GBP/USD Rate Retreats from Highs - Kashkari, U.S Debt Worries Cited

- Written by: Gary Howes

Above: File image of Fed board member Neel Kashkari. Image Dan Nguyen / ProPublica. Reproduced under CC 2.0 licensing.

Global investors are turning nervous, and this is boosting the Dollar.

The Pound to Dollar exchange rate has retreated from its highest level since March (1.28) amidst a broad-based U.S. Dollar rally that has a deterioration in risk sentiment to thank.

Pound-Dollar has retreated to 1.2724 at the time of writing, with analysts citing rising fears of further interest rate rises at the Federal Reserve for a deterioration in sentiment, which typically boosts the Dollar.

"Risk off as rates beat AI hopes, with markets focused on policy and high for longer with fears of another rate hike," says Bob Savage, Head of Markets Strategy and Insights at Bank of New York Mellon.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The world mostly is stuck watching rates with the near $300bn in US supply this week the event into month end," says Savage, "mix in Fed speakers and the Beige Book and you have the set up for more trouble."

Tuesday's five-point bounce in the U.S. Conference Board's consumer confidence measure is widely cited as having boosted the Dollar as it raises fears U.S. inflation will remain elevated amidst resilient consumer demand.

This will reignite speculation that the Federal Reserve has little room to cut interest rates and could, in fact, opt to raise them again.

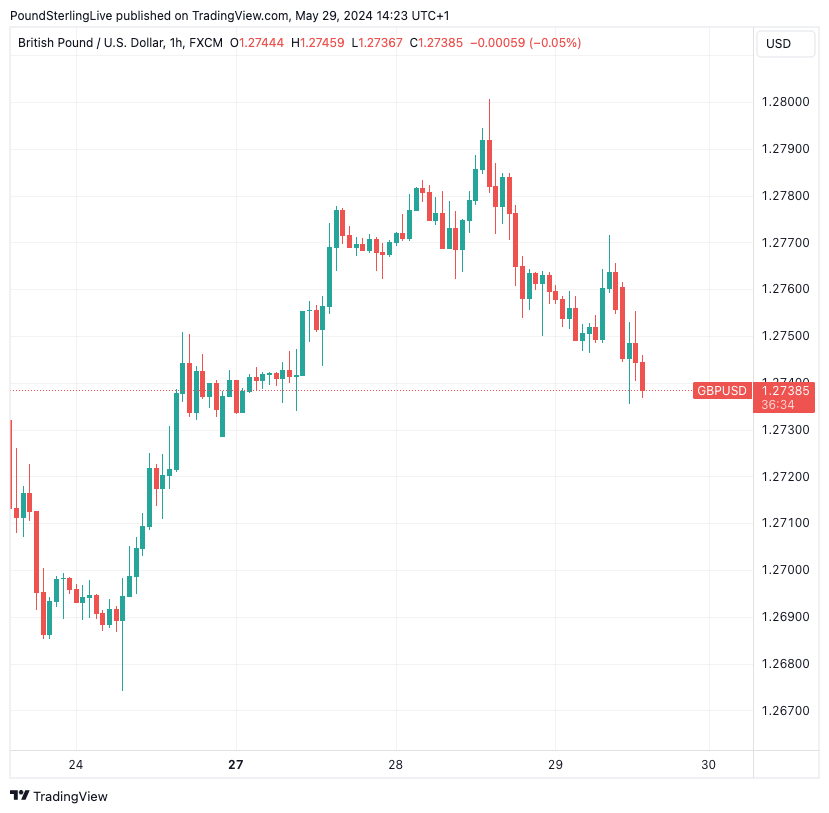

Above: GBP/USD at one-hour intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

Minneapolis Federal Reserve President Neel Kashkari gave weight to this idea, saying further rate hikes remained a possibility.

"I don’t think anybody has totally taken rate increases off the table. I think the odds of us raising rates are quite low, but I don’t want to take anything off the table," said Kashkari at a monetary policy forum in London. He added, "wage growth is still quite robust relative to ultimately what we think would be consistent with the 2% inflation target."

"The dollar is advancing, yields are higher, and equity futures are in retreat as more overt hawkishness from a Fed official weighs on global risk sentiment," says Karl Schamotta, Chief Market Strategist at Corpay.

The U.S. debt burden is also a concern as the government looks to borrow billions of dollars by issuing fresh bonds. If demand for this debt is not adequate, the yield offered by the bonds rises, which is supportive of the USD.

"Weak demand for 2- and 5-year UST auctions yesterday suggests supply may be becoming an issue for the market," says Win Thin, Global Head of Markets Strategy at Brown Brothers Harriman. "Hawkish comments from the Fed added to the selloff, as did the stronger than expected Conference Board consumer confidence reading for May."

Wednesday sees the U.S. Treasury auction $28BN in 2-year floating rate notes and $44BN in 7-year notes. Fed members Williams and Bostic are due to speak today.