Euro-to-Dollar Rate Forecast for the Week Ahead: Near-Term Weakness

- EUR/USD is in a short-term down-trend which is forecast to fall to the 200-day MA at 1.2010

- The main release for the Euro in the week ahead is inflation data

- The key release for the Dollar is Non-Farm Payrolls, but Manufacturing ISM, the FOMC and Inflation data are also important

One Euro buys 1.2136 Dollars at the start of the new week, having been as high as 1.24 in mid-April.

Concerning the outlook, our technical studies note EUR/USD has broken down below the March lows at 1.2157 and reached new lows last week of 1.2055 - it is in a short-term downtrend which is expected to continue.

The pair originally formed a triangle pattern during most of February and March which it then broke out to the downside of (see chart below). This generated a minimum downside target of 1.2000, and assuming this target is valid the exchange rate still has a little further to go to reach it.

A break below the April 27 lows would probably provide the confirmation for more downside to a target at 1.2010, just above the 200-day moving average (MA) at 1.2008.

The bearish forecast is supported by the falling MACD momentum indicator of the chart below. The MACD has fallen below the zero-line which is a bearish sign. It looks like it is in the process of forming a three-wave zig-zag pattern with an incomplete final leg. This suggests the final leg may have lower to run which would infer more downside for the exchange rate too.

Analysts at a leading Scandanavian investment bank have meanwhile confirmed their expectations for the Euro's turn lower against the Dollar has finally materialised, and further losses are likely.

"EUR/USD is finally starting to 'catch down', as we had anticipated for a while. And now that plenty of technical damage is done, we think it makes sense to stay short in EUR/USD, despite the looming negative US data surprises," says Andreas Larson, an analyst with Nordea Markets.

Nordea Markets believe the single most important driver of the Dollar is the rise in the yield on US government dent - or bonds - which have recently shot to the 3% mark.

This rise in yields has in turn been consistent with a strengthening of the US economy relative to the rest of the world, and the Eurozone in particular. If we see a continued run of consensus-beating US economic data releases, the Dollar could therefore maintain its strength.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

It is a relatively busy week for the US Dollar given the economic schedule includes the May FOMC meeting on Wednesday, Non-Farm Payrolls on Friday, Inflation data on Monday and ISM Manufacturing on Tuesday - all big-hitting data releases with the potential to move markets.

Possibly the most important release is US Personal Consumption Expenditure (PCE), which is the US Federal Reserve's favoured inflation gauge.

Core PCE is the one to watch, released at 13.30 on Monday, April 30, and is expected to show a strong rise to 1.9% in March from 1.6% in February.

Given the importance of rising bond yields as a factor in the strengthening Dollar, PCE has the potential to fuel further gains since yields reflect investor compensation for inflation.

The Dollar could gain a lift, especially if PCE comes out higher, for example, at 2.0% which would be slap bang at the level of the Fed's inflation target.

Higher inflation encourages the Fed to raise interest rates which leads to a stronger Dollar, because higher rates draw more capital inflows from foreign investors seeking a lucrative place to park their money, and this increases demand for Dollars.

"US inflation numbers are likely to be of even greater importance. The recent pick-up in US inflation has helped boost the 10y yield in recent months and has also provided tailwinds for the USD," says Andreas Steno Larsen.

To some extent, Monday's inflation result has the potential to impact on the Federal Open Market Committee (FOMC) meeting on Wednesday, at 19.00. The Fed sets interest rates according to its inflation expectations but as things stand at the moment it is not expected to make any changes to its forward guidance or change the interest rate at this particular meeting.

"With no press conference or forecast updates, the May FOMC meeting should be a relatively quiet affair. We expect no significant changes to the statement language, with a small risk that a more upbeat inflation outlook ends up sounding hawkish," says TD Securities.

Another key release for the Dollar is the Manufacturing ISM, out on Tuesday at 15.00.

The consensus expectation is for the ISM to slow slightly to 58.6 in April from 59.3 previously.

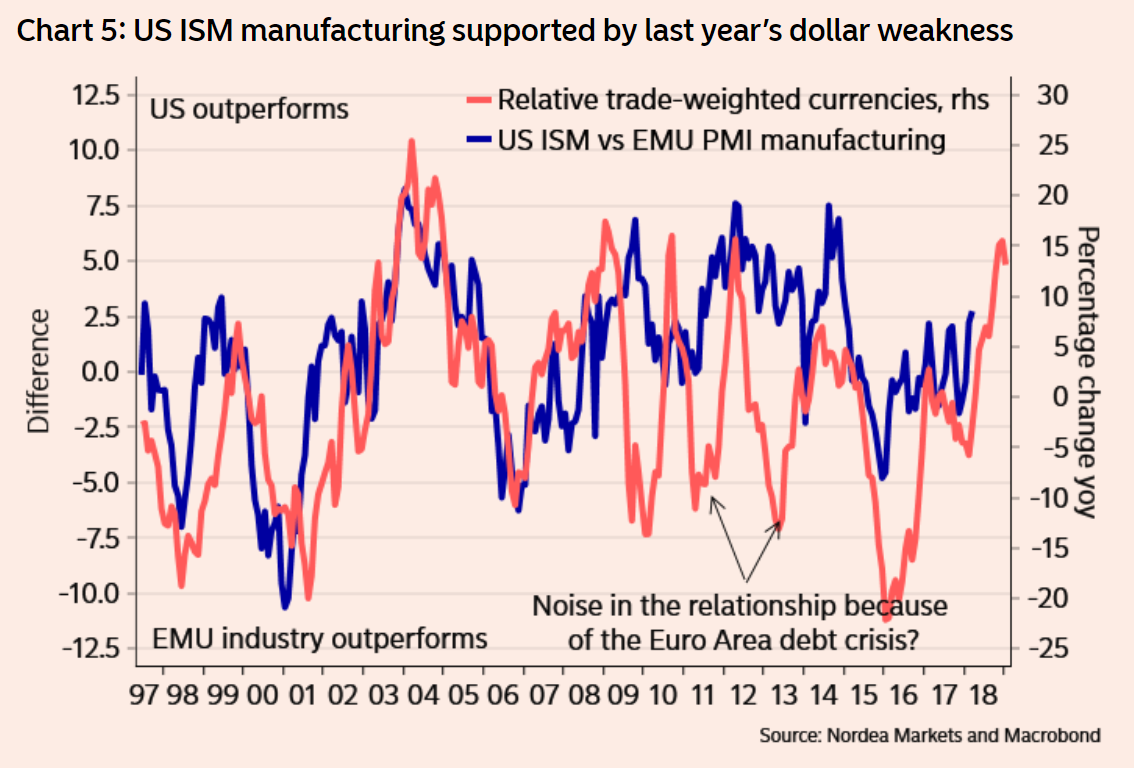

"The coming week’s sentiment indicators, such as China PMI (Monday) and US ISM manufacturing (Tuesday), might thus help fuel further gains of the trade-weighted dollar," says Andreas Steno Larsen, strategist at Nordea bank, adding, "US ISM is quite likely to stay at a lofty level, as US sentiment is currently getting a boost from the US tax reform as well as from dollar weakness."

The fairly close correlation between the Dollar and ISM is shown in the chart below:

Finally, US Labour data, out at 13.30 on Friday is forecast to show Non-Farm Payrolls (NFPs) recover to 195k in April from a shockingly low 103k reported in March. Another key release within the labour data bundle is average hourly earnings as this has a more direct influence on inflation.

Data and Events for the Euro

The most important release for the Eurozone in the week ahead is inflation data out at 10.00 GMT on Thursday, May 03.

Core is forecast to slip to 0.9% in April from 1.0% in March, compared to a year ago, whilst headline inflation is expected to remain at 1.3%.

"Base effects (i.e. a sharp increase in April 2017) do not help prospects for a rise towards 2%. Nor does the early timing of Easter, given a possible moderation in travel costs in April," says Philip Shaw, an analyst at Investec.

"Risks appear to lie to the downside with a 0.8% reading instead," adds TD Securities in their briefing.

German inflation data, released on Monday at 13.00, three days before the Eurozone-wide data, can often help predict the Eurozone number.

Indeed other member state data such as Italian inflation is also out on Monday.

Services industry inflation is an especially useful gauge for general Eurozone inflation, according to Andreas Steno Larsen, FX and FI strategist at Nordea Bank.

"German flash inflation often leads the way for the Eurozone numbers. Especially the service price inflation correlates closely with the Eurozone core inflation," says Steno Larsen.

Inflation is a key influencer of the Euro because they impact on interest rates at the European Central Bank, and higher interest rates, in turn, drive capital inflows. The ECB is looking to withdraw stimulus and potentially start raising interest rates in 2019; an assumption adopted by markets in 2017 that lead to the Euro outperforming.

However, the ECB will only move if inflation is on track to hit their 2.0% target.

The other major release for the Euro in the coming week is first-quarter GDP data, out on Wednesday, May 2, at 10.00. Fears of a steep decline in the growth rate may be overexaggerated according to some individual state GDP releases already out, such as those for France, Spain, and

Austria, where GDP data- though not very good - was 'face-saving'. As such the result is not expected to surprise to the downside and hit the Euro.

Nordea estimates growth to have slowed to 0.5% in the Euro area in Q1 compared to the previous quarter, based on the results for Spain and France. This is slightly above the market consensus expectation of 0.4%, but slightly below the previous 0.6% result for Q4.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.