Pound Hits New 2025 High

- Written by: Gary Howes

Image © Adobe Images

The Pound Sterling reached a new 2025 high against the U.S. Dollar, and further near-term gains are possible says a Lloyds Bank technical strategy briefing.

The Pound-to-Dollar exchange rate reached 1.2708, its highest level since December 18, amidst a steady rise in expectations that the Federal Reserve has scope to cut interest rates more than twice in 2025.

Just two weeks ago, the market saw one measly cut falling in December 2025, but the market has since added a further 30 basis points to expectations amidst signs the U.S. economy is cooling from the red-hot expansion seen at the end of 2025.

"As US exceptionalism fades, USD has room to trade softer," says Christopher Wong, FX Strategist at OCBC Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

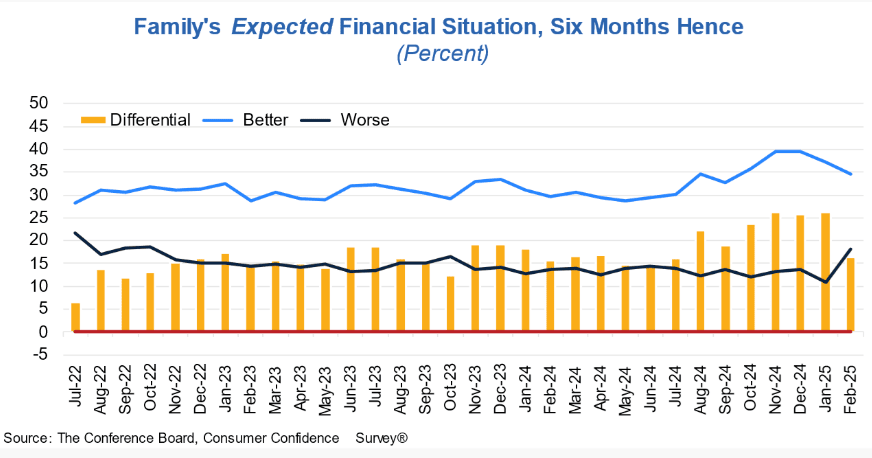

New data from The Conference Board released Tuesday showed consumer confidence has declined noticeably since the new President took power amidst the helter-skelter of policy announcements and restructuring.

The data showed confidence in January fell to its lowest level since June last year, while the expectations index also plummeted to the lowest level since June.

"Marked weakness in U.S. consumer confidence data added momentum to the idea that job losses in the public sector could create a tipping point for the US labour market that pushes the economy into recession," says Daragh Maher, Senior FX Strategist at HSBC.

"This is a very different tone to the generally upbeat nature of US activity data, which has seen consensus GDP forecasts for 2025 move ever higher over the last year. It is possible that the U.S. exceptionalism theme is peaking out," he adds.

Above: Increased pessimism will press the brakes on the 'hot' U.S. economy.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"Pessimism about future employment prospects worsened and reached a ten-month high," said The Conference Board, commenting on its findings.

Deteriorating employment prospects coincide with Elon Musk's jobs bonfire at Federal institutions under the DOGE programme, which seeks to cut spending and make government more efficient.

Meanwhile, the cost-cutting drive raises expectations that Trump's administration will achieve its objective of capping and then lowering the country's growing debt burden. An early negative side effect of these efforts will be weaker growth and the end of the U.S. exceptionalism trade, which is inherently disinflationary.

However, analysts at Berenberg warn fears for the U.S. economy are overblown.

"We do not believe that the recent downside surprise in macroeconomic data and Department of Government Efficiency (DOGE)-driven job cuts justify concerns about economic growth in the U.S. We expect the economy to grow above trend in 2025, with the labour market remaining healthy despite slower employment growth," says Atakan Bakiskan, U.S. Economist at Berenberg Bank.

He expects DOGE-driven layoffs to total a maximum of 300k by year-end, which would reduce nonfarm payrolls by up to 30k per month. "This should not significantly impact the U.S. labour market," says Bakiskan.

If correct, the spell of Dollar weakness will be broken in the coming weeks, hinting that GBP/USD upside has its limits.

Next Objectives for Pound-Dollar

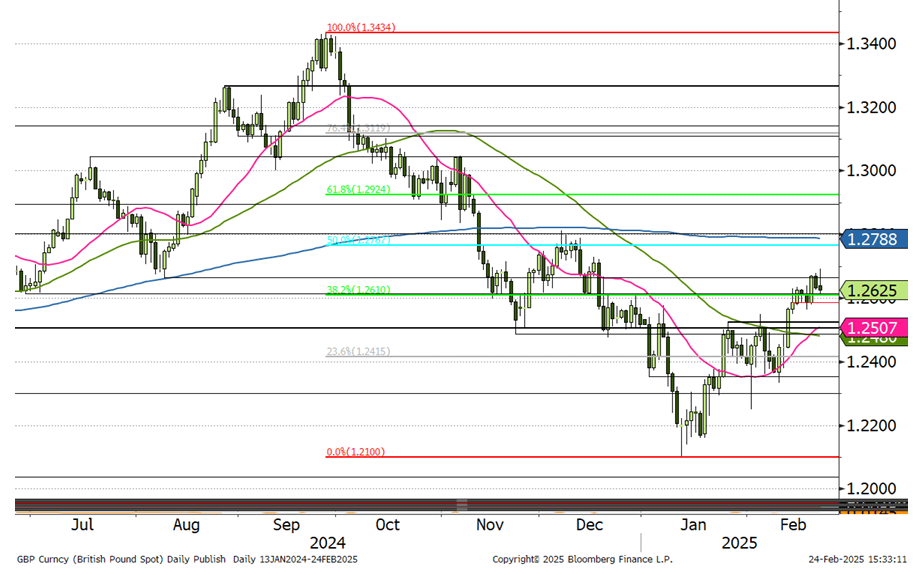

Lloyds Bank technical analyst Nick Kennedy says GBP/USD retains positive momentum and there is now scope for a push on towards 1.2789/2803, which still looks the ultimate objective."

Above: Pound-to-Dollar exchange rate daily technical studies. Image courtesy of Lloyds Bank.

GBP/USD has risen 2.0% in February, reversing and overcoming the 1.0% decline recorded in January, bringing an end to a run of four consecutive months of decline.

Is the selloff, which started in October, now complete?

"For bearish sentiment to re-establish, we’d need a slide back below the ~1.2487/1.2523 band," says Kennedy.

From a tactical perspective, he says "modest longs" are worth retaining here, "with a buy on dips strategy the plan while we're north of 1.2480."