Revenge of the Dollar Delivers Pound Sterling's Reality Check

- Written by: Gary Howes

- USD back on top

- Sends GBP, EUR sharply lower

- Markets in the red

- OPEC cuts oil production

- Fed committed to further hikes

Image © Adobe Images

The Dollar is serving up a reminder that it remains the preferred asset in the current complex and uncertain global economic environment.

Dollars were bought, stocks and all other currencies sold as investors called time on a recent rally in sentiment, spurred on by an activity-crunching rise in global oil prices.

Oil prices rose after OPEC announced in Vienna they had agreed to cut global production by two million barrels a day.

All the while the prospect of ever higher interest rates at the U.S. Federal Reserve loom, pushing up the cost of finance and enhancing the demand for the liquidity and safety of cash, while also making U.S. assets all the more attractive.

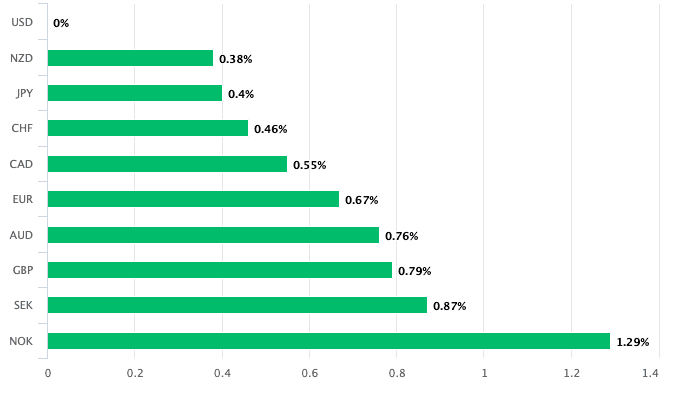

Above: The USD was the best-performing major currency on Oct. 05.

"Further substantial rate hikes are likely between now and the end of the year, it is too soon, in our view to expect the USD to backtrack significantly near-term," says Jane Foley, Senior FX Strategist at Rabobank.

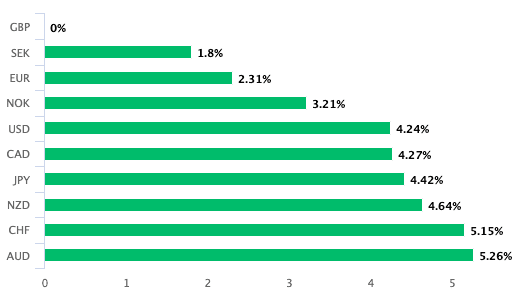

The Pound was particularly vulnerable to the Dollar given its strong advance over recent days. The Pound is the best-performing currency of the past week, leaving it especially exposed to a pullback:

Above: GBP is the best-performing major currency of the past week, leaving it exposed to a deeper retracement than most.

The Pound to Dollar exchange rate (GBP/USD) is down over a percent at the time of writing at 1.13, taking international payment rates at high-street banks to approximately 1.1065 and rates at independent payment specialists to around 1.1257.

The Euro was another laggard in global FX, falling a per cent against the Dollar. "We favour selling rallies in EUR/USD," says Foley, "we remain USD bulls and retain our EUR/USD 0.95 target on a 1 to 3-month view."

The Dollar fell and markets rallied Tuesday after U.S. labour market data came in much weaker than expected, raising hopes that the Fed could soon slow its frantic pace of rate hikes.

The Bureau of Labor Statistics (BLS) said on Tuesday that job vacancies fell from 11.17 million to 10.05 million over the course of August. "In one line: The first clear sign of weakening labor demand will pressure the Fed to do less if it persists," said Ian Shepherdson, chief economist at Pantheon Macroeconomics, in the wake of the data.

But fast forward 24 hours and the release of U.S. non-farm employment data from ADP showed a gain of 208K jobs in September, beating expectations for 200K and the previous reading of 185K, serving as a reminder this remains a strong economy.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Also, the monthly ISM Services Index declined only modestly in September, according to data out midweek.

At 56.7 it is still consistent with expansion in the sector.

Federal Reserve Governor Philip Jefferson said on Tuesday, in the maiden speech of his tenure, inflation "may take some time," to come down and the Fed "are committed to taking the further steps necessary."

Markets are expecting a fourth consecutive 75-basis-point rate hike in November.

"With Fed officials continuing to bang their hawkish drum, the key underlying driver of the dollar’s strength remains intact and the risk of a continued self-reinforcing dollar melt-up is high," says Jonas Goltermann, Senior Markets Economist at Capital Economics.

Analysts at investment bank Nomura said in a recent note, "the simple fact is that the escalated U.S. Dollar appreciation of late is effectively the U.S. 'exporting inflation to rest of world,' and has iterated the 'Our currency, your problem' dynamic of old, causing tremendous strains economically...and increasingly, metastasising in markets."

The note adds that "the velocity of things breaking around the world (Yen, Yuan, Euro, Sterling, SONIA, Gilts, MBS, Lev Loan deals, the entirety of the UK LDI / Pension complex) is obviously a 'neon swan' telling us that we are clearly now in the 'market accident' stage from the tightening surge".

The global environment, therefore, faces a wall of worry and, at the very least, the Federal Reserve must signal it is ready to slow down its hiking cycle for the pressure to ease.

Until then, the Dollar remains supreme.

If you are looking to secure your payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.