Sell GBP/USD Exchange Rate Ahead of 2017 Slump say ING

ING are clear on where they see the British Pound headed in 2017, that is why they are recommending a Sell on GBP/USD.

Sterling bounced to its strongest levels against the Dollar since October in the week November 28-December 2 having hit 1.2696 on news the UK Government would be seeking to buy its way into gaining unfettered access to the EU's single market in upcoming Brexit negotiations.

However, the strength should be viewed as a good opportunity to sell GBP/USD, as it is likely to fall back down towards 1.20 according to analysts at ING.

Pound Sterling’s weakness will come on the back of increased uncertainty around the triggering of article 50 and the political deadlock with Brussels confirming the issue will remains a major weight on Sterling over coming months.

And, the Pound is unlikely to be boosted by safety flows from Europe in the event of increased concerns about the rise of anti-EU political sentiment there.

The Dollar will continue to rise in value on the back of higher US Treasury yields as Trump begins to deploy his ‘wish-list’ of stimulus and protectionist policies.

The Dollar’s strength is expected to come on the back of tighter monetary and looser fiscal stance, similar to that adopted by Ronald Reagan in the 80’s, which led to a 30% rise in the Dollar.

ING's Turner says:

“One of our main headaches, however, is making Trump’s domestic policies add up.

“For example, delivering 4% real (or did Trump mean nominal?) GDP growth should see the Fed Funds target rate being taken up to at least 2%.

“Wouldn’t a loose fiscal, tight monetary policy mix propel the dollar even higher – and further hollow out the US manufacturing sector Trump is so keen to rebuild?”

He further adds on the same theme:

“Republican Presidents have typically been more bearish for the dollar, although that applies more to the Bush Administrations than it does to the Reagan era of the 1980s.

“Instead Ronald Reagan triggered a boom-bust cycle, in which loose fiscal and tight monetary policy sent the dollar some 30% higher – sucking in cheap imports and destroying the current account deficit – before G5 nations agreed to devalue the dollar in 1985.

“Some are already speculating that Trump’s policies will engineer a similar cycle.”

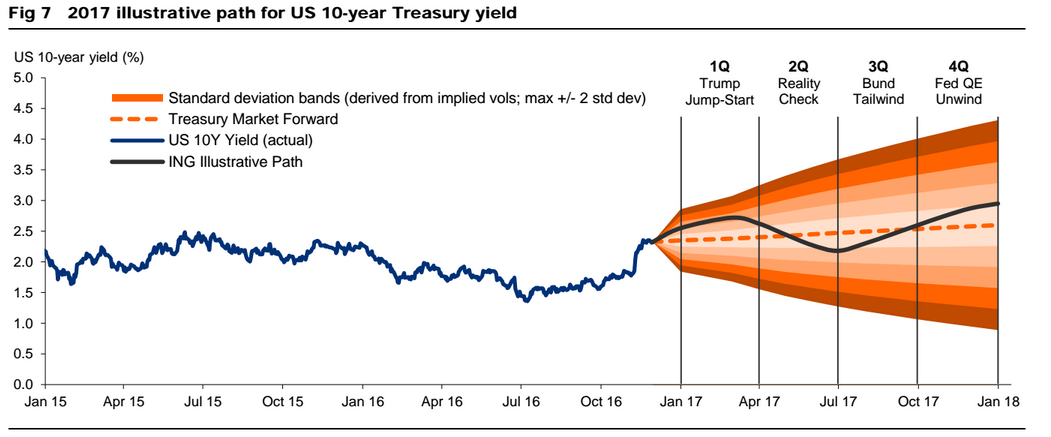

Outlook for US Treasury Yields in 2017

A major driver for the Dollar are US Treasury yields so the outlook for these in the year ahead could also help to clarify the trajectory of the Dollar.

ING have come up with a detailed forecast for how yields are expected to move in 2017 (see chart below).

In the first quarter, he sees a pop higher likely after the delivery of the President’s Budget as hopes of Trump's stimulus and protectionist ‘wish-list’ are revived.

In Q2 analysts see yields pull-back however because of a reality check in the form of resistance from Congress preventing some of his policies from getting through.

In Q3 yields will rise due to flows from Europe as it struggles due to rising political uncertainty.

In Q4 yields will recover again based on expectations of tightening in Federal Reserve policy, and more interest rate hikes.

The dollar is also expected to be supported by the repatriation of funds from outside the US, which are also expected to support equities higher as they offset higher borrowing rates.

ING Pessimistic About Outlook for the Pound

Whilst more upside seems almost unavoidable for the US Dollar, the Pound is forecast to weaken by ING.

“The broader risks to GBP continue to lie to the downside – at least until the tail-risk of a ‘messy divorce’ has been taken off the table,” comment’s ING’s Viraj Patel.

Extended uncertainty over the outcome of Brexit is likely to wear away at Sterling, leading to the GBP/USD fall to 1.15 in the first half of 2017.

Patel also sees another headwind for the currency coming in the form of a weakening in the real economy, which he expected to trigger another interest-rate cut from the Bank of England.

“All of this suggests that 1H17 will remain a tricky backdrop for GBP: the BoE is likely to follow-up with a Bank rate cut to the lower bound (and an extension of QE) in response to a slowdown in the real economy. Uncertainty over the size of the negative long-run productivity shock (stemming from a lack of economic openness) means that we are cautious about calling for GBP upside until all the potential ‘bad news’ is in the price,” concludes Patel.

Forecasts and Trade Strategy

Based on these main themes ING’s Turner sees GBP/USD rotate back down to 1.15.

Turner recommends opening half the sell position at an entry level at 1.2820 and the other half at 1.2630.

He places a stop-loss at 1.2915 and expects a return of 9.6% down to a target at 1.1500.