US Dollar to Strengthen as Trump Rhetoric to be Overpowered by Market Forces say Goldman Sachs

The Dollar’s current bout of weakness has seen it steadily devalue since the start of January.

The Dollar Index, which is a composite of the currency versus a trade-weighted basket of counterparts, fell from a high of 103.81 on January 5 to a low of 99.91 on Thursday, Feb 2.

Behind the Dollar’s devaluation is mainly due to Trump’s anti-strong-Dollar rhetoric argue strategists at Goldman Sachs.

Indeed, it does seem to have coincided with an increasing focus by Trump and his advisors on the role of foreign exchange as an important component of the US wealth story which has in turn drawn focused criticism of the strong Dollar.

But coupled with this, and perhaps more importantly, there has been a growing awareness that Trump’s trade, tax, repatriation and fiscal stimulus policies are incompatible with a weaker Dollar.

We reported similar sentiments by strategists at Morgan Stanley who argue a politically-driven risk premium has sneaked into USD valuations, as investors have digested the new US administration's actions and rhetoric on trade.

A strong Dollar makes US exports less price competitive and imports cheaper and more attractive to US consumers – an outcome which is precisely the opposite to the “Buy American, Hire American,” slogan of Trump’s campaign.

Because the driver of Dollar weakness is jawboning, Goldman Sachs believe the Dollar will eventually recover from its current level arguing the unit is ‘undervalued’.

Trump’s efforts to talk it down are ultimately likely to prove futile when pitted against the might of market forces.

The Undervalued Dollar

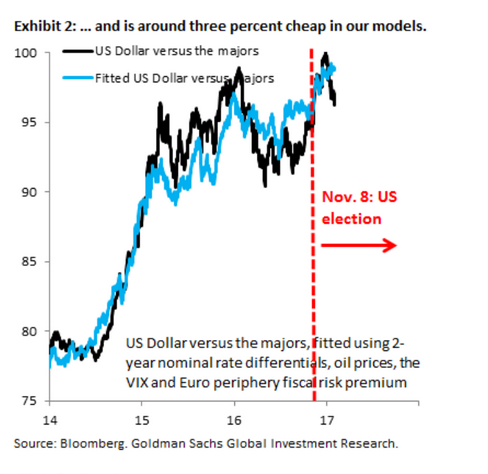

The currency of the US is currently below what it would normally be expected, according to Goldman Sach’s fair-value evaluation model.

This model suggests an index rate which is ‘fair’ for the Dollar, if this is above the current level of the Dollar index then the Dollar is undervalued, if below, it is overvalued.

The model is complex, but it is mostly based on the difference between US interest rates and the interest rates of major counterparts, such as the EU, UK and Japan.

Currencies gain in value when their domestic interest rates rise compared to the rates of counterparts.

This is due to the influence of the carry trade, which involves borrowing in a low interest rate currency and using the money to purchase a higher interest rate currency – essentially pocketing the difference as profit.

Carry is a major driver of currency value, but there are others which Goldman have incorporated into their model.

These include the price of Brent Crude Oil, “the VIX as a proxy for risk appetite,” and “Euro periphery bond yields as a proxy for risk of EU break up.”

The price of oil is a driver for the Dollar because Oil is priced in Dollars so when it is high the aggregate demand for the US currency increases, pushing up the value of the Dollar.

The Dollar also gains as a result of increasing risk aversion because investors tend to pull out of risky emerging market debt and pile back into the safety of uncle Sam, which is a reserve currency.

The risk of EU break up affects the value of the Euro which is the Dollar’s most heavily weighted counterpart in the Index.

The chart below shows that whilst for most of the time Goldman's model fits the Dollar Index's value closely, the Dollar's recent weakness has seen it diverge from the estimate of fair value.

The Dollar is falling way lower, indicating undervaluation.

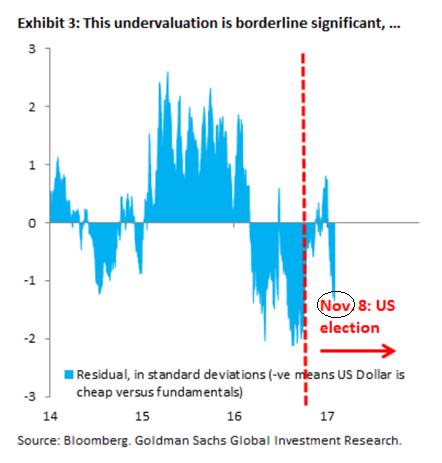

The picture below shows the margin of divergence plotted as a standard deviation, which is reaching a semi-significant level.

Possible Causes

Goldman’s Robin Brooks discusses several possible explanations for the weakness.

“The Dollar is now 1.3 standard deviations cheap. The market is debating a variety of explanations for this residual: (i) better growth abroad, in particular in the Euro zone; (ii) a building expectation for an inflation overshoot in the US; and (iii) balance sheet run-off as an alternative to Fed hikes. None of these fit what the market is trading,” he comments.

Yet he dismisses these reasons one by one.

If there was better growth in the Eurozone then interest rates would be rising there which would be reflected in the model, but they aren’t.

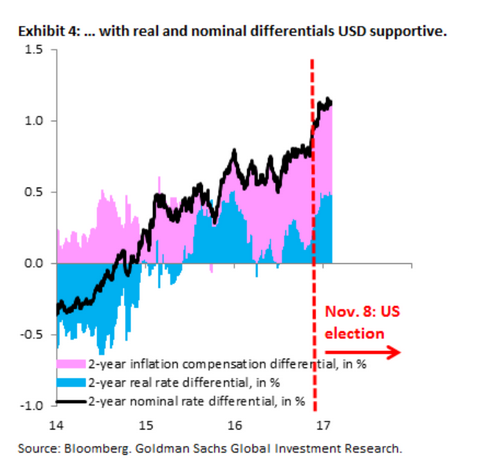

An inflation overshoot explanation should see ‘real’ interest rates deteriorate due to inflationary erosion.

This is the explanation for the falling Dollar stipulated by Citibank.

“It is interesting to note that the divergence (between Dollar and Rates) which began last week also coincides with a spike higher in the inflation expectations to new highs in the trend. Once again, real rates and the DXY seem to be moving together and this should be watched,” says a note from Citi.

Goldman’s argue this is not the case, however, showing a chart with both non and inflation adjusted rates moving in tandem higher.

A “Balance sheet run off” basically means the Fed deciding not to invest the principle from bonds they own maturing as an alternative to raising rates, however, this would still impact rates by reducing overall demand for bonds and therefore raising yields, which would be reflected in the model.

Brooks argues, therefore, that these explanations do not fit the facts.

Instead, he sees the rhetoric from the Trump administration as causing the Dollar’s weakness.

“Exhibit 5 shows that the decoupling of the Dollar coincides with the stream of communications from the new administration from early January, which have signalled discomfort with a strong Dollar,” says Brooks.

Brooks concludes that the Dollar will eventually go higher as Trump will find it increasingly difficult to talk it down.

The Fed has the most power in relation to devaluing the Dollar but it is independent from the government and it is debatable whether it would work in concert with Trump to devalue the currency.

“We think the “Dollar down” rhetoric says more about the constraints facing President Trump, rather than likely outcomes.

“After all, a policy mix that combines fiscal stimulus and protectionism is hard to reconcile with a weaker currency, even if that is what the new administration wants,” he says.

In particular, Goldman see steady upside pressure on the Dollar from improving economic data.