Analysts see Dollar on the Back Foot Following Midweek Fed

- Written by: Gary Howes

- USD tipped to struggle in wake of Fed hike by Goldman Sachs

- Most analysts say Fed nearing end of hiking cycle

- But financial conditions continue to ease

- Offering potential for 'hawkish' surprise say some

- Which could support USD in near-term

Above: File image of Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

The Dollar is expected by analysts to remain offered through the Federal Reserve interest rate hike and policy guidance due midweek, although others warn the recent easing in financial conditions could yield a 'hawkish' surprise.

The Fed meets on Wednesday to deliver a widely-anticipated 25 basis point interest rate hike, but uncertainty persists as to how many further interest rate hikes are likely.

This means the Dollar's reaction will more likely be centred on the Fed's economic and interest rate forecasts as well as the verbal guidance from Chair Jerome Powell.

"We expect the Fed to slow the pace by 25bp at its next meeting, which could also keep the Dollar on the back foot, in part because it sets a more manageable pace for other central banks to match," says Kamakshya Trivedi, a foreign exchange strategist at Goldman Sachs.

Expectations for a slowdown in hikes are supported by the ongoing decline in inflation, slowing jobs growth, weakening of durable goods consumption and non-manufacturing ISM data consistent with a retreating economy.

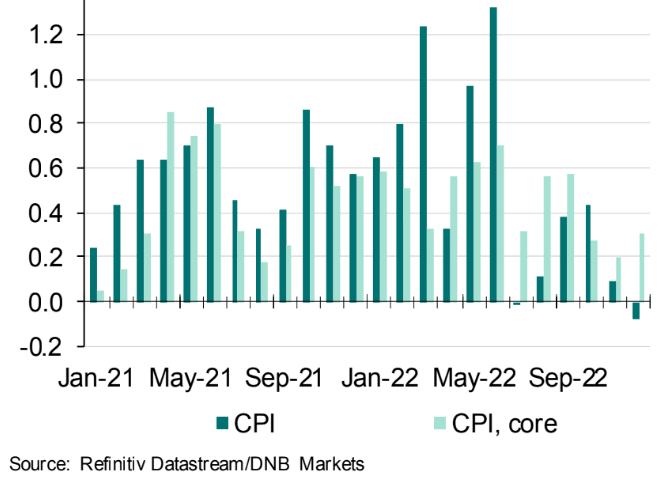

Above: U.S. inflation is cooling, in line with the Fed's aims. Chart: Inflation % month-on-month, seasonally adjusted. Source: DNB Markets.

Analysts are closely aligned on expecting a 25bp hike but there is a divergence in opinion about the nature of the guidance that will be forthcoming regarding the prospect of further hikes.

The Bank of Canada last week raised interest rates again but clearly stated it would now pause the hiking cycle, prompting a fall in the Dollar that would suggest investors see this as a harbinger for Fed guidance.

A clear trend of falling CPI inflation supports the view that the Fed could signal it is ready to pause but a stronger-than-expected GDP report for the final quarter of 2022 suggests the economy remains resilient, leading some analysts to say the job is not yet done.

"With Powell on the mound, rocking the Federal Reserve uniform, he may use recent accelerating data as a justification to surprise the market with a 50 basis point hike," says Jose Torres, Senior Economist at Interactive Brokers, the broker/dealer and day trading app provider.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"We expect that guidance will still point to more hikes at coming meetings, and our new forecast includes two more hikes in March and in May," says Knut A. Magnussen, an economist at DNB Markets.

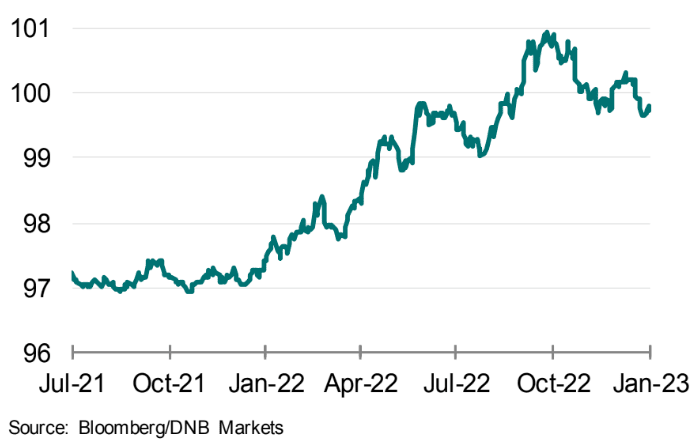

Furthermore, the cost of money in the U.S. has fallen as bond yields come down, which is not consistent with the Fed's stated agenda of bringing inflation back down.

"The recent easing of financial conditions is clearly an argument for further rate hikes," says Magnussen.

Above: U.S. financial conditions index show an easing in the cost of money, which might not be consistent with the Fed's aims when targetting lower inflation.

In line with a need to keep funding conditions restrictive, Magnussen says that guidance is likely to indicate further interest rate hikes are likely as the following key paragraph will be repeated:

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

Should the Fed push back against softer funding conditions in a 'hard' manner, the Dollar could rally as expectations for future rate hikes are shored up.

However, analysts at UBS are more inclined to view Wednesday's decision and guidance as being unsupportive of the Dollar.

"There is a risk that the USD could end up weaker, rather than stronger, after the meeting," says Dominic Schnider, Strategist at UBS.

"The interest rate peak now seems closer for the Fed than others. US inflation is likely to quickly roll over in 1H, and the latest data prints point to higher recession risks than in Europe. None of this is good news for the dollar," he adds.

Whatever surprises come out of the Fed on Wednesday will, at most, cause a relatively contained adjustment to expectations for the Fed's peak interest rate.

Therefore the broader direction of travel remains well understood, and this is consistent with a continuation of the Dollar weakness of the past three months.

"We believe the USD will correct further in 2023. Its significant overvaluation can no longer be supported once the Fed stops hiking, global growth shows signs of troughing and market volatility comes down," says Paul Mackel, head of currency research at HSBC.

Any bouts of Dollar strength - including that which might occur on Wednesday - will likely be faded, keeping the Pound-Dollar exchange rate supported above 1.20.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes