USD/JPY Forecast: "Magnetism" of 106.00 Back in Play

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The USD/JPY exchange rate's tightening consolidation continues with the pair quoted at 106.16 ahead of the weekend. Analyst and technical forecaster Richard Perry of Hantec Markets says rallies remain a chance to sell.

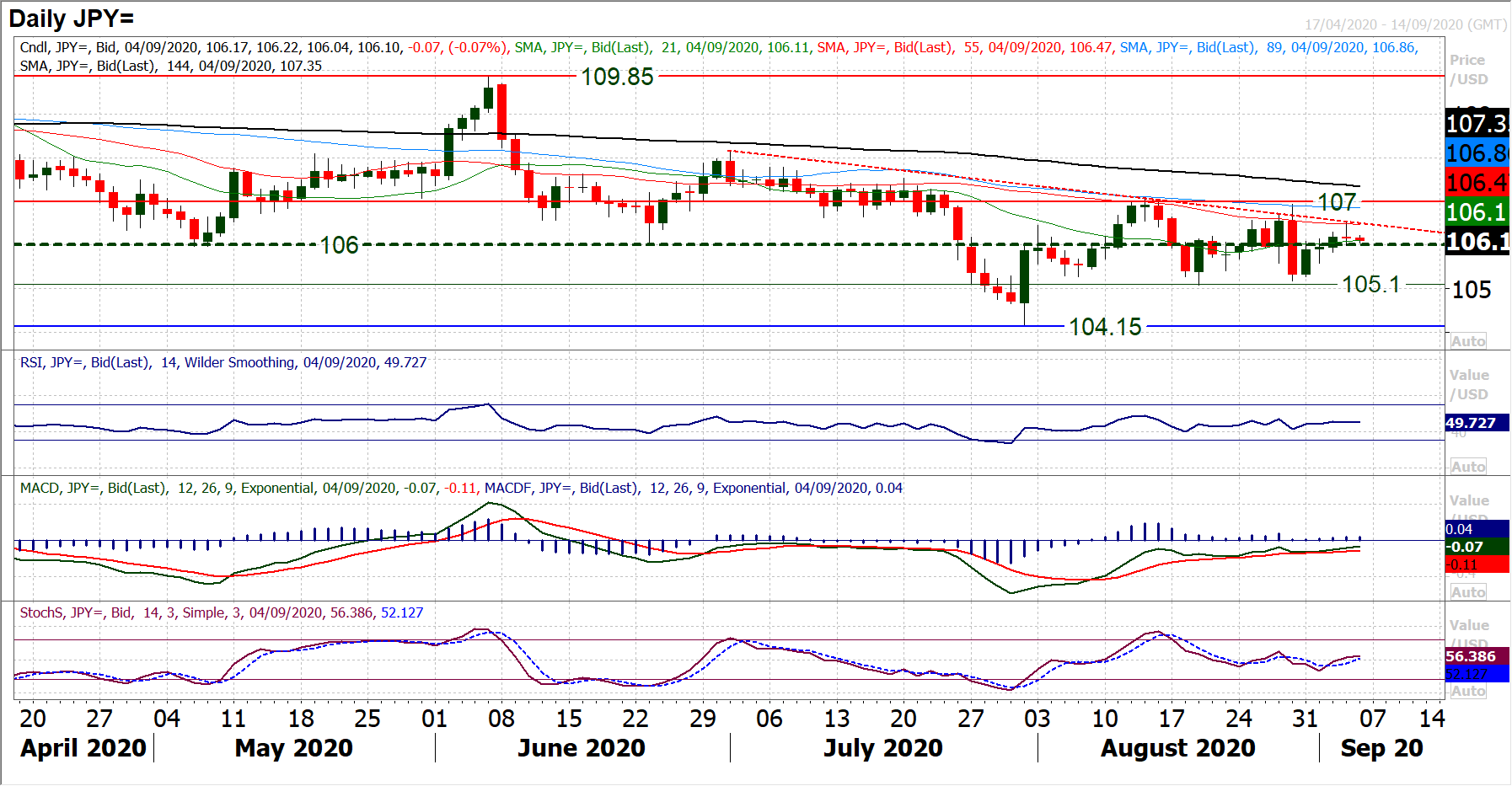

Once more we see a rally into the 106/107 band of overhead supply is struggling to sustain upside traction.

Yesterday’s doji candle denotes uncertainty with the run higher and end a string of positive closes this week.

Interestingly, one more the magnetism of the old 106.00 pivot has come into play again.

We have noted previously the resistance of the two month downtrend, and this stopped the rebound almost to the pip yesterday.

The trendline falls at 106.55 today and remains a basis of resistance, whilst the falling 55 day moving average (around 106.50) is also still seemingly a gauge of resistance.

The hourly chart shows a (slightly redrawn) near term uptrend still intact but the run is lacking intent now.

Resistance is building around 106.50 for another potential lower high.

We continue to view rallies as a chance to sell on Dollar/Yen within the four week trading range 105.10/107.00 and favour pressure towards the lows once more.

A sudden bout of selling pressure ripped through Wall Street yesterday to leave traders scratching their heads.

Maybe stocks can go down as well as up after all? The tech-led decline was seen most significantly through a -5% decline on the NASDAQ, but with little real catalyst, it seems to be simple profit taking.

As eye watering a decline as it may seem, it is important to note that the NASDAQ has simply unwound to levels of Monday last week.

The question becomes how will traders respond now? A correction just shy of -10% was seen in June, but was a brief shakeout and just a set up for the next bull run. This has developed a sense of negative sentiment across markets, with bond yields falling and risk aversion hitting assets such as oil.

Despite this, the near term dollar rebound has begun to stall, perhaps due to the upcoming Nonfarm Payrolls report today. Traders will be wondering whether this is now another opportunity to sell USD as the broad outlook for the dollar remains negative.

A ultra-dovish Federal Reserve, backed by continued dovish Fed speakers (Charles Evans suggesting rates would not go up until inflation hit 2.5%) leaves the dollar under ongoing pressure.

It is likely that jawboning from the ECB over the strength of the euro, and the perception of a “no deal” outcome from Brexit trade negotiations hampering sterling could now create an increasingly choppy outlook for major USD pairs. Focus will turn to payrolls later today, with the growth of jobs in the US economy continuing but signs of a slowing pace.

The big focus for today on the economic calendar is the August US jobs report, with the US Employment Situation released at 1330BST.

Headline Nonfarm Payrolls are expected to once more show good growth, with +1.400m jobs created (after +1.763m jobs gain in July).

Although the ADP employment report again disappointed sharply to the downside on Wednesday, hopes are high for another positive payrolls. Unemployment is expected to improve and to drop into single digits again to 9.8% (from 10.2% in July). The anomaly of wage growth continues to show through, with Average Hourly Earnings expected of zero growth in the month of August, whilst the year on year wage growth is expected to decline to 4.5% (after 4.8% in July).