GBP/USD Week Ahead Forecast: Higher Range, Bank of England and Fed in Focus

- Written by: Gary Howes

- GBP/USD pullback underway

- But weakness expected to be shallow

- UK Inflation, Bank of England in focus

- Fed decision likely most important event of the week

Image © Adobe Images

Pound Sterling has retreated from its March highs against the Dollar and risks a further setback if UK inflation disappoints and the Federal Reserve strikes a hawkish tone.

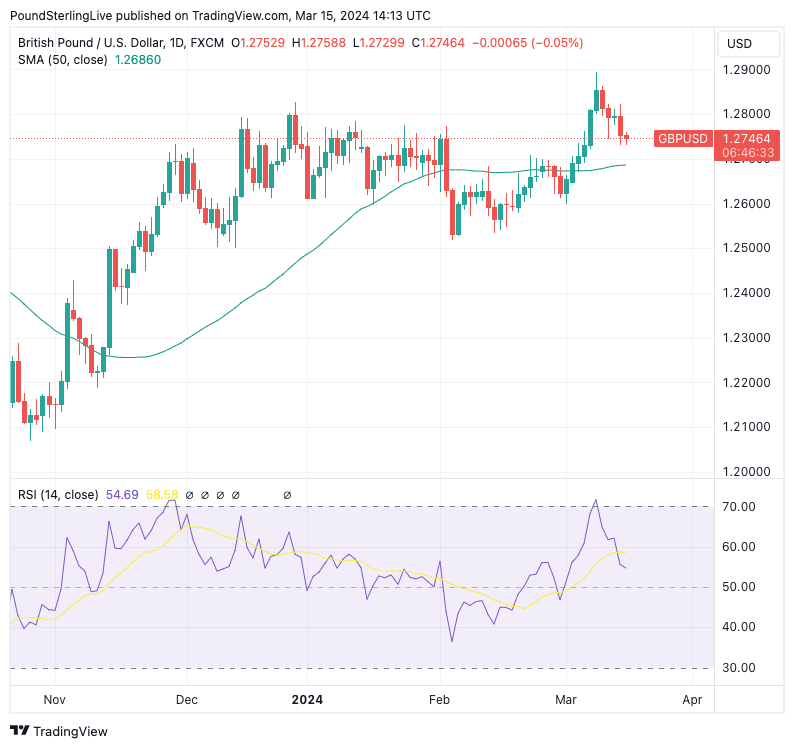

On Friday, March 08, the pound to dollar exchange rate peaked at 1.2893. At the same time, the Relative Strength Index hit 70, signifying overbought conditions that were due to unwind.

An unwind duly ensued, with the pair retreating back to below 1.1750, aided by some stronger-than-expected U.S. inflation prints.

Above: GBP/USD at daily intervals with the RSI in the lower panel, showing an unwind from overbought conditions. Track GBP and USD with your own custom rate alerts. Set Up Here

Nevertheless, the pullback hasn't been deep enough to threaten the 50-, 100—and 200-day moving averages, which suggests we are only witnessing a pullback within a still-intact uptrend.

A break below the 50 DMA at 1.2686 would put us on notice that a more notable turn in trend is underway, while a break below the 200 DMA (1.2589) would flip the pair into a downtrend.

Analysis from Quek Ser Leang, Markets Strategist at UOB, says "GBP has to break clearly below 1.2710 before further weakness is likely... the chance of GBP breaking clearly below 1.2710 will increase in the next few days as long as the strong resistance (now at 1.2820) is not breached."

The main risks for the Pound in the coming week are the release of inflation numbers on Wednesday, PMIs and the Bank of England decision on Thursday and Friday's retail sales.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

UK Inflation: Tuesday, 07:00

The headline CPI inflation rate is expected to fall to 3.6% in February from 4.0% in January, the month-on-month increase is expected to read at 0.6%, up from -0.6%.

The Pound will come under pressure if the print undershoots expectations as markets would see a greater likelihood that the Bank of England will cut interest rates in June. The trend of disinflation in the UK is underway, what matters for the Pound is the speed at which it transpires.

"We are forecasting a sustainable return to 2% inflation this year," says Brian Martin, Head of G3 Economics at ANZ. "We forecast wage growth will fall towards 4% y/y by mid-year, allowing the BoE to be confident that underlying inflation is falling sustainably."

Bank of England: Thursday, 12:00

The Bank of England will keep Bank Rate unchanged at 5.25%, but any changes to the accompanying statement and vote composition will potentially move markets.

Should another member of the Monetary Policy Committee (MPC) join Swati Dhingra and vote for a cut, the Pound could come under pressure. Any shift in guidance that hints at the prospect of future rate cuts could also weaken the Pound.

"Hawks and core MPC members are likely to sustain their views and keep BoE firmly on hold. GBP/USD may have faltered but should be contained in a higher 1.2700-1.2950 range into the BoE meeting," says a note from Westpac.

"The GBP could be vulnerable to any evidence that more MPC members are coalescing around the view for stable rates and/or rate cuts," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"We think August is the earliest that the MPC will have enough evidence of progress on inflation to start cutting rates. The May labour market report and June inflation data will feed into its updated macroeconomic forecasts as part of the Monetary Policy Report," says ANZ's Martin.

UK PMIs: Thursday, 09:30

Thursday sees the release of PMI data for March, which will give a strong snapshot of this month's activity. The headline services PMI is expected to read at 54.2 which would indicate a strong expansion and confirm the recession is truly over.

Markets are positioned 'long' on the Pound, which hints that it will require a sizeable beat to prompt meaningful gains. By the same token, the bigger reaction would likely be to the downside on any undershoot in the data.

UK Retail Sales: Friday, 07:00

January's release of retail sales for December showed an unexpected slump that prompted a decent sell-off in the Pound.

February's release meanwhile showed retail sales increased 3.4% y/y in January, indicating that the economy likely exited recession at the start of the new year.

In short, the retail sales print matters, and another strong reading could shore up the Pound and confirm that a strong recovery is underway.

Federal Reserve Decision: Wednesday, 18:00

With inflation and payroll data behind us, the next major event facing the Dollar is the March policy decision, due Wednesday at 18:00 GMT.

The Fed will keep interest rates unchanged and will likely reflect on the recent 'stickiness' in U.S. inflation and robust data outturns.

How strident the Fed sounds on the need to keep rates steady will be of interest and could pose upside risks to the Dollar.

Furthermore, upgrades to the Fed's new economic forecasts and interest rate projections (the dot plot chart) pose additional upside risks to the USD.

"The USD could have a better time of it. The median Fed dot for -75bp in 2024 cuts is flimsy, needing just two officials to back away. As it is, after two consecutive stronger CPIs, the March and April prints ahead of their June meeting must print decisively softer to give officials the confidence to ease," says a note from Westpac.

Image courtesy of Crédit Agricole.

"Key for the markets would be any indications that stickier US inflation, a more resilient real economy and easier financial conditions would be seen by the Fed officials as warranting a somewhat less aggressive easing from here. To the extent that this gives the USD rate appeal a boost, the currency could regain ground more broadly," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.