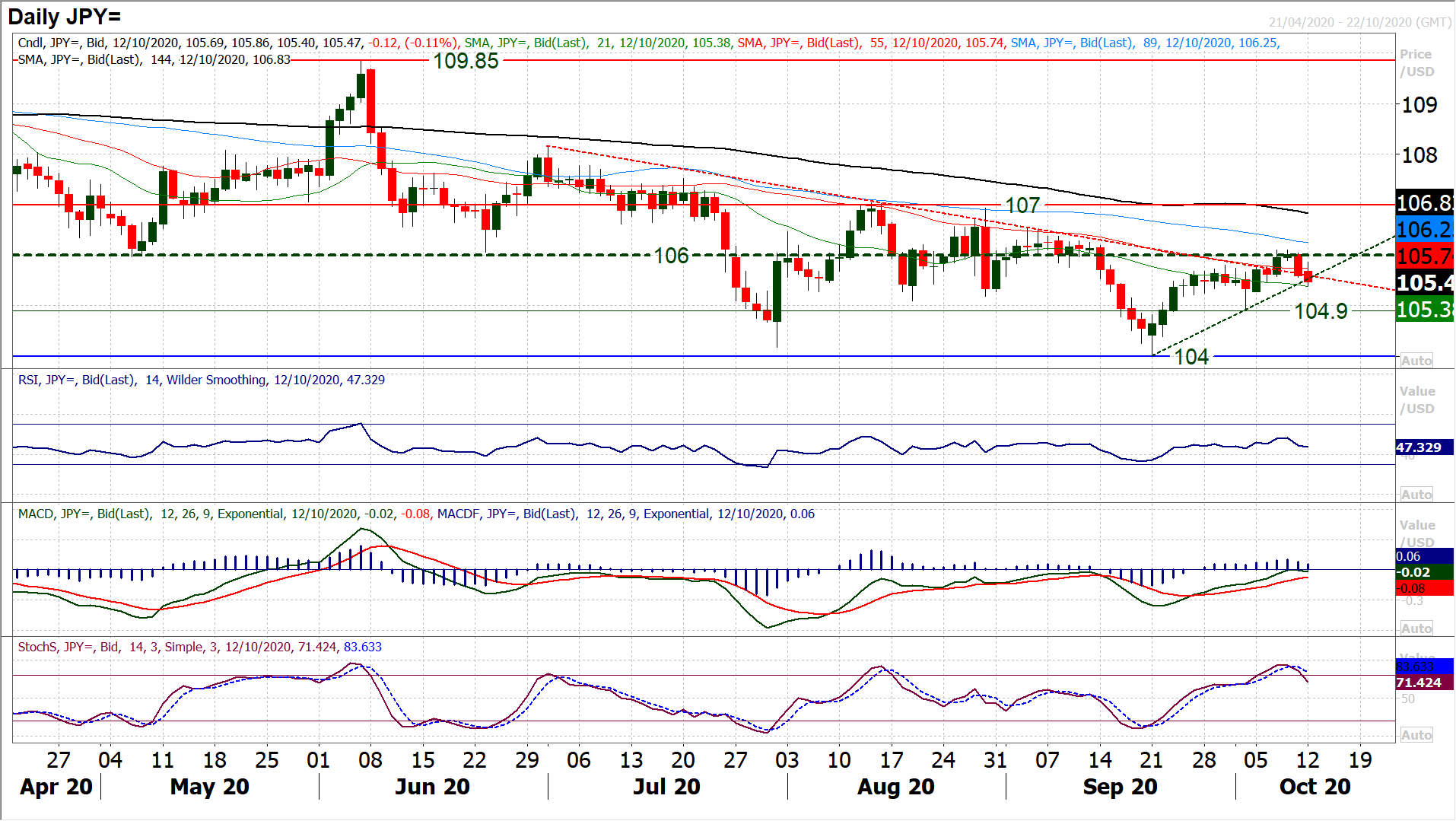

The Dollar-Yen exchange rate has retreated amidst signs the near-term outlook is turning corrective again, according to Richard Perry, analyst at Hantec Markets.

The improvement in risk over recent sessions helped to pull Dollar/Yen back into the middle of what now has to be considered to be a multi month trading range 104/107.

However, with decisive turn away from the dollar on Friday, Dollar/Yen has swung sharply weaker once more and this is continuing early today.

There are hints of an "evening star" three candlestick set up formation (Wednesday to Friday) which is turning the outlook corrective again.

This comes with a Stochastics bear cross sell signal. The move has already broken a recovery trend too. What is notable from a medium term perspective is that the rally has once more faltered around the 106.00 old pivot.

With the recent breach of the three month downtrend, we turned more neutral on Dollar/Yen on a medium term basis for a range between 104/107. The failure around 106.00 before turning lower just leaves a slight negative bias once more on a near term basis.

This may now generate a drift towards testing 104.90 again.

Major markets look somewhat cautious in early moves today as several key issues remain on a knife-edge.

US politics remains front and centre. Whilst the market appears to be positioning for a Biden victory in the US Presidential election, there is a lack of clarity still on whether a fiscal stimulus agreement can be struck prior to the election.

In some ways, the market is taking it as a win/win, with the Democrats driving a hard bargain (wanting more funding), but equally in the knowledge that the opinion polls have Joe Biden around 10%/12% ahead.

Whether fiscal support is agreed now or after a Biden victory (still an assumption at this stage) then it will be risk positive. Markets are also tentatively pricing for moves towards a potential Brexit trade deal agreement.

However, there is a balance to this mood today, as the Peoples Bank of China (the PBoC) made it cheaper to short the Yuan and this has just weighed across risk assets today.

It is all leaving a slightly cautious look for forex with the dollar clawing back some of Friday’s losses.

This is weighing on gold, whilst the Aussie is also slipping back slightly. Despite this though, equities still seem to be sustaining the positive bias.

Today is Columbus Day in the US and cash Treasury markets are closed which could leave markets slightly lacking direction.