Dollar-Yen a "Prime Play for the Trump Newsflow": Hantec Markets

- Written by: Richard Perry, Hantec Markets

The Dollar-Yen exchange rate starts the new week higher at 105.60 amidst firming investor sentiment. This does however remain a market where strength is sold into according to analyst Richard Perry at Hantec Markets.

With a multitude of fundamental and newsflow factors pulling the pair higher and lower on Friday, the rather uncertain candlestick (long upper and lower shadows with a small body) leaves a degree of uncertainty in the market.

However, the way that Dollar/Yen fell like a stone initially on Friday morning, it would suggest that it is a prime play for the Trump newsflow.

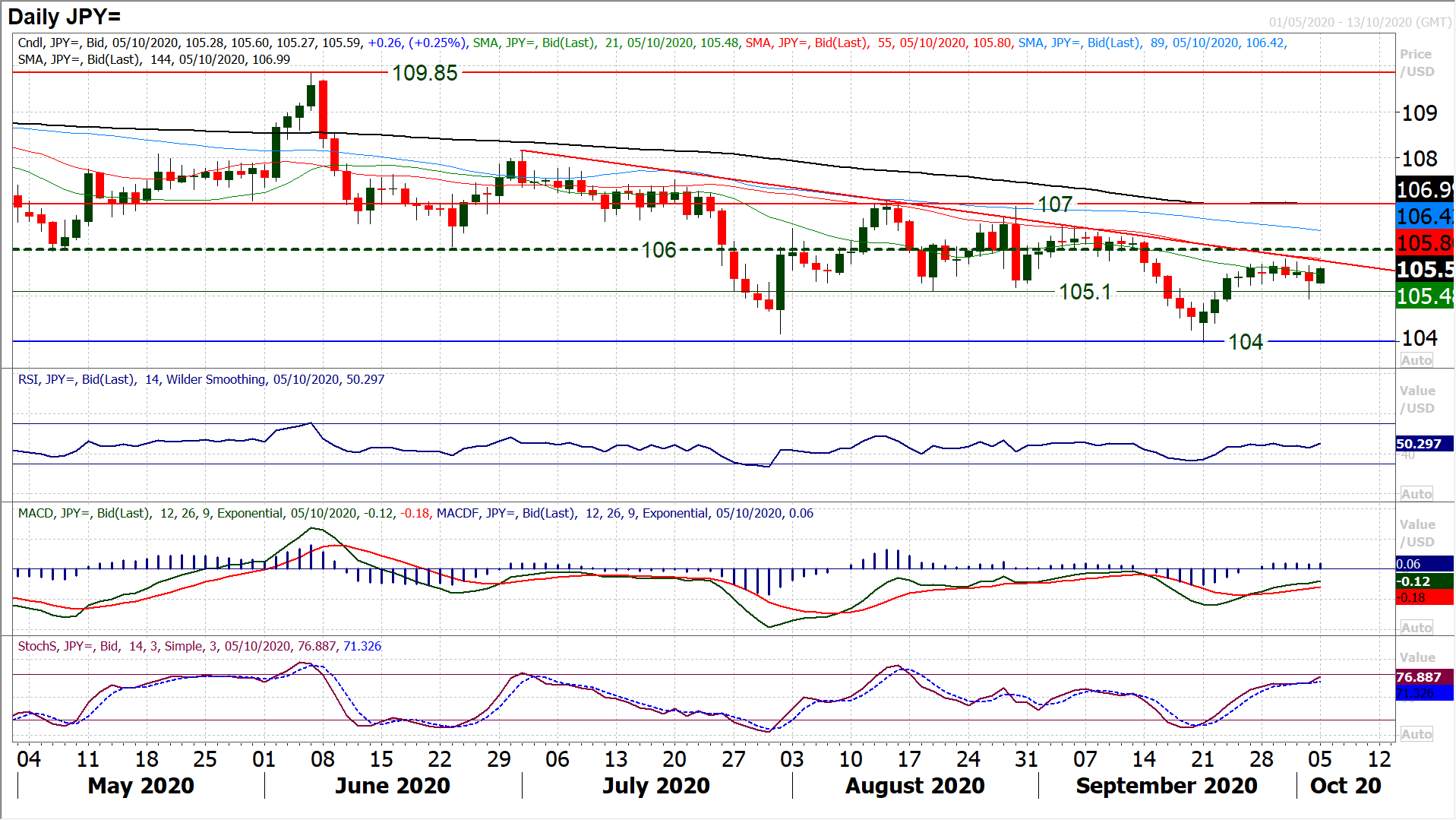

A complete unwind of the move, with initial gains today now leaves the market back at the technical key resistance of the three month downtrend and 55 day moving average (currently 105.80).

This is where the bulls need to step up and show themselves if they want to change this outlook which continues to be one to sell into strength.

Having seen rallies fade so consistently, we look for another failure under 105.80 (also last week’s high) favour using intraday strength as a chance to sell.

We look for likely renewed pressure on 105.10/105.30 support, with a close below opening the downside again towards 104.00 once more.

Traders are still trying to make sense of what Donald Trump’s COVID-19 infection means to risk appetite.

There are some suggestions that he is stable yet also that he is on a steroid treatment only used for the more severe of cases.

The broad assessment is that Trump will really struggle over the final month of the Presidential election campaign. Quite how the voters of the US make of this may be reflected in the opinion polls, but if voters do not know what a Trump presidency brings now, they must have been living in a hole for the past four years.

Markets are a little more settled today, with risk appetite recovery after taking a hit on Friday.

There may well be further room for elevated volatility on updates to Trump’s health, but for now, the start of this week looks to be fairly positive for risk.

With ever rising COVID second wave fears though, it will be interesting to see if this improvement in risk can last. A weaker yen is a standard response, whilst it is interesting to see the dollar not suffering too much.

Gold unwinding some of its recent gains (even as the dollar is slipping slightly today) is a little surprising and is worth keeping an eye on.

An equities rebound is the main risk positive response, along with oil bouncing too. There is still a sense that markets are sitting at a crossroads though, albeit with elevated volatility. The next trend that begins to form could therefore be crucial to the medium term outlook.