Current US Dollar Negativity Unwarranted Argues DBS

The US Dollar Index – which measures the Dollar’s performance against a weighted basket of counterparts - has pulled back substantially since the start of 2017, falling from heights of its post-trump euphoria rally in the 103s to the current 96s.

Part of the reason for the decline has been dwindling expectations that the Trump administration will deliver on its tax and spending promises – promises which included a large reduction in corporation tax and a massive 550bn infrastructure spending budget which was to deliver a shot in the arm for the economy.

The failure of Trump to get key early legislation reducing the healthcare budget through Congress, however, has lowered expectations he will be able to pass more demanding spending promises.

Given these promises helped propel the Dollar higher, their lack has pushed it lower.

May’s (the month not the prime minister) lacklustre employment data finally put the boot in to the Dollar by bringing under scrutiny previously held expectations the Federal Reserve was entering a new monetary tightening cycle in which many rate hikes were envisaged over the next 2-3 year window.

Analysts at DBS Research Group, however, are not so sure the current scepticism for the Dollar are warranted – they still see robust fundamentals underlying the scratched veneer, which but for a little French polishing will shine through.

“The US continued to grow at the 2% pace that has been its norm for the past 6 years. Does that mean things aren’t improving? Not at all. Job growth continues to run at 165k/175k per month – three times faster than the 55k/month growth in working age population – and unemployment has fallen to 4.3% – among the lowest levels in post-WWII history,” they argue.

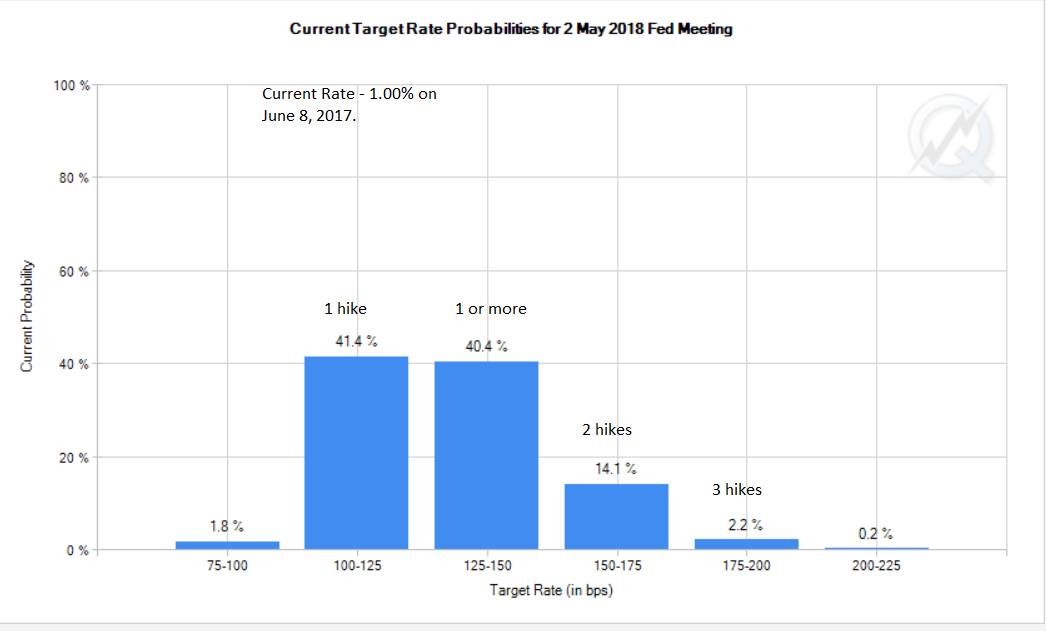

Current market expectations of when the Fed is likely to hike rates are still cautiously showing that after the June rate hike, there is a 59% chance of at least another hike by May 2018 – which is almost a year away.

There is only a 16% chance of three more hikes – that is roughly a hike per quarter to May 2018.

According to DBS this is well below what should happen.

Their base case is for a hike per quarter to mid-2019.

“We’ve now had two hikes in two quarters and markets think a June hike will make it three-for-three. Our guess is the Fed won’t stop there. Why would it?”

Rather than dwelling of one indifferent Non-Farm Payrolls print markets need to take a broader view, growth in the US and internationally is sound.

“Everything in the economy is back to normal, unemployment has fallen to 4.3% and inflation has been trending north for more than a year. And, as San Francisco Fed President Williams puts it, “the Fed still has the pedal to the metal”. That doesn’t make sense,” says DBS’s David Carbon.

They see a normal level for rates as lying between 2.75% and 3.00%, which, “at one hike per quarter, it would take two years to get there. That’s a long time. We don’t expect the Fed to waste any of it. Best plan on one hike per quarter through mid-2019, with the risk that the Fed has to up the pace before then.”