The US Dollar Suffers Worst Week Since June, Pound-to-Dollar Rate Could Reach 1.35

The US Dollar is the talk of foreign exchange markets ahead of the weekend with the currency on target to record its worst performance since June.

“The USD is ending the week on a soft note overall. A near 1.8% drop in the DXY is the currency’s worst performance since late June – which shows no sign of moderating any time soon,” says Shaun Osborne at Bank of Nova Scotia.

Bearish USD drivers include:

- low US yields (10Y bonds at 2.02%), reflecting fading Federal Reserve December rate hike expectations (22% of a 25bps tightening priced now) and;

- concerns about adverse weather’s impact on the US economy;

- more balanced global growth, which reduces the US economy’s growth advantage and;

- a shift towards monetary tightening in some developed market economies which, alongside declining US bond yields, has eroded the USD’s yield advantage, especially at the long end of the curve.

“USD moves are verging on the extreme but the technical undertone remains strongly bearish and we think risks are clearly tilted towards broadly lower USD levels, rather than a rebound, in the next few weeks,” says Osborne.

The Dollar’s falls allow the EUR/USD exchange rate to rise up to 1.2063 and cement the previous day’s breach of the 1.20 handle. This level should now acting as support against any significant weakness.

The GBP/USD exchange rate is meanwhile up to 1.3213, its highest level in five weeks.

It looks as though more gains are likely.

“With the broad USD under pressure, this rate is getting dragged higher. We have rallied through 1.3080 resistance and so now focus on 1.3160/70, which is the last main resistance ahead of the highs at 1.3270,” says Robin Wilkin, a technical analyst with Lloyds Bank Commercial Banking.

Wilkin says A break of 1.3040/1.3000 is needed to suggest the lower high we are looking for is in place.

“Once confirmed we look for a move back towards 1.25 medium term range support. A move up through 1.3170 and 1.3270 would risk a move towards next resistance around 1.3500,” says Wilkin.

Get up to 5% more foreign exchange by usinga specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Euro-Dollar Tipped to Extend Higher

The Euro has achieved fresh highs against the Dollar having reached 1.2092 earlier in the session, and Scotiabank’s Shaun Osborne thinks there is more to come in the near-to-medium term.

European Central Bank President Draghi’s comments on the strengthening of the Euro exchange rate at Thursday's ECB meeting do not represent a serious block to additional gains in Osborne's opinion, with the tapering decision punted to Oct and the Fed outlook still cloudy.

EUR/USD short-term technicals are bullish argues Osborne who notes the intraday chart reflects some decent selling pressure off the overnight high and while price action looks modestly negative on the hourly candle patterns (bearish engulfing) “we do not expect any significant downside pressure on the market to develop at this point.”

Deutsche Bank say the Dollar is in Trouble

As mentioned, one of the drivers of the Dollar’s recent underperformance appears to be the market’s apparent belief the US Federal Reserve will not raise interest rates in December.

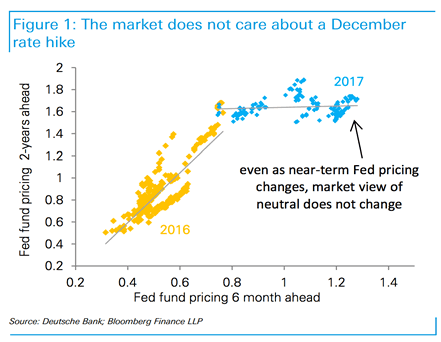

“The market continues to refuse to price additional rate hikes from the Fed, a phenomenon we have termed zombification. This is not about whether the FOMC will raise rates in December but a broader question of what will happen beyond,” says George Saravelos, Strategist with Deutsche Bank in London.

For Saravelos, the Dollar-Fed story is not about whether the Federal Reserve will raise rates in December but a broader question of what will happen beyond.

Saravelos believes the Fed will resist aggressive interest rate rises in 2018 as many of the members of the decision-making body - the FOMC - will be replaced by Donald Trump.

“Whoever is appointed, there may be a high bar for making big policy change in H1 of next year,” says Saravelos.

Deutsche Bank believe that because Fed Funds are approaching neutral, the more the Fed hikes, the closer we approach the point at which the Fed will stop anyway.

“This perversely leads to rate hikes easing financial conditions because it makes it more likely that the Fed will then stop. It also makes the dollar asymmetrically reactive to a dovish versus hawkish Fed,” says Saravelos.

There are other reasons why Saravelos believes “the Dollar is in trouble.”

“The FX market is undergoing a fundamental shift in drivers. It is no longer been driven by relative monetary policy expectations but an adjustment to flow imbalances that have built up through the implementation of highly unconventional global monetary policy,” says Saravelos.

The analyst explains:

“Part of this imbalance is a structural underweight in European assets which we have written about in the past. More broadly however, Americans are hugely underweight in their investment allocations to the rest of the world.

“Over the last few years Americans have liquidated close to the entirety of their foreign fixed income portfolio and are likely in the process of re-allocating back to the rest of the world.”

“The shrinking in US-world relative growth differentials and ongoing political turmoil in the US may have helped catalyse this trend.”

As such:

“We struggle to identify conditions that would sustainably shift the dynamics described above and would not fade recent dollar weakness.”