Pound Sterling Hits New 2023 High against U.S. Dollar, Will Powell Spoil Sterling's Party?

- Written by: Gary Howes

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

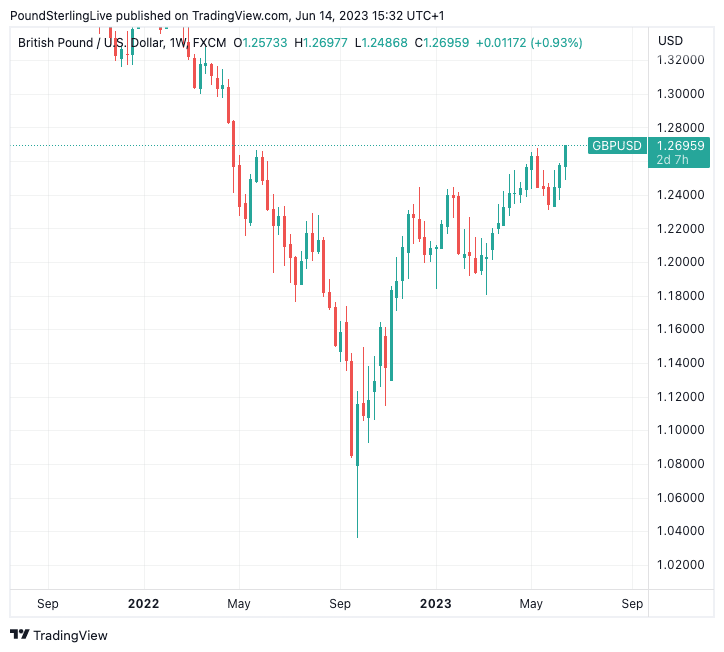

The Pound to Dollar exchange rate (GBPUSD) hit a new 2023 high but the test of this milestone level coincides with the looming midweek Federal Reserve policy decision that could boost the Dollar and result in a retracement for Pound Sterling

GBPUSD rose to 1.2695 in late London trade, just hours ahead of the 19:00 BST Fed decision, making for the strongest rate of exchange since April 2022.

Pound Sterling remains in a bullish configuration against the Dollar and it would likely require the Federal Reserve to spring a surprise if the uptrend is to be truly broken.

But the Fed has the ability to spoil Sterling's party in the near-term if it surprises with a 25 basis point interest rate hike and warns further such moves are likely given the ongoing persistence of elevated U.S. inflation.

To be sure, U.S. inflation is decelerating, as per yesterday's data release, encouraging a base-case assumption in the market for the Fed to forgo another interest rate hike.

Therefore the immediate downside risk for GBPUSD would lie with a surprise to this assumption which would come in the form of a rate hike, something analysts at TD Securities say is a surprise they are prepared for.

"This week's decision is likely to come down to the wire, but we maintain our long-held view that the Fed will tighten rates by a final 25bp in June to a range of 5.25%-5.50%," says Oscar Munoz, Chief U.S. Macro Strategist at TD Securities.

Above: GBP/USD at weekly intervals showing new highs.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Under such a scenario TD Securities sees in the region of 0.10% to 0.20% upside for the Dollar, suggesting downside to Pound-Dollar would be relatively subdued.

Nevertheless, the setback could allow for a period of short-term consolidation to evolve across the Dollar complex and ensure GBPUSD is capped below 1.2680.

Should the Fed forgo a rate hike the odds of a July move would likely rise.

"While economic activity indicators have yet to suggest the Fed is on a clear path to 2% inflation, they can afford to gather more data given the accumulation of rate increases and as the risks to the outlook have become more two-sided," says Munoz, who sees a 40% chance the Fed skips.

Under such a scenario there could be a 0.60% contraction in the Dollar, a move if realised, could push the Pound-Dollar to fresh multi-month highs.

As always the tone and the guidance will be important, meaning market reaction will be subject to much nuance.

Should the Fed skip a hike yet signal clearly it remains concerned about inflation and strongly hint at further hikes, the Dollar could in fact end the day higher.

This is the likely market reaction in the event the market is persuaded to put back the time it expects the Fed to begin cutting interest rates again.

"We expect Chair Powell to reiterate that the Fed remains data dependent and that economic data since the May FOMC meeting has not shown convincing signs of slowing. Although the growth moderation resulting from curtailed credit supply should help limit inflation pressures over time, he will also make clear that inflation risks remain elevated," says Munoz.

Munoz's colleague, Mark McCormick, Global Head of FX and EM Strategy at TD Securities, says whether the Fed hikes in June or July (or skips both) the Dollar will remain focused on the near completion of the tightening campaign.

He adds this skews the risks towards a USD pullback in the second half of the year.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks