US Dollar at a Turning Point say Westpac, Latest Inflation Data Comes in on Expectation

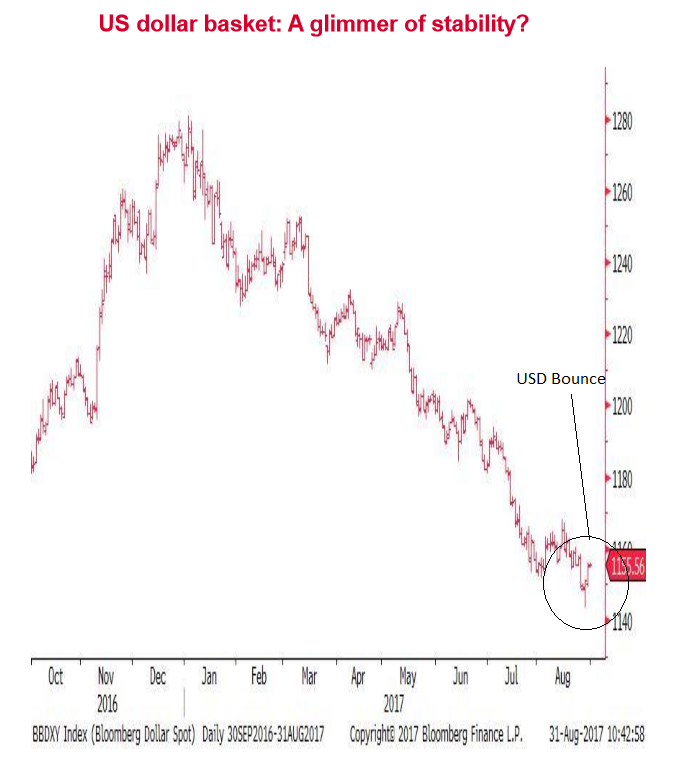

The Dollar could be at a turning point, according to analysts at Westpac Bank, who note how several major USD pairs are rotating after touching key levels in the last few days.

"US$ price action has been more encouraging of late, with notable reversals around EUR/USD 1.20, AUD/USD 0.80 and sub-109 on USD/JPY," said Westpac's Sean Callow.

Callow adds that, "short term momentum should remain with the dollar," but that for the rally to progress it would probably need a fundamental catalyst, such as a promise that the US Congress will raise the debt ceiling once it returns from its Labour Day holiday.

Recently President Trump said he would shut down the government if Congress did not vote to raise the debt ceiling and finance a wall with Mexico, however, that was before Hurricane Harvey hit Texas causing massive amounts of destruction.

It is now thought the government and Congress are more likely to pull together to address the natural disaster caused by Harvey.

The large amount of infrastructure work which will be required to rebuild Housten and its environs will need funding so whether or not the ceiling is raised may become a moot point in the weeks to come.

Nevertheless, Westpac's Callow cautions restraint, arguing that it is still too early to read too much into the rebound.

"To be sure, as the chart shows, the dollar’s nascent recovery is tiny in the context of a year of substantial decline, long since wiping out the bounce after the US election," said the analyst.

The flow of US data has been positive of late, with, "strong readings including Jul retail sales, Aug consumer confidence and revised Q2 GDP (now the strongest quarter since Q1 2015)."

Despite imperfect inflation data Fed officials have a lot of strong sentiment and activity data to justify a pre-year-end rate hike, which would, of course, push the Dollar higher.

The probabilities of such a hike have lingered in the 35-40% range, according to Callow, "despite a rally in US 10 year Treasuries."

Normally a rally in T-bonds and therefore a corresponding fall in yields, would be expected to reduce rate hike expectations, but on this occasion, this does not appear to have been the case.

It could mean the probabilities are 'robust' enough to withstand short-term fluctuations in the Treasury market, but it is also probably due to the market's reaction to North Korea's provocative missile test over Japan, which sent investors fleeing to safe-havens, one of which is the 10-year US Treasury bond.

Offsetting the resilience of Fed rate hike expectations is the possibility that the impact of Hurricane Harvey may delay and rise in interest rates in order to support the relief and rebuild effort by keeping borrowing 'cheap'.

This might not necessarily mean the Dollar will fall in response as would normally be the case, however, as natural disasters often spur repatriation and investment flows which can support a currency, as was the case of the Yen after Fukushima - and this is doubly so given the attraction of T-bonds as a safety play.

Westpac also sees inflation headwinds counteracting interest rate hiking, as Callow expects the Fed to revise down their forecasts for Personal Consumption Expenditure (PCE), and argue that official CPI and PCE data needs to meet or beat expectations between now and December to justify and end-of-year hike, resulting in a "high bar."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

July Inflation Data Hit Target

The US Dollar remained broadly unchanged after the release of inflation data on Thursday, which showed personal consumption (PCE) rose by 0.1% month-on-month in July and 1.4% year-on-year (YoY).

The results were exactly in line with analyst's expectations.

Year-on-year, prices fell from 1.5% in June to 1.4%.

The Dollar index, which measures the strength of the Dollar against a basket of currencies remained at about 93.10 after the release.

GBP/USD rose from 1.2857 to 1.2880 after the results as the Pound strengthened against the Dollar.

EUR/USD rose from 1.1825 to 1.1840 following the release, reflecting a slight weakening of the Dollar versus the Euro.

PCE is the Federal Reserve's preferred gauge for measuring inflation so it is an important release on the economic calendar.

Before the release analysts from Westpac had said that PCE would need to come out at, or above expectations for the remainder of 2017 for there to be any hope of a further rate hike in the year.

As such, the marginally negative USD reaction versus the Euro and Pound may be slight overreactions and the currency is expected to make a comeback