Dollar-Yen Outlook: "Decisive Close above 105.80 would be a Positive Signal"

- Written by: Richard Perry, Hantec Markets

The Dollar rallied 0.40% against the Japanese Yen on Monday leaving the technical setup on the charts more constructive on the prospect of further gains for the Dollar, according to Richard Perry of Hantec Markets.

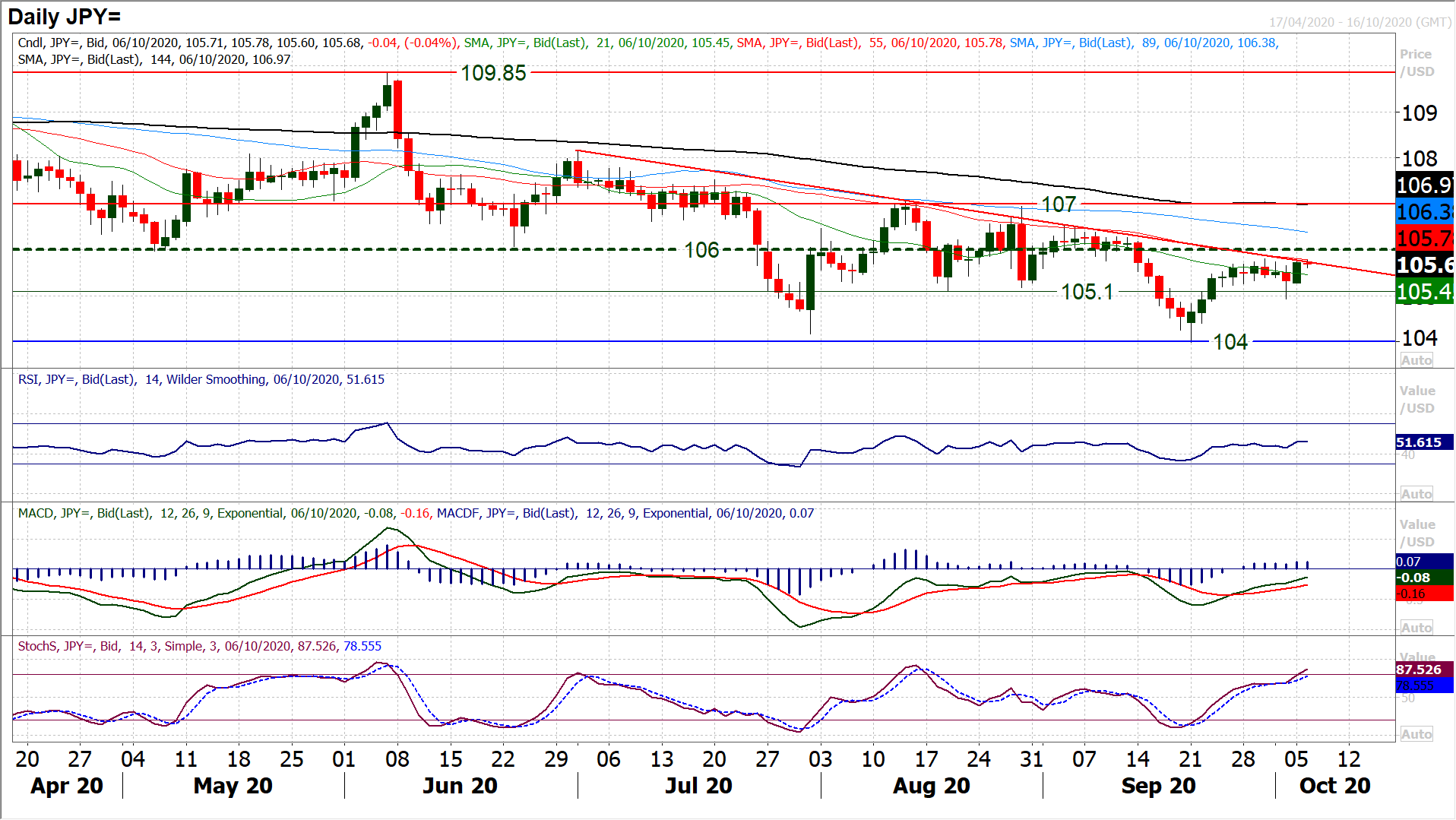

An impressive turnaround in the past session and a half is now testing the resistance of 105.80.

Yesterday’s decisive solid bull candle is also now testing the resistance of the three month downtrend (c. 105.75) and the 55 day moving average (c. 105.80).

Given the close proximity of the old 106.00 pivot, this is an important moment in the outlook for Dollar/Yen.

Will the recovery from 104.00 have another burst of life? A decisive close above 105.80 would be a positive signal, and would confirm above 106.00.

This would then open 107.00 once more (therefore suggesting Dollar/Yen is actually in a bigger 10 week trading range between 104/107.

The hourly chart shows initial support around 105.50 over the past couple of sessions. Holding above 105.50 maintains the upside pressure.

Markets have taken on a more positive attitude to risk as President Trump has been allowed to leave hospital to return to the White House.

Whilst it is still too early to declare the President clear of COVID, for now, the immediate risk to government has been reduced. It means that focus can also be on the US fiscal stimulus talks.

House Speaker Pelosi and Treasury Secretary Mnuchin are still deep in discussions and there is hope that something may be agreed, although this would still need to be voted upon by the Republican controlled Senate.

Broad risk took a leap yesterday, pulling equities sharply higher and out of safe havens such as the dollar and the yen. This morning is a little more cautious though. As we come into the European session, major markets are all but flat.

Fed chair Powell and ECB President Lagarde both speak today and this may be adding to the caution.

Overnight, the Reserve Bank of Australia opted to sit on its hands with its monetary policy decision, holding rates and the 3yr yield target at +0.25%.

However, this does not remove the easing bias that seems to be set up for the meetings ahead, and the Aussie has just lagged this morning as a result.

Today is arguably more about central banks than the data on the economic calendar. However, UK Construction PMI is at 0930BST and is expected to slip slightly to 54.0 (from 54.6 in August).

The US Trade Balance is at 1330BST and is expected to show a deterioration in the deficit to -$66.1bn in August (from -$63.6bn in July).

US JOLTS jobs openings are at 1500BST and are expected to increase slightly in August to 6.69m (from 6.62m in July).

The central bank speakers continue with the ECB’s Christine Lagarde who speaks at 0935BST.

Then later in the session, there is the main event, with the Fed chair Jerome Powell at 1540BST. Furthermore, there is the FOMC’s Patrick Harker (voter, centrist leans hawkish) at 1645BST and the FOMC’s Robert Kaplan (voter who dissented at the last meeting) speaking at 2300BST.