USD/JPY at Highly 'Sensitive' Level, Holds Significance for Outlook

Image © Adobe Stock

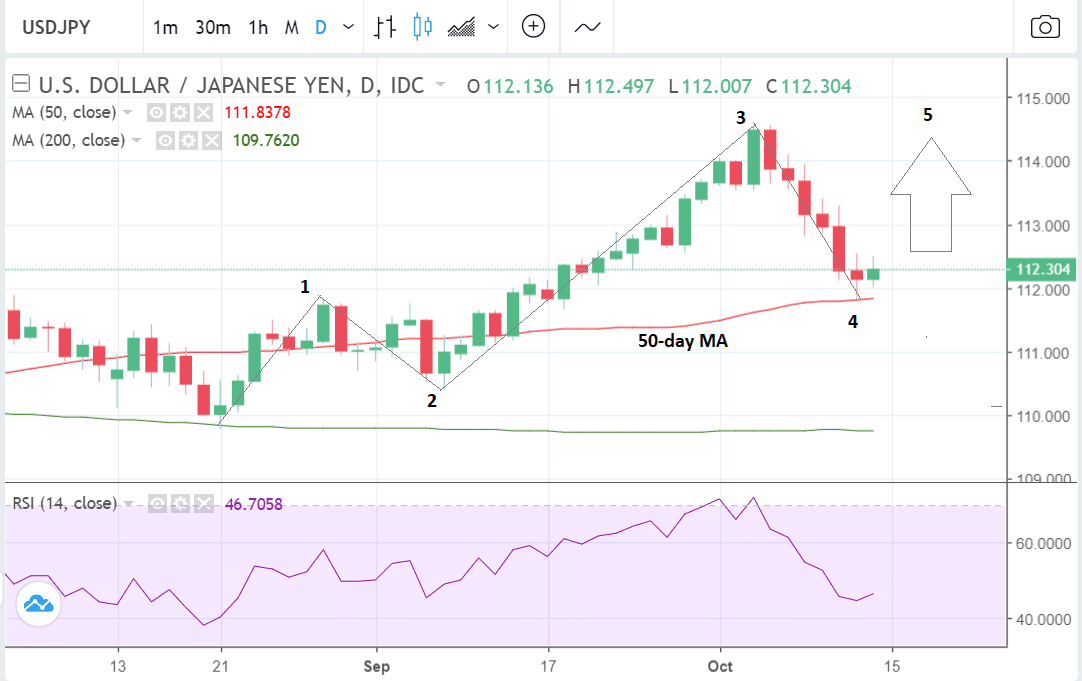

- USD/JPY bullish as long as it holds 111.83

- Potential for move back up to 114.55 highs

- Break above kijun line at 112.47 key bullish signifier

USD/JPY is at a key 'make-or-break' level with important implications for the future outlook for the currency pair.

The exchange rate has fallen for six consecutive days from a peak of 114.55 to a low of 111.83 at the level of the 50-day moving average (MA).

The 50-day is likely to provide a 'floor' below which it will be difficult for the pair to break and from which it may even rebound. If it does break below it would be a very bearish signal for the pair.

Investors often use major MAs such as the 50-day to inform key buying and selling decisions, so a break (on a closing basis) above or below can have significant implications.

A break below the 111.82 August 29 highs would have additional implications for the technical outlook for the exchange rate based on another technical perspective too.

A break of that level would suggest a more negative Elliot wave interpretation of the chart and bias the outlook to being more bearish.

The current wave pattern strongly suggests the next move will be a bullish rise back up to the 114.55 highs in a final 5th wave higher, however, a break below the 111.82 level would negate that possibility and indicate a more bearish outlook instead.

This is because 111.82 represents the peak of wave 1 in a bullish interpretation and it is one of the rules of Elliot that wave 4 can never fall below the top of wave 1 - if it does it means the market is forming an alternative wave count.

At the time of writing the pair is trading at 112.30 after recovering from above Thursday's lows.

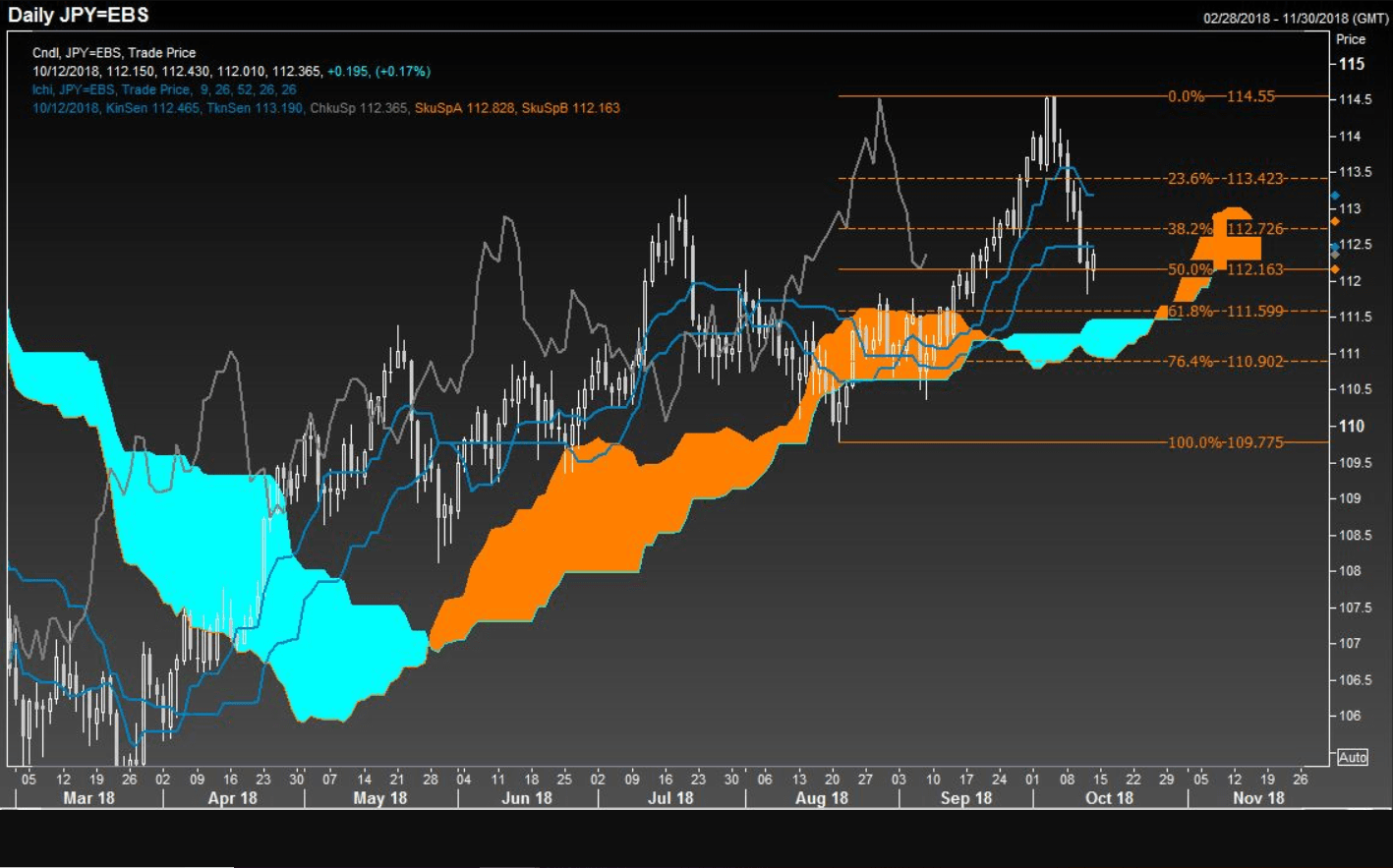

Analysts at Reuters say a close above 112.47 would secure a 'foothold' higher and probably indicate a strong recovery was underway.

Their analysis is based on the location of the Kijun Sen - or Kijun line - a level on Japanese cloud charts which Yen traders often use in their analysis of the exchange rate. The Kijun Sen is situated at 112.47 at the moment, but a close above would be a very bullish signal.

If the exchange rate continues recovering we would expect it to eventually re-touch the 114.55 highs. It is still too early to say whether this is likely to happen or not, but a continuation higher would start to reinforce the bullish case.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here