US Dollar Forecast Higher on MPK Advantage by Barclays

- Written by: Gary Howes

The British pound to dollar exchange rate (GBPUSD) is directionless ahead of the US Fed meeting mid-week. But, looking ahead the USD will strengthen suggests new in-depth research from Barclays.

The sideways movement of USD exchange rates that have been in place since March suggests that market participants still doubt interest rates will start rising at the US Fed soon.

The pound v dollar exchange rate has trended sideways since March – 1.58 has defined the maximum while 1.52 appears to be support.

At the time of writing the inter-bank market quoting sterling/dollar at 1.56 while retail rates on international payments are being offered at 1.5162 and independents are closer to the market at 1.5412.

Researchers at Barclays have confirmed they are bullish on the USD’s outlook saying the US dollar does not need the Fed to strengthen.

This is an interesting view, particularly if we consider the volume of commentary available at the present time which says Fed decision-making and interest rate projections are all that matter to the USD.

Barclays do not deny interest rates are important to the outlook of the USD, but they do highlight that Fed policy is not the be-all and end-all.

“Fed rate hikes likely only validate what international investors already know: the US is the place for returns,” says Marvin Barth at Barclays in London. “Vacillating market expectations for Fed policy likely will drive the bumps and dips along the USD’s trend, but that trend is driven by differential returns on capital – broadly defined – and clearly is higher.”

It’s All About the Return on Capital

The research note advocating for a stronger US dollar, entitled ‘Three Questions: Top Dollar’ is notably academic in approach:

“Exchange rates are the prices that equilibrate returns to capital across economies, shifting capital from economies with an excess (hence lower returns to capital) to economies with a shortage (providing higher returns). Interest rate differentials are related to broader return differentials – hence their correlation with currency trends – but are an imperfect proxy,” say Barth.

Broader 'returns to capital' includes the returns from the entire range of investments in an economy: sovereign (“risk-free”) rates, credit, public equity, private equity, real assets, et cetera.

"More succinctly, they represent the return to an additional dollar invested in an economy, however it is financed, ie, the marginal product of capital (MPK). Investment in a new firm, factory, real estate development, oil well, or infrastructure project can be financed through a range of financial securities, loans or private partnerships, according to the risk tolerances of investors tiered in the payment waterfall," says Barth.

But the returns to all of those instruments come from the underlying asset, which represents the overall return on capital. Where are returns to capital the greatest?

Among developed economies, the US and UK are the leaders by a wide margin.

This is why the US dollar and pound sterling are relative out-performers in global FX over recent months.

Barclays' research into the USD’s outlook is detailed in nature, but the crux is:

“A rebound in the US data over the summer, as winter weakness fades, likely will bring forward markets’ expectations for Fed tightening, fuelling another leg higher in the USD. But for those questioning how much further the USD can go, history, demographics and current returns to capital suggest it is quite a bit further.”

There are then a large range of drivers that will drive the USD higher in the opinion of Barclays.

Furthermore, it is worth pointing out that questions of risk are starting to appear on the horizon once more with Chinese stock markets in apparent free-fall.

Barth and his colleagues at Barclays say that their studies show one thing – when risk is on the table there is only one currency that risk-managers want to own, and that is the dollar.

The attractiveness of the USD as a safe-haven currency could well propel the next level of USD appreciation.

Indeed:

“In “risk-on” states, superior US economic fundamentals are likely to support higher returns to capital and currency appreciation. In “risk-off” states, the USD is likely to be supported by its highly attractive safe-haven attributes including low volatility in asset returns.”

Key Points to Consider on the USD Outlook:

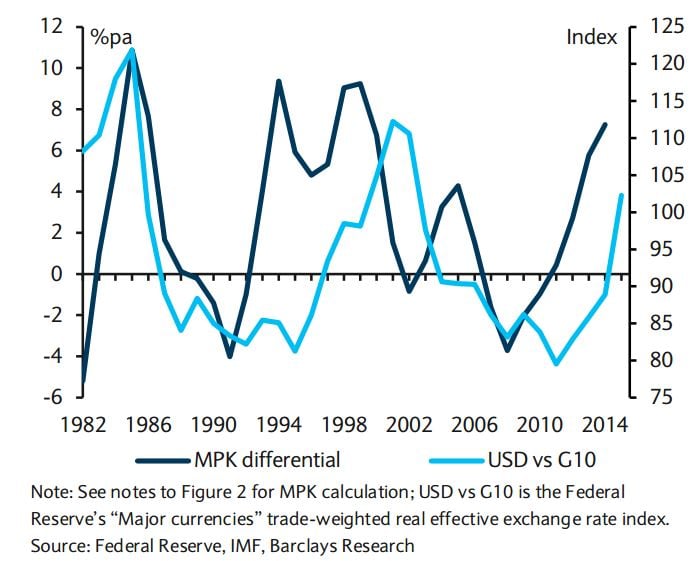

- Among the G10, the MPK is highest by a wide margin in the US; it even is catching up with emerging markets

- MPK differentials are clearly related to broad currency trends: capital flows to where the returns are greatest

- Large output gaps and overinvestment elsewhere, plus lags imply persistent USD strength for years to come

- Relative risk matters too, and the USD is king when safety is considered

- With the long-run value of alternatives in question, “antidiversification” is another reason to favour the USD

Meanwhile, Barth’s colleague at the British investment bank, Jose Wynne, has reiterated his call for the euro / dollar exchange rate to fall to parity.

“We think the policy divergence theme remains firmly in place. Although we believe the bund sell-off increases EUR sensitivity to euro area uncertainty, we see a short EURUSD position as among the best to hold. We continue to expect EURUSD to trade through parity in early 2016,” says Wynne.