Dollar Stronger after "U.S. Inflation Hit a Boiling Point"

- Written by: Gary Howes

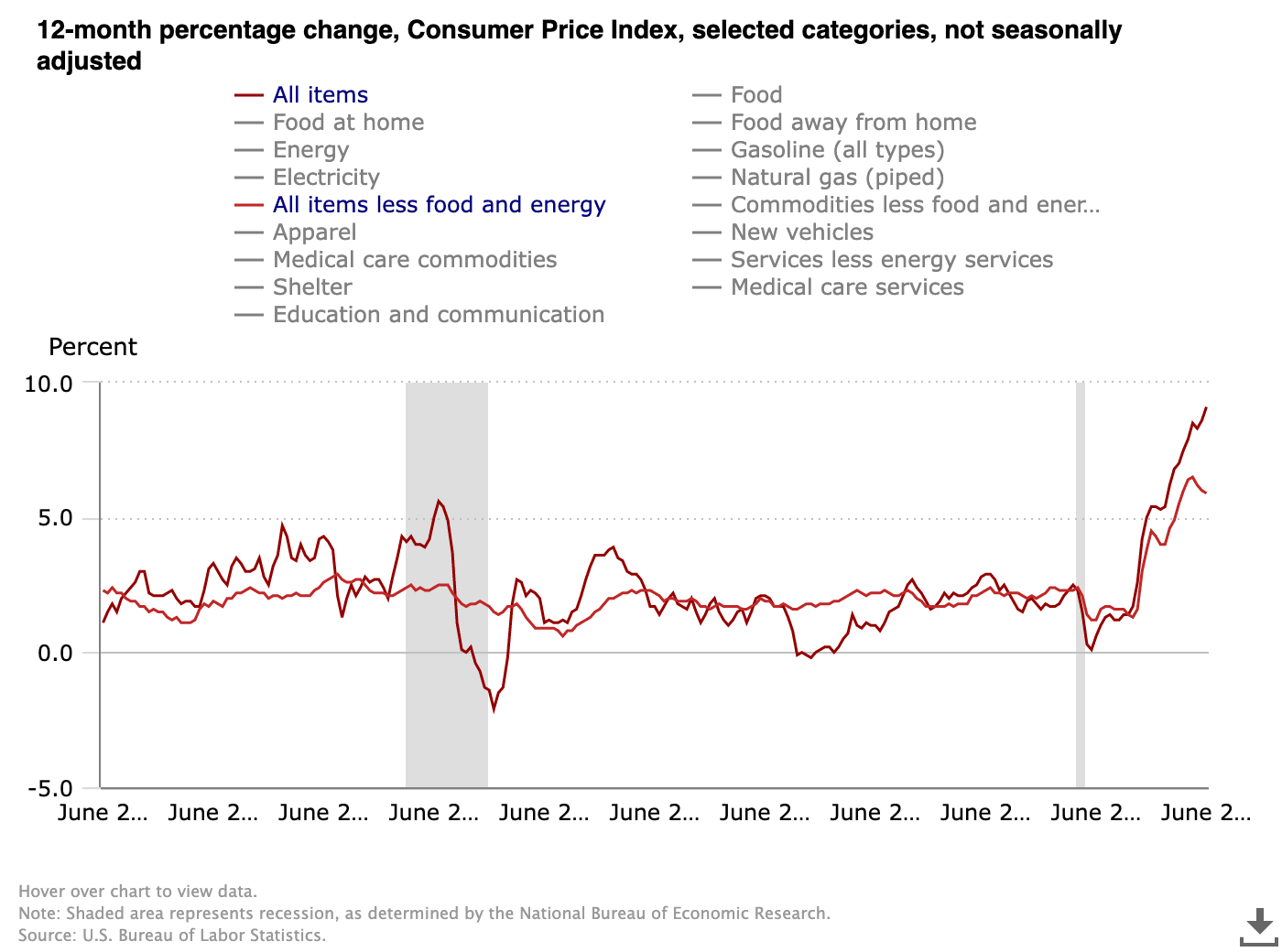

- Inflation reads at 9.1%, beating expectations

- USD initially bid

- Odds of a 100bp Fed hike rise

- As do odds of an U.S. recession

Image © Adobe Images

A stronger than expected inflation reading out of the U.S. has fuelled fresh bidding interest for an already dominant Dollar.

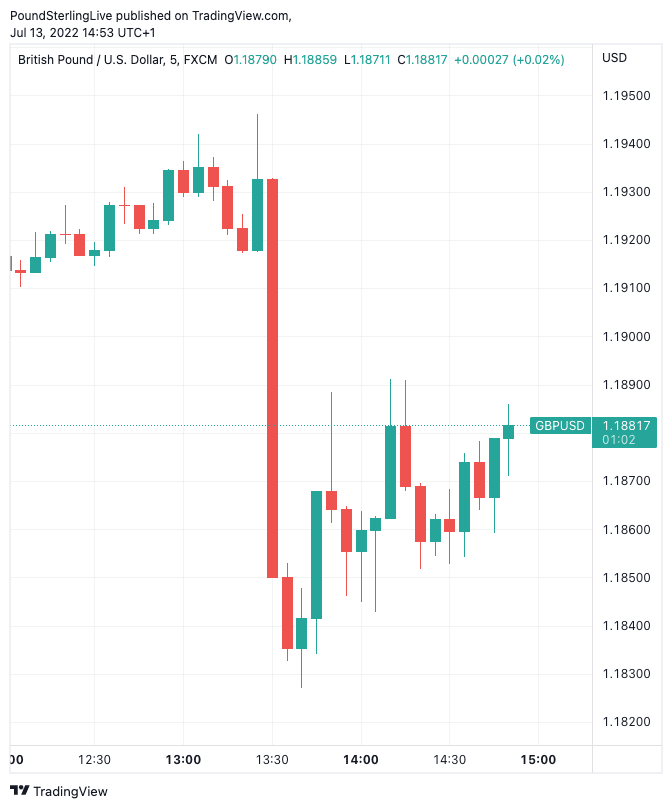

The Dollar raced back towards parity against the Euro and tested 1.1840 against the Pound in the immediate minutes following the inflation reading which revealed U.S. CPI read at 9.1% year-on-year in June.

This is higher than the market's anticipated reading for 8.8% and represents an increase on May's 8.6%.

"U.S. inflation hit a boiling point in June," says Claire Fan, Economist at RBC Economics. "Price pressures still much too strong to delay Fed rate hikes."

The immediate message to the markets that peak inflation could yet remain some way off in the U.S., heaping pressure on the Federal Reserve to hike interest rates and engineer a recession in the economy to cool demand.

The BLS revealed Core CPI - which strips out the effects of inputs such as fuel - read at 5.9%, ahead of the 5.7% markets were expecting and a shave lower than May's 6%.

Shaun Richards, an independent economist, says a rough initial estimate suggests U.S. inflation is about 9.5% on UK and Eurozone measures of CPI.

UK inflation is at 9.1% year-on-year, that of the Eurozone is at 8.6%.

The U.S. economy does not face the same acute gas price issues as European nations and this gives a strong indication of how broadband U.S. inflation is.

"Nothing positive to flag here for the Fed. Headline stronger, core stronger in YoY and MoM terms. Nothing transitory about these numbers - the inflation process seems well established by now," says Patrick Saner, Head Macro Strategy at Swiss Re.

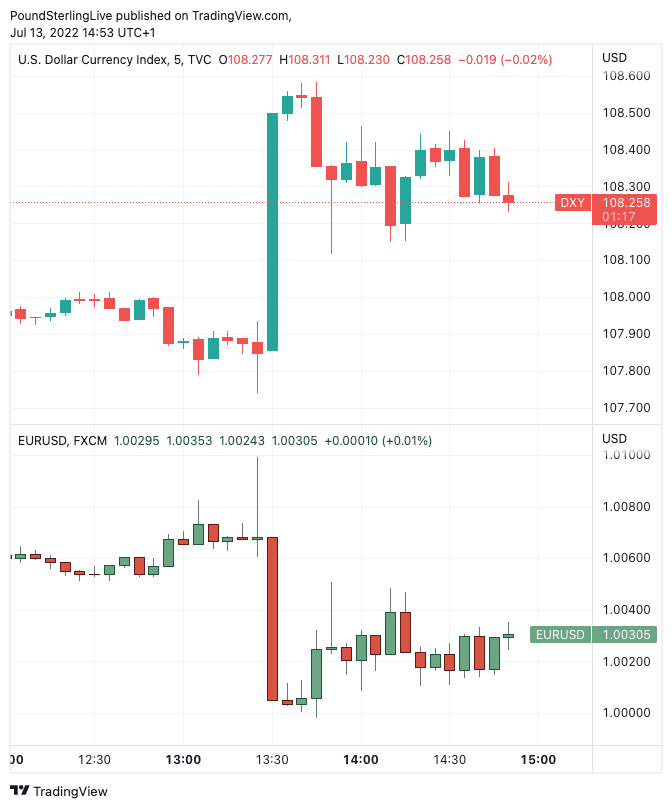

The Dollar rose 0.60% in the give minutes following the release with the Dollar index - a broad measure of USD strength - going to 108.37.

Above: Dollar index (top) and EUR/USD (bottom) at 5-minute intervals.

The Pound to Dollar exchange rate fell 0.70% in the five minutes following the release and is at 1.1835 a the time of writing, dollar payments on a typical bank account are in the region of 1.15 and independent providers are offering rates around 1.16.

The Euro to Dollar exchange rate fell 0.63% in the five minutes following the release to quote at 1.0028, dollar payments on a typical bank account are in the region of 0.9737 and independent providers are offering rates around 0.9950.

Regarding the currency market's reaction, much will now depend on how the battle for Euro-Dollar parity plays out given the significant option market and speculative activity that accompanies this area.

"The US inflation data is clearly attracting the long USD macro trade & explains the move down to 1.00 but it looks clear to me euro buyers are staking up again," says Neil Jones, head of institutional FX sales at Mizuho.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"Which media outlet is going to leak a 100bps Fed hike. That's where the market sentiment will shift to given the beat in core CPI.... used/new car prices are strong again. Shelter too. Breadth of CPI gains doesn't look like it's easing," says Viraj Patel, Macro Strategist at Vanda Research.

Money market pricing shows investors currently affix a 22% Chance of an 100 basis point Fed hike in July, with the odds of a 75bp hike rising to a near-certainty 78%.

Another key money market measure of investor expectations - the 2 year / 10 year yield curve - meanwhile inverted by its greatest degree since 2006, a strong signal investors believe recession risks have risen.

Above: GBP/USD at five-minute intervals.

But a recession is exactly what the Fed needs to strangle demand in the economy and bring it back in line with supply, thereby cooling inflation.

"It is the breadth of the price pressures that is really concerning for the Federal Reserve. With supply conditions showing little sign of improvement the onus is the on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions," says James Knightley, Chief International Economist at ING Bank.

At the time of this article's most recent update the bid under the Dollar has dried up somewhat, potentially likely to the aforementioned roadblocks littered around Euro-Dollar parity.

For crosses such as Pound-Dollar the broader trend in the Dollar matters and this in turn largely rests with Euro-Dollar, the world's most liquid currency pair.

Some analysts remain of the view that a continuation of the Dollar' rally is ultimately highly likely given the sheer acceleration in Fed interest rate hike expectations.

"EURUSD bounced after effectively reaching parity. The rally is likely to be short-lived as overarching macro forces remain negative for the EUR. Indeed, the evisceration of the much heralded current account should continue to leave the EUR prone to a sub-parity paradigm," says a note from TD Securities' Global FX Strategy team.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes