US Dollar Rally Nears Key Resistance Point, Political Risks High

The US Dollar has enjoyed strength of late, is this the beginning of a more sustainable recovery?

Strong investor demand for the US Dollar has allowed the currency to achieve an one-month best against the Euro and an 11-day high against Sterling.

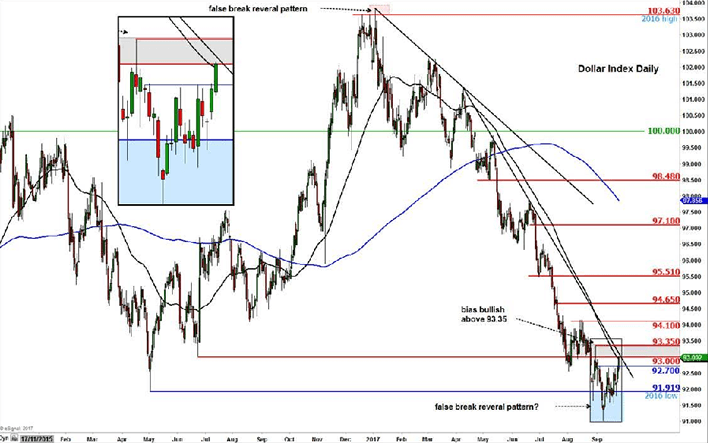

As a result the Dollar index - which is a measure of broad Dollar value against a basket of currencies - has bounced strongly in recent weeks.

Whilst it is still early days, the Index is showing the potential to reverse trend higher however it will have to break above some key obstacles to assure traders first.

It now stands at 93.00 and is just below the down-sloping trend-line drawn from the April 2017 highs.

It has also just touched the 50-day moving average just under the 93.00 level (see technical chart below).

Both these levels offer tough overhead resistance, which Dollar bulls will have a hard time bidding above, if they are successful it will open the way higher and establish a new bullish phase.

“The Dollar Index is at its highest point on the week, having already risen slightly in each of the past two weeks. At 93.00, it is now testing the lower band of a key short-term resistance range between 93.00 and 93.35,” says Fawad Razaqzada, Market Analyst at Forex.com.

In relation to the resistance zone created by the 50-day moving average and the trendline, the analyst says the following:

"A sustained break above here would create the first “higher high”, and he follows this up with, “we are potentially on the verge of a bullish reversal confirmation for the Dollar.”

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Last Gasp of the Bull Trend?

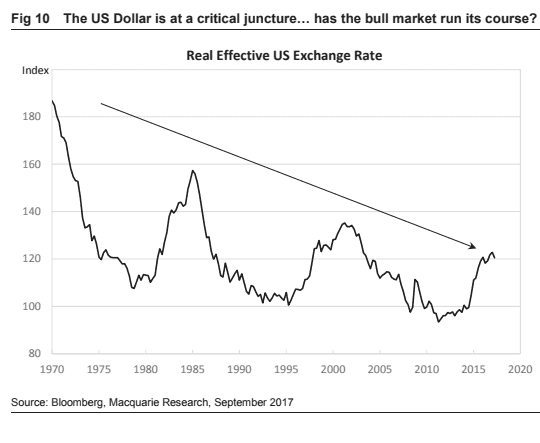

The Forex.com view contrasts with that of Macquarie’s analyst Ric Deverell, who thinks the recovery over the last few weeks represents the last gasp of the Dollar uptrend which will soon reverse and give way to a continuation of a deeper bear grand cycle.

“While the Dollar has stabilised around current levels in recent weeks, we feel there is a risk that over the coming year or two the Greenback unwinds much of the gain seen in 2014 and 2015,” says Deverell in a recent note to clients, dated September 26.

“Over the past 45 years, the dollar has tended to move in big cycles, with turning points generally signalling a more substantial change in direction than recognised at the time,” adds Deverell.

The Dollar's rise between 2010 and 2016 was as a result of an “outperformance of the economy” as well as diverging monetary policy, however, the rest of the world is catching in both these areas, limiting the Dollar’s amplitude for further appreciation.

Currency pairs are expected to return to the PPP value, which means Purchasing Power Parity, which is the exchange rate valued at which it would need to be for two baskets of identical goods to cost the same amount.

PPP would indicate the EUR/USD pair should be valued at 1.33 and USD/JPY at 102 and Macquarie;s end of year forecasts for these pairs is close to these levels at 125 and 100 for 2018 and 1.35 and 90 for end of 2019.

Political Risks Heightened

Near-term, the main event in the pipeline for the Dollar is a speech from Janet Yellen, Governor at the Federal Reserve, scheduled for 17.45 BST, September 26.

however, given how hawkish the Fed was at its last meeting Yellen is unlikely to be able to surprise markets by even more hawkish talk, so upside potential could be limited.

Another possible source of volatility for the Dollar is likely to be the political situation in Washington where house Republicans are trying to pass another repeal of Medicaid, which would make the savings necessary for slashing taxes.

According to CNN Politics the Bill will likely be dead in the water given the number of house Republicans saying they will vote against the latest variant – adapted to try to woo the no-voters on the Republican bench – will mean they will lack the majority required to push through the reforms.

“Susan Collins announced Monday afternoon that she will oppose the GOP's latest plan to overhaul the Affordable Care Act, bringing the total number of public "no" votes to three and likely killing the last-ditch effort to repeal Obamacare this week,” says CNN’s Lauren Fox.

This appears to be the final attempt to repeal Obama Care and if it fails the Dollar is likely to fall due to the diminishing possibility of tax cuts.

Donald Trump said he would make the tax cuts if Obamacare was repealed thus making the savings necessary to afford lower taxes.

The Dollar would be expected to rise on news of tax cuts or ‘reforms’ because they would be assumed to create a fiscally-stimulating environment for the economy and thus lead to greater growth.

Not all economists agree, however, as has been shown in a recent note from Unicredit, who questioned the positive growth potential of cutting corporation tax, since savings are normally reinvested in share buy-backs helping share-holders rather than in new investment or higher wages.

“The evidence for lower corporate taxes boosting growth, employment and wages is, however, limited.

Instead, the rate cuts will primarily benefit company shareholders and thus further add to already high income inequality,” said Dr Harm Bandholtz, Economist at Unicredit.

Any gains in the Dollar due to tax cuts might be short-lived if their analysis is right and no extra growth is achieved.