Pound-to-Dollar Rate Forecast for the Week Ahead: Looking Bearish

- GBP/USD is showing multiple bearish signs and is forecast to fall

- Main releases for the Pound are inflation and retail sales data

- For the Dollar, the main release is the minutes from the May Federal Reserve meeting

© Adobe Stock

One Pound buys 1.3457 Dollars on the interbank market as the new trading week begins, down from the prior trading week's 1.35 rate as the exchange rate probes new lows.

GBP/USD is showing multiple bearish signs which do not bode well for the outlook.

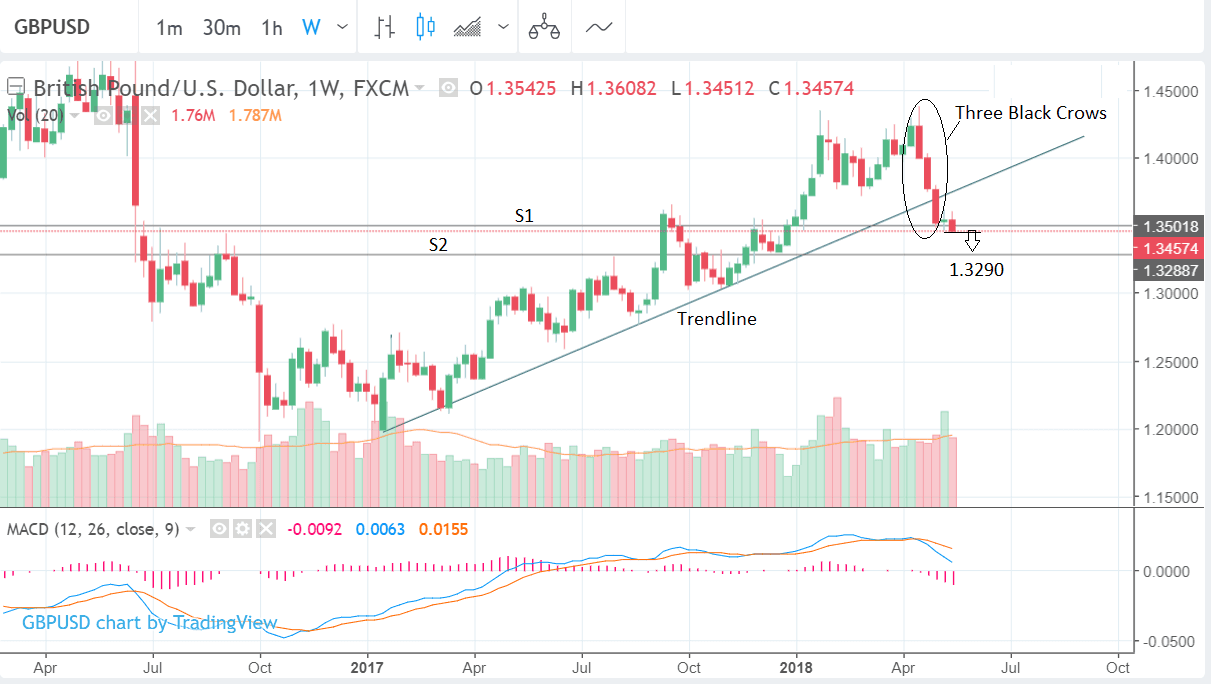

Last week we highlighted an extremely bearish chart formation which had developed on the weekly chart called a 'three black crows' candlestick pattern, which comes from the old art of Japanese candlestick charting.

The pattern on GBP/USD conforms to most of the criteria required for forecasting a high success rate as a bearish signal, and, therefore, strongly suggests lower prices on the horizon. The next question is how low?

There is no reliable way of forecasting how far the market will fall after the formation of a 3-black crows pattern but the chart contains other clues of how far down the market could go.

Another bearish feature of the chart is that the exchange rate recently broke below the important trendline drawn from the 2017 lows, and when this happens the length of the move preceding the break often provides a guide as to the length of the follow-through lower after the break.

In the case of this trendline break, the length of the prior move is from the peak at 1.4377 in the middle of April to the trendline at the breakpoint at roughly 1.3705. The golden ratio (0.618) of this length should provide a guide for the follow-through if extrapolated from the breakpoint lower. This method generates a target at roughly 1.3275.

Although the target generated using this method is at 1.3275 we note that the S2 monthly pivot is situated just above, at 1.3288, and is likely to present a major obstacle to the downtrend.

Monthly pivots are levels on charts used by traders to gauge the trend. They also offer support and resistance to prices in and of themselves acting as 'real' barriers to the trend on price charts, thus the pivot at 1.3288 may well stall the downtrend if it evolves so we have adjusted our target up to 1.3290 to reflect this risk.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

USD: What to Watch

The US Dollar has been driven higher over recent weeks as US inflation expectations have risen, reflected in an increase in US Treasury bond yields to above 3.0%, a measure of compensation for bondholders can expect from inflation depreciation.

Higher yields are generally indicative of higher interest rates, which tend to support the Dollar as they attract greater inflows of foreign capital, drawn by the promise of higher returns.

With this dynamic in mind, the focus on yields is likely to continue as the US Federal Reserve (Fed) scheduled to release the deliberations from its recent interest rate-setting meeting, in the form of the publication of meeting minutes, at 19.00 GMT, on Wednesday, May 23.

"We expect US Treasury yields to be in focus again with the publication of the minutes to the 1-2 May Federal Open Market Committee meeting and with Fed Chair Jerome Powell set to take part in a panel discussion at the end of the week," says Philips Shaw, analyst at Investec, adding, "the Fed’s 12/13 June policy meeting is now rapidly approaching. Ahead of this investors will be looking for signs that the Fed is looking to step up its pace of normalisation."

The other main economic data release for the Dollar is the preliminary estimate for May Purchasing Manager Indices (PMI) in Manufacturing and Services, released at 14.45, on Wednesday.

PMI's are surveys gauging the level of activity in key sectors. The Composite PMI is forecast to rise to 55.0 from 54.9 in the previous month, the services PMI is expected to rise to 54.9 from 54.6 and Manufacturing to remain at 56.5.

GBP: What to Watch

It's a busy week ahead for Sterling traders, with a welter of economic releases due for the Pound.

Inflation data, out at 9.30 on Wednesday, forms the main data event with traders looking to see whether prices are moving in a direction consistent with further interest rate rises at the Bank of England. Over recent months we have seen the Pound become increasingly attuned to Bank of England interest rate expectations; moving higher when expectations for a rate rise increase, and moving lower when those expectations are rowed back.

We recently reported that economists at Capital Economics are expecting two interest rate rises in 2018 which would present an highly bullish outcome for Sterling, but the data will have to start moving in the right direction very soon for this assumption to prove correct.

And of course, the Bank of England is watching the data and will only move on rates once they have evidence the economy is picking up pace once more.

"UK inflation figures from April will be closely watched by markets and influence the pricing of Bank of England," says Andreas Steno Larsen, a strategist at Nordea Bank.

Inflation is expected to fall to 2.1% from 2.3% as base effects from the weak Pound start to fall away.

"As for April there is a clear risk of a rather low result due to base effects," adds Larsen.

Analysts at Investec are more bullish about inflation in April:

"We expect to see inflation tick up to 2.6% from 2.5%, albeit with the April rise likely to be a blip on a path in which we see inflation moderating," says Investec economist Victoria Clarke.

Global oil prices have been on the rise, and we would expect this to perhaps deliver an upside surprise. However, the core CPI release will therefore be crucial as it strips out the likes of external one-offs like oil, and the Bank of England uses the number as a proxy for underlying wage growth. In short, a beat on the core CPI would likely help Sterling higher, core is forecast to read at 0.5%.

In other UK releases, retail sales figures due Thursday morning will also be closely watched amidst concerns about UK growth (and consumer spending) momentum.

The BRC’s April figures were particularly weak, with the timing of Easter a depressing factor; we suspect the ONS’s Easter timing adjusted numbers will not look quite so gloomy.

The second estimate for UK GDP growth is due at the end of the week where Clarke suspects we will see an unrevised reading of +0.1% print. A beat would however likely boost Sterling.

Right at the beginning of the week we get some second-tier numbers with public sector finances released at 9.30, they are expected to show government borrowing fall by 7.0bn in April. Recent public sector data has been positive on the whole so a further fall in borrowing would be seen as a positive for the economy, although a surprise reading either way would pobably be necessary to move the Pound.

The Consortium of British Industry will also be releasing two reports for the month of May: the CBI Industrial Trends survey at 11.00 GMT on Monday and the Distributive Trades survey at the same time on Wednesday. Both will provide the most up-to-date information on economic activity in the UK and could, because of their timeliness, impact on Sterling.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.