Pound Sterling in Fresh Gains as Britain Gets a Pay-rise

“One thing we haven’t heard the MPC mention yet however is the strength of sterling over the past year.” - Andy Scott at HiFX.

It was only in early February that we heard the UK Prime Minister calling on UK business to increase pay to staff.

Even the PM will be surprised by the speed at which his wish has been delivered; it was announced by the official statistics body, the ONS, on Wednesday, that December's UK average earnings index rose to 2.1% vs 1.7% expected.

The prior reading for wage growth was at 1.8% (revised up from the initial 1.7% reported).

Combined the increase in wages with yesterday’s record-low inflation data and we can see, statistically at least, that living standards in the United Kingdom are on the way up.

The news saw a flurry of buying interest in the British pound with the exchange rate complex making gains right across the board.

All ground ceded to the euro on Wednesday has been reversed and the GBP/EUR exchange rate is approaching 2015 highs once above 1.3554.

The pound to dollar exchange rate (GBP/USD) is meanwhile solidifying its recent stabilisation following months of decline. The currency pair is at 1.5428.

“Sterling reacted positively to the both the Bank of England minutes and the employment data as it reintroduces the possibility of a rate hike this year,” says Andy Scott, associate director of FX advisory services at HiFX.

Unemployment Back at Pre-Recession Levels

Boosting buying interest further was additional ONS data which reported that employment levels have risen at a faster-than-expected rate to market expectations.

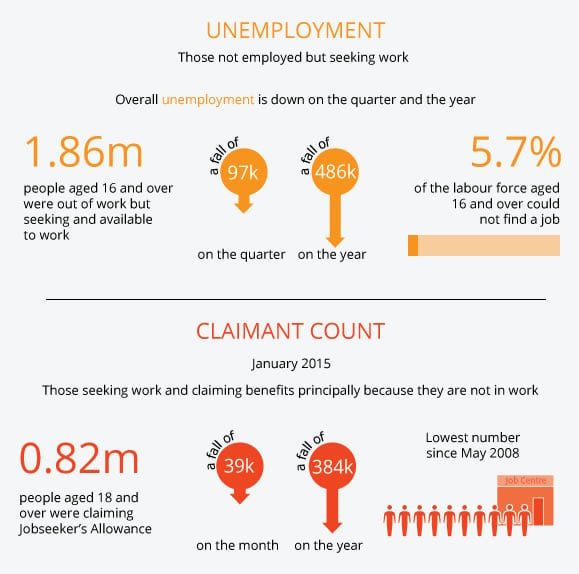

The number of unemployed in the population fell by 97K on a quarterly basis meaning that 5.7% of the potential labour force aged above 16 are without a job. Economists had expected the rate to read at 5.8%.

Furthermore, those seeking unemployment benefits has fallen by 39K on the month, there are 384K less people seeking handouts from the state than there were a year ago.

Bank of England - Still no Warnings Over the High Value of the Pound

In other key mid-week news, the Bank of England released the minutes from their February meeting of the decision making committee.

Everyone was unanimous in wanting to keep interest rates at a record low of 0.5%.

However, HiFX’s Andy Scott finds it curious that the high valuations in the British pound exchange rate complex have still not been addressed by the Bank:

“One thing we haven’t heard the MPC mention yet however is the strength of sterling over the past year, which reached a multi-year high on a trade weighted basis – even though it’s weakened against the U.S. dollar.

“A strong currency when you’re faced with disinflation can add to the problem, and we see this as something that’s likely to register on the BoE’s radar in the months ahead.”

While other global central banks are seen to be taking desperate measures to devalue their currencies we note that such a move would be highly unlikely in the UK.

Indeed, the Institute of Directors has warned that for the sake of stability the Bank of England should start raising interest rates sooner rather than later.

James Sproule, Chief Economist at the Institute of Directors tells us:

“Today’s figures must not stand in the way of starting the process of normalising interest rates.

“Keeping the base rate at its extraordinary low of 0.5 per cent while the economy is growing and productivity is improving could be a dangerous decision. For rate rises to be gradual, they must start soon.”

Pound / Euro Exchange Rate Recovers

The GBP has staged a recovery against the euro following Tuesday’s losses.

The single currency found some support yesterday after rumours emerged that Greece would be asking for a bailout extension at some point today.

“The rumours were unfounded, however the price action would suggest that if an agreement can be reached in a timely manner we should see a recovery in the Euro,” says Emily Tang at Halo Financial.

Talks continue and near term direction may well be dictated by comments and rumours of a resolution so it is best to remain flexible.