Pound-Yen Outlook: Potent Bullish Pattern Forming

Image © Adobe Stock

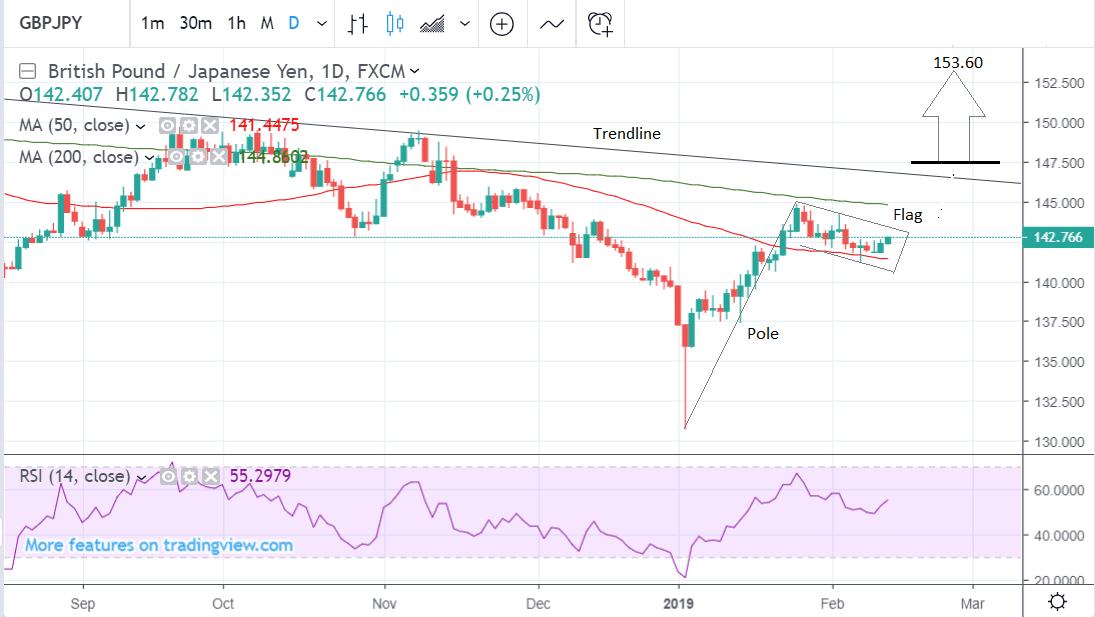

- GBP/JPY forms bull flag with upside potential

- Break above trendline to provide confirmation

- Pair highly sensitive to Brexit uncertainty

The Pound-to-Yen exchange rate is trading at 142.75 mid-week, up over half a percent so far this week, mainly due to a weakening of the Yen as markets dumped the 'safe haven' currency in favour of riskier, higher-yielding investments such as stocks.

The Yen weakened and global stocks rebounded on further hopes for progress in China-U.S. trade talks, while traders also cheered the U.S. Congress finally breaking an impasse over part-funding for President Donald Trump's Mexican border wall.

Our technical studies suggest GBP/JPY is rising in bull flag pattern which is likely to break considerably higher; the steep climb through January from the 130.69 lows constitutes the ‘pole’ part of the flag whilst the consolidation during February is the ‘flag square’.

If the pair can successfully break above the 200-day moving average (MA) and the major trendline above it, it will probably rally significantly higher.

A move above 147.50 would provide strong confirmation of a continuation higher to a target at 153.60, which is the target established for the bull flag.

The 200-day MA and major trendline are serious impediments to further upside and the area between the 144.80 flag highs and the 147.50 confirmation level constitute a tough resistance zone which could act as a hard-ceiling to the exchange rate and potentially prevent further upside from evolving.

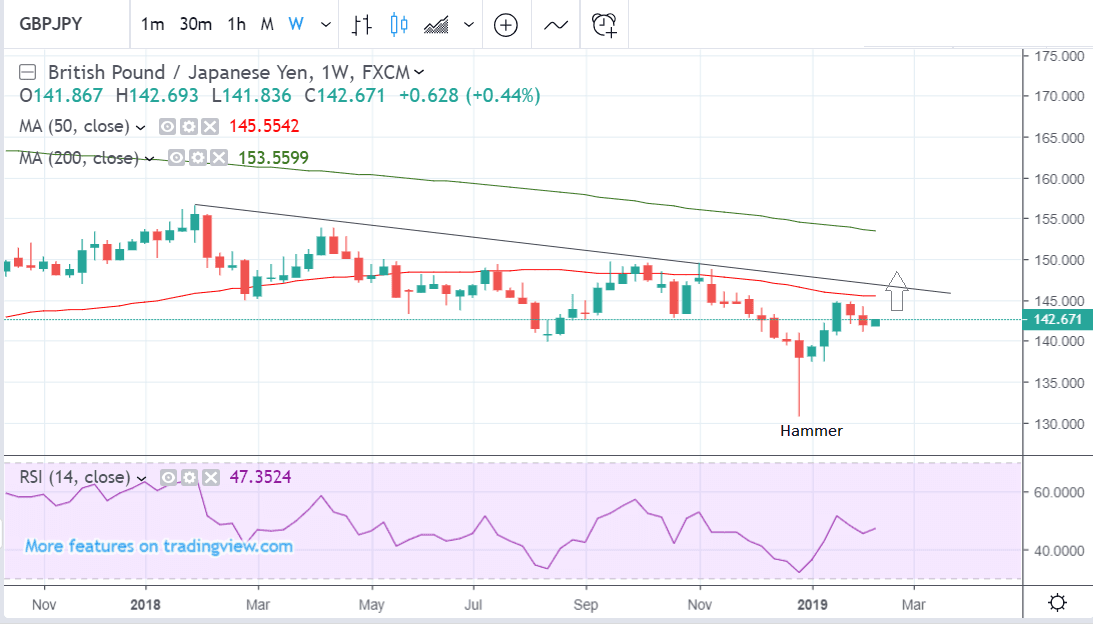

The weekly chart looks bullish after the pair formed a hammer candlestick pattern at the December 130 lows providing a strong bullish reversal signal.

The exchange rate then rose up to the 50-week MA at 145 and has since pulled back a little. The pull-back is weak and looks more corrective than trending, so the short-term uptrend will probably resume soon. A move up next would look more natural than a move back down to the 130s.

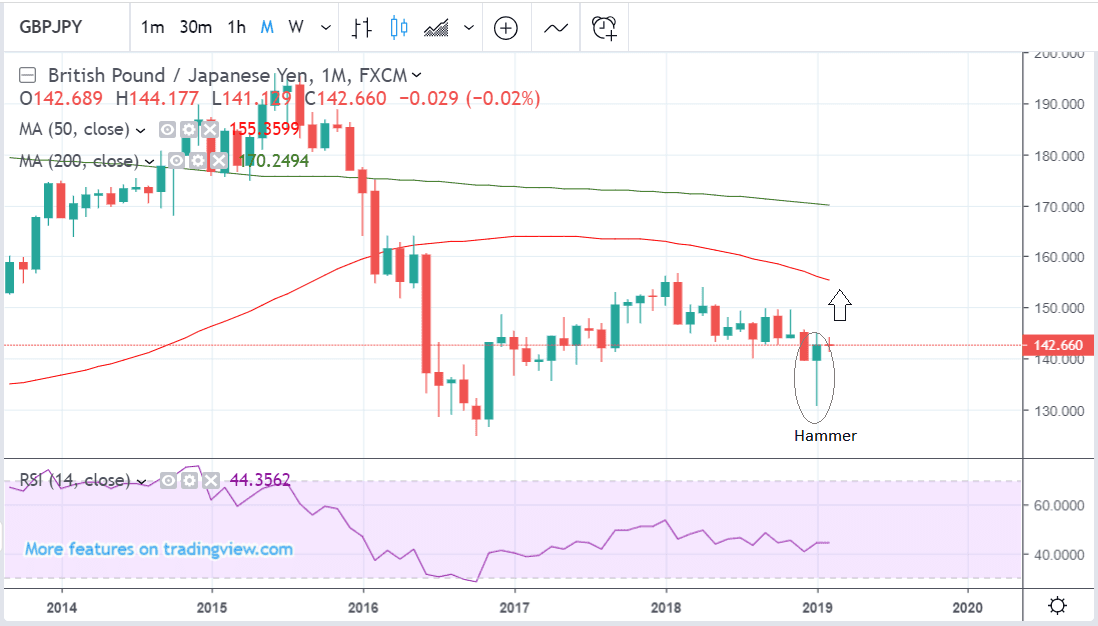

The monthly chart - denoting a long-term timeframe - is also showing a strong reversal signal in the form of a bullish hammer candlestick forming in January. This is a further sign there is likely to be more upside to come and that the longer-term downtrend is finished. The hammer will be enhanced if this month (February) is also bullish.

Looking at the fundamentals, we expect global investor sentiment to hold sway over the Yen, but those inclined to look at the domestic picture will be eyeing Japan's Q4 GDP out at 23.50 GMT on Wednesday evening.

The expectation is for GDP to rise by 0.4% compared to the -0.6% decline in Q3. If the figure undershoots in and is negative for Q4, however, it will represent a technical recession for the Japanese economy and weigh heavily on the Yen.

GBP/JPY is meanwhile also likely to be more sensitive than most pairs to a change in Brexit sentiment, and this could prove to be a fundamental stumbling block to any further advance in GBP/JPY.

The Japanese Yen is a safe-haven currency, which means it rises when markets are in turmoil. The current broad backdrop of uncertainty due to Brexit could probably strengthened the Yen as investors have favoured it as a safe place to entrust their capital.

However, a possible fundamental catalyst for any breakout higher would be for Prime Minister Theresa May to gain a concession from the EU on Irish backstop, by making it time-limited, for example.

Although Brussels has hinted the Irish backstop, if ever triggered, would only ever be temporary no game-changing official concessions have been forthcoming which could sway Brexiteers in her party to support her deal.

Nevertheless, there is a chance this could happen and, if so, it might satisfy a majority of UK parliamentarians, leading to a win for her bill and a rise in GBP pairs.

The rise may be especially sharp in the GBP/JPY pair, because simultaneously as the Pound is rising, the Yen will probably be weakening as safe-haven flows reverse, and this would propel the pair even more rapidly higher than in a normal Sterling pair.

Most analysts think there is a very low probability of a 'no deal' Brexit. Since most Brexit scenarios involving a deal are expected to lead to an appreciation in Sterling, the outlook is generally held as bullish for the currency, and therefore even more bullish for GBP/JPY.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement