Pound Sterling Pulls Back, But $1.26 Possible if Stocks Can Push Higher

- Written by: Gary Howes

Image © Adobe Images

The British Pound is poised to extend its recent gains against the Dollar say some analysts we follow, but global investor sentiment would need to remain supportive.

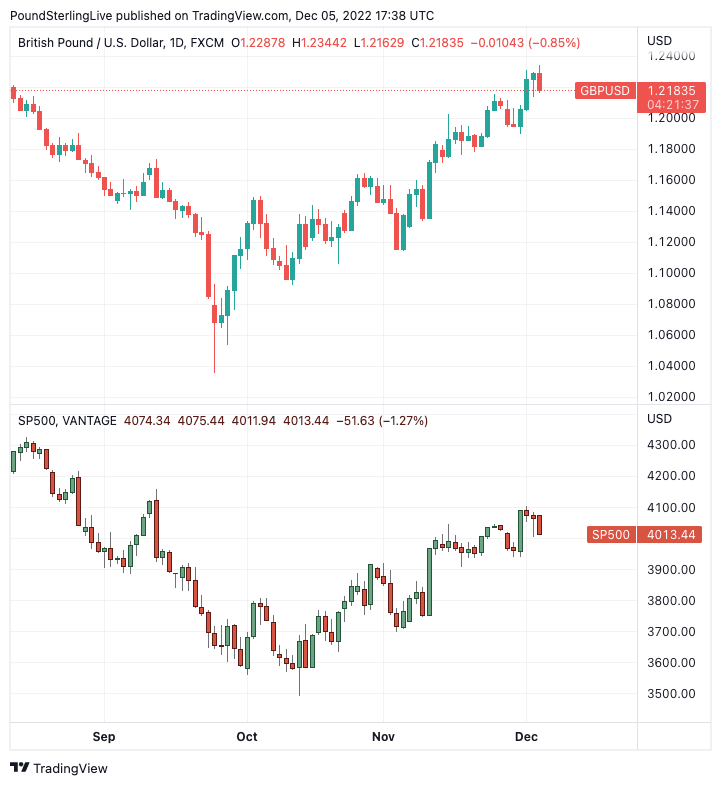

The Pound to Dollar (GBP/USD) has retreated from six-month highs in tandem with a reversal in fortunes for global stock markets and developments over the coming days will likely depend on whether the pullback deepens.

Stocks retreated from recent highs as investors worried the rally may be overstretched and after data showed that U.S. services industry activity unexpectedly picked up in November.

Tactically, investors will be looking to book some decent gains and Michael Wilson, Chief U.S. Equity Strategist at investment bank Morgan Stanley, says clients should consider taking profit after the S&P 500 reached a target of 4,000-4,150.

"Equity markets have come a long way in the last couple of months. The S&P 500 has rallied some 16% off its lows, with cooler US inflation data and hopes of a more cautious Fed serving as fuel for the advance," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

"Nonetheless, it is difficult to trust this recovery as the fundamentals haven't really changed. Valuations remain expensive and the data pulse continues to weaken as higher interest rates dampen economic activity, making the rosy earnings estimates for next year seem vulnerable to negative revisions," he says.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Fundamentals turned the Dollar higher with the U.S. ISM Non-Manufacturing PMI reading at 56.5 in November, which is well ahead of analyst expectations for 53.3 and represents an acceleration on October's 54.4.

The pick up in activity follows a better-than-expected U.S. jobs report on Friday and both these data releases suggest the Federal Reserve has further work to do if it wants to cool the economy and bring down inflation.

"ISM services PMI showing incredible strength in the face of higher rates. Inventories and new export orders the two weak areas as we see strength across many of the other elements," says Joshua Mahony, analyst at IG. "With strong services PMI and NFP figures, rising earnings may push for more hawkish Fed."

The Pound had scaled new six-month highs against the Dollar amidst a rally in equity markets as investors expect the Federal Reserve to slow the pace at which it hikes interest rates, as well as signs of a continued loosening in Covid restrictions in China.

Above: GBP/USD (top) and S&P 500 stock index (bottom).

"The expected slowdown in interest rate hikes, coupled with the potential unlocking, albeit gradual, of China’s zero-Covid policy, has helped support risk sentiment, which the British pound is highly sensitive to. GBP/USD has scored eight out of ten weekly gains, amounting to a circa 18% uplift," says George Vessey at Western Union Business Solutions.

Despite the recent retreat from multi-week highs, analysts continue to anticipate the potential for further near-term gains.

Vessey says the Pound has now retraced more than 50% of its 2022 drop and may look to test the 61.8% retracement level which is currently located around the mid-$1.24 region.

GBP/USD is quoted at 1.2213 at the time of writing, taking dollar payment rates on a typical bank account to around 1.1967, those at competitive cash providers to around 1.2095 and competitive international payment providers to approximately 1.2170.

"The theme in the markets continues to be a weaker USD with markets lowering interest rate expectations despite continued hawkish Fed speak and supportive data. The China narrative will likely keep up the risk-on mood in markets and keep pressure on USD," says Thanim Islam, Market Strategist at Equals Money.

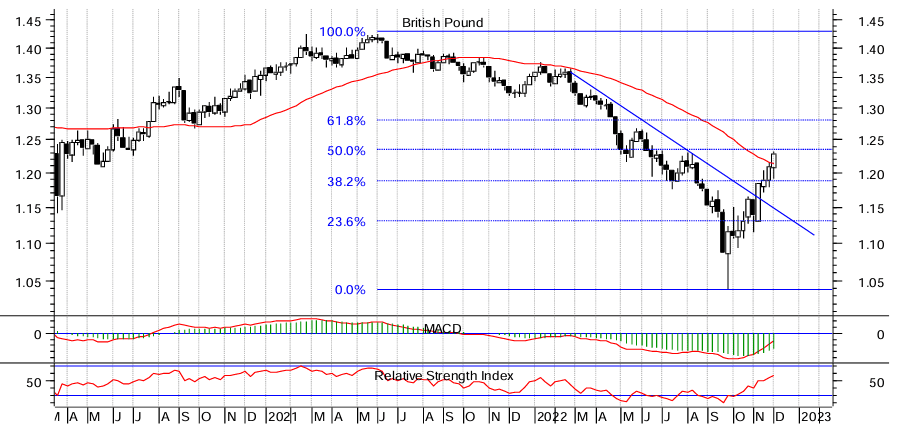

BilL McNamara, an analyst at The Technical Trader, says GBP/USD merits a closer look from a technical analysis perspective, following its latest price action.

"As the weekly chart demonstrates pretty clearly, there has been a clear shift in the UK’s currency’s fortunes over the last couple of months; while part of this move is likely down to the perception that the government’s finances are now in safer hands, the reversal in fortunes is also about the shift out of the dollar," says McNamara.

Above: Pound sterling to United States Dollar at weekly intervals with associated analysis from The Technical Trader. Consider setting a free FX rate alert here to better time your payment requirements.

The weekly chart gives a broader overview of market action and won't be particularly bothered by any near-term volatility in the exchange rate.

McNamara says investors appear to have come to the conclusion – "with some justification" – that the interest rate cycle in the US has peaked, and falling bond yields have been accompanied by a sell-off in the currency that has seen the trade-weighted dollar (DXY) fall by 9% since its September peak.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Can the move lower in USD continue to contribute to the GBP/USD uplift?

"It looks like there might be more to come on that front. As a result, sterling might reasonably be expected to gain further ground against the greenback, and the next target is 1.26 or so," says McNamara.

Jordan Rochester, an analyst at Nomura, also has the 1.26 figure in his sights.

"Flat GBP for now, but risk-on will = GBP/USD higher," says Rochester in a currency market briefing issued on Monday.

The Nomura analyst says the current market regime is not so much about currency-specific idiosyncratic factors, but rather "is the beta to risk sentiment positive or not?".

"Despite clear reasons for GBP to underperform its European peers from a macro point of view (UK housing in decline, BoE arguably more dovish than its peers, less fiscal spending in the UK and weaker ETF flows into the UK), this is also a very consensus view. We are still probably in a phase of position unwinding of the main 2022 trades and GBP shorts are clearly one of them," he adds.

Rochester says it remains difficult for Sterling to underperform while equity markets continue to rally.

Therefore, whether a 'Santa rally' can emerge over the coming days could be key to how far Pound-Dollar ascends.

"What does this mean for GBP/USD? Because of our EUR/USD view it’s quite possible that it may breach above 1.25 by mid-December, much earlier than expected with no meaningful resistance until 1.2667," says Rochester.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks