GBP/USD Forecast: H2 Median Point Drops 200 Pips

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling Live and Corpay have launched the midyear forecast collation for the Pound to Dollar exchange rate.

The document shows that the world's best-regarded foreign exchange analysts and economists have downgraded their view on the Pound's prospects against the Dollar.

The forecast document - available as a discretionary free download - collates the forecasts of all the major investment banks to give an actionable point target for those with payment requirements to consider.

The median forecast of the major investment banks is particularly useful as it shows where there is greater consensus. It allows those with payment requirements the ability to formulate as reliable an expectation as possible.

As we reach the mid-year stage, we can report that the median GBP/USD prediction is shifted lower by 200 pips from where it started the year.

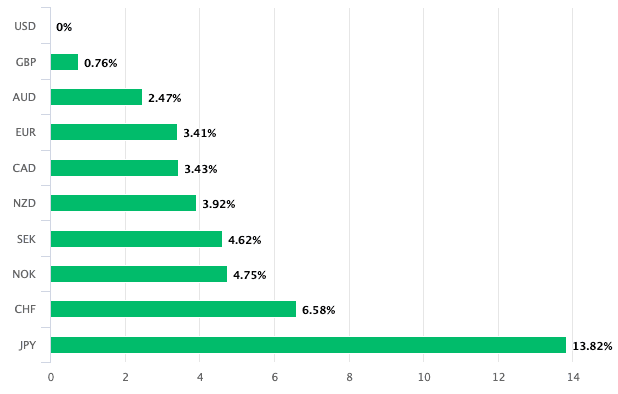

Above: King Dollar reigns supreme in 2024.

To be sure, the median is still higher than current spot levels (1.2670). However, the downgrade recognises the Dollar's outperformance in 2024.

"We have been bullish on the USD throughout the year on the premise that the Fed will cut slower than other central banks and that the dollar was under-pricing the US election. The dollar’s rally in recent days is arguably in part due to the market finally starting to price a higher risk premium on this event," says George Saravelos, an analyst at Deutsche Bank.

At the start of the year, investors reckoned the Fed would gift up to seven interest rate cuts throughout the year, which would ultimately weigh on the Dollar. The first cut was expected in March.

Fast-forward to June, and we have had no cuts. There is now less than a 50% chance of a Fed cut by the September meeting. The market is now fully priced for just one cut this year.

Some Fed officials have even warned this could also be too optimistic.

Meanwhile, the U.S. stock market outperforms, giving global investors the incentive to buy dollars to fund forays into market darlings like Nvidia.

The forecast document, meanwhile, shows that one investment bank thinks the Pound-Dollar exchange rate can fall as low as 1.11. At the other extreme is a forecast for 1.35.

We suspect the median could be correct in anticipating levels higher than current rates, but a cross of 1.30 will require a sudden downshift in the U.S. data pulse. This is, of course, still possible, but data-dependency is the watchword heading into the year's second half.

"The USD will remain stronger for longer," says Alan Ruskin, Macro Strategist at Deutsche Bank. "The market already has the Fed cutting rates by more than most. The risks of the expected policy divergence playing uniquely negative for the USD, given what is priced, is seen as limited."