GBP/USD Rate Forecast to Gain From Here

The GBP/USD exchange rate has retraced some of the ground it made following the announcement of the UK Government's Brexit plans.

The Pound welcomed the clarity provided by Theresa May, but we would typically expect a retracement after such large moves.

Was the pop higher justified or will we see selling pressures return?

The decline might actually have more to do with a resurgent US Dollar which is up against most major currencies having suffered a poor 2017 so far.

"The pound is the worst performer so far today. After the rapturous reception to Theresa May’s speech, today sterling traders may be taking a finer look at the detail, and concerns may start to arise about Theresa May’s tough line on Europe, saying that she would prefer no deal, rather than a bad deal with the EU after Brexit," says Kathleen Brooks at City Index.

Despite the rectracement, some believe Pound Sterling experienced a game-changer of a day on Tuesday January 18 thanks to a fresh infusion of confidence and certainty provided by the UK Prime Minister.

Nordea Markets Forecasting Gains into 1.30s

Already we are starting to hear from institutional analysts as to where they see GBP/USD going now that the UK government has laid out its plans for Brexit.

Analyst Johnny Bo Jakobsen at Nordea says the foreign exchange markets have already priced in the hard-Brexit that was announced today.

"Since the GBP has been already hit a lot and is already broadly undervalued, we expect it recover in the near term," says Jakobsen.

"We retain a mildly stronger GBP in our forecast, which also reflects the big political uncertainties in the US and the euro area," says the analyst.

Nordea are forecasting GBP/USD at 1.25 in three months, 1.33 in six months where it should close out the year.

The US Dollar Outlook: Eyes on Yellen, Inflation

With the Dollar looking to take back control it could be worth watching events in the US for the remainder of the week.

Mid-week sees the first of two speeches by Federal Reserve Chair Yellen.

"The Fed narrative on portfolio reinvestment has lately shifted toward a slightly more hawkish tone, so watch for any new insights from Yellen," says Elsa Lignos at RBC Capital Markets.

Datawise, hHeadline CPI should get another boost from firming gas prices (consensus forecast headline & core 2.1%y/y).

It will be the first time that headline CPI is north of 2% since mid-2014 and we expect it to hit 2.5% in both Jan and Feb given easing year-ago comps in energy.

"It is dangerous to draw too many conclusions from a single inflation number, but given the stall in the ‘Trumpflation’ trade and the technical pressure on USD, it needs a strong number to avoid a further washout of USD longs," says Lignos.

Best Day in Years

Markets like what they heard from the Prime Minister.

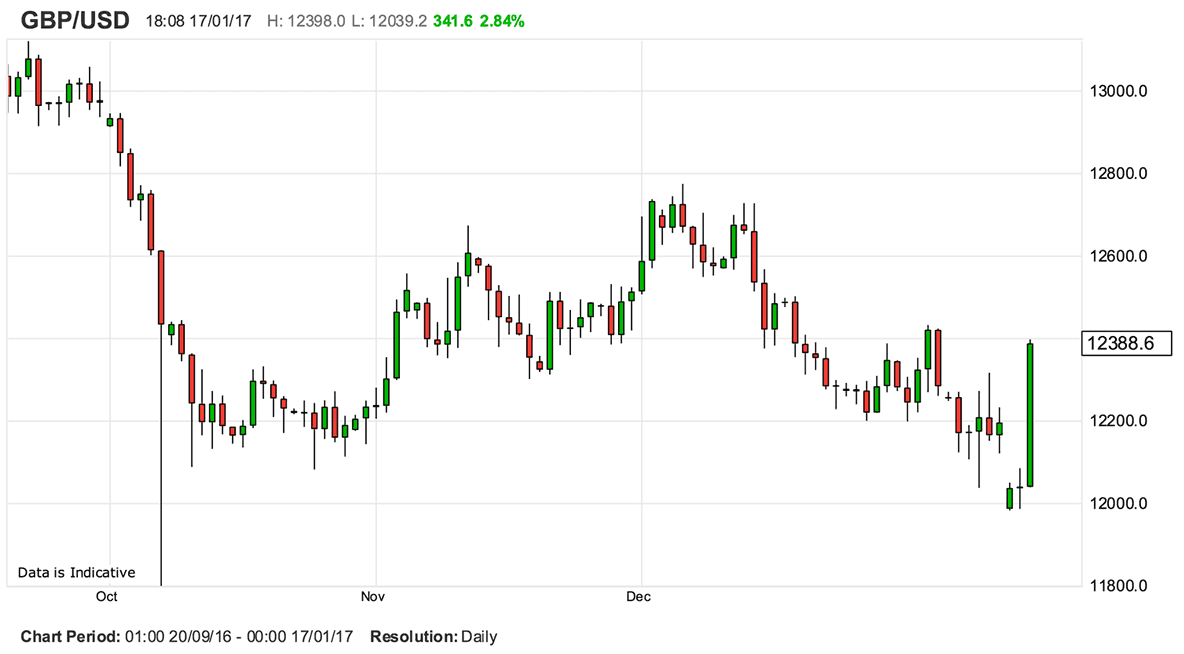

The GBP/USD exchange rate opened the day at 1.2040 - it is at 1.2377 at the time of writing.

This represents a jump of 2.75%.

If these gains can be held then this leap will be the biggest daily gain since July 12 1991.

If the gain exceeds 2.88% then we are looking at the biggest jump since September 25 1989.

This leap confirms markets are relieved by the clarity that has been provided.

“May’s speech provided clarity where there was uncertainty, and if there is anything markets hate, it is uncertainty,” says Joshua Mahony at IG in London. “With everything now out in the open, there is a good chance we will see the Pound start to recover from here on out.”

Mahony believes May has shown she was willing to undergo a short term, clean cut, rather than slowly bleed out at the hands of resentful EU representatives who seek to make an example of the UK.

"Today could very well mark the beginning of the end for Sterling weakness, for May’s bold approach has put everything out in the open, thus reducing the likeliness of further Sterling selloffs each time anything remotely resembling a hard Brexit is brought up," says Mahony.