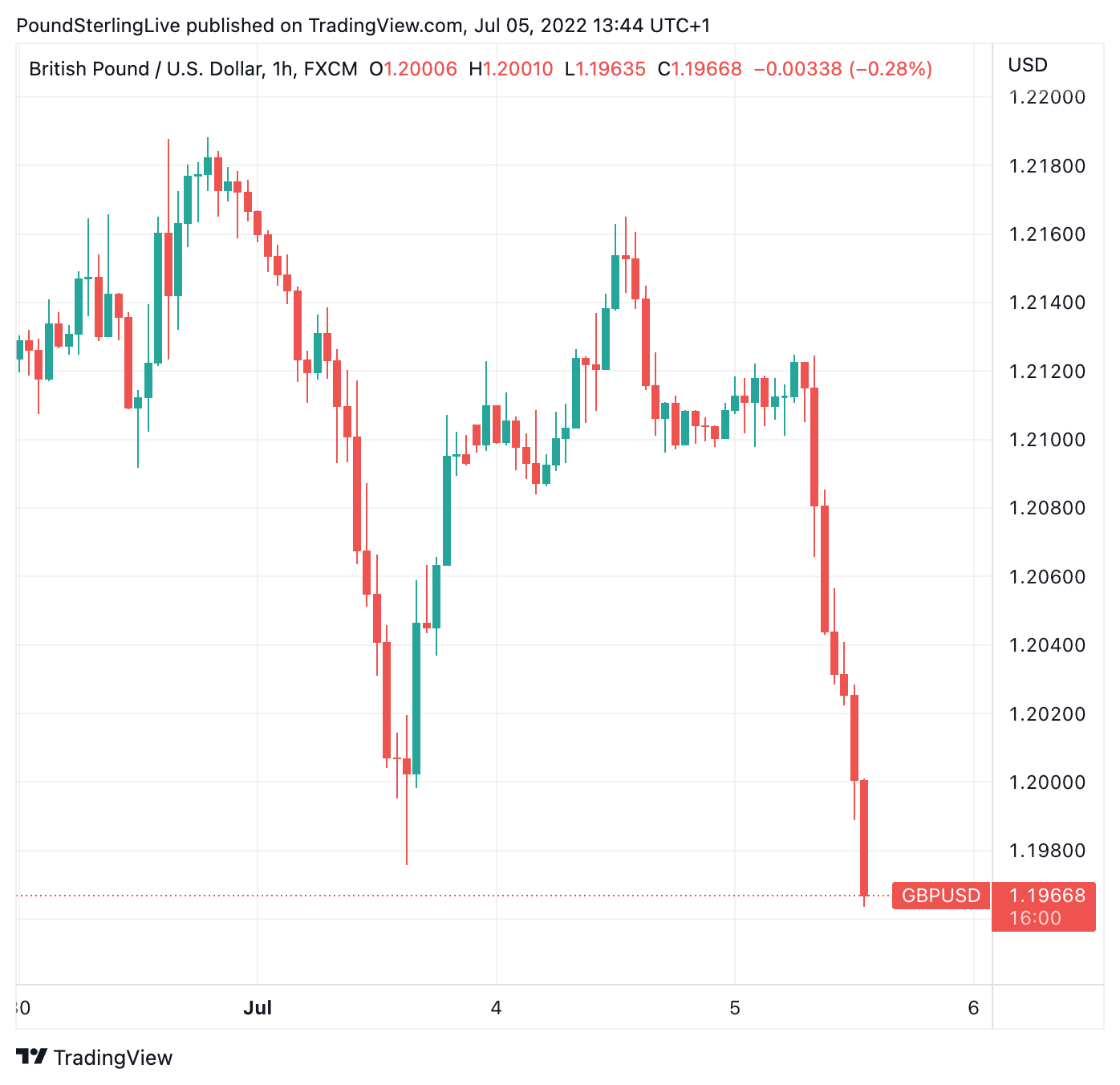

Gas Crisis: Pound Falls 1.25% against Dollar, GBP/USD Back Below 1.20

- Written by: Gary Howes

- GBP/USD down 1.0% to 1.1950

- As European gas market crisis deepens

- Amidst Russian supply squeeze

- and Norwegian gas field worker strikes

Image © Adobe Images

European currencies are back under pressure and testing multi-year lows against the Dollar as investors react to another surge in European gas prices.

It is the Euro that is bearing the brunt of the pain with a 1.30% loss to the Dollar at the time of writing taking it back to levels last seen in 2003, however Pound Sterling is not immune given the UK gas market's connections to Europe and is a percent lower and back below 1.20.

The British wholesale gas price for day-ahead delivery leapt nearly 16% Tuesday, adding to a similar gain made the day prior, raising the prospect of record breaking inflation rates and a sharp economic growth slowdown.

European gas prices surged after news of supply constraints from Norway where gas field workers are striking.

Sensing an opportune moment to squeeze the Europeans, Russia might have intentionally ceased gas flows through the Yamal pipeline.

The Yamal news broke this morning and the Euro and Pound were promptly sold and the ever-safe haven Dollar bought.

Flows of Russian gas via the Nord Stream 1 pipeline and deliveries through Ukraine also edged lower on Tuesday according to Reuters.

The developments escalate inflationary pressures and raises concerns the UK and Eurozone economies will see growth rates slip further.

The Pound to Dollar exchange rate fell to a low of 1.1983, taking bank account international payment quotes to as low as 1.1565 while independent payment specialists offered rates around 1.1950.

Above: GBP/USD at daily intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Surging gas prices will inevitably push up inflation rates across Europe and slow growth in fast stalling economies.

The Bank of England and European Central Bank meanwhile have little choice but to raise interest rates in the face of surging inflation, although the payoff will be even lower growth.

High inflation and falling growth spells stagflation.

Currency markets are betting that those currencies belonging to stagflationary economies will continue to lose value to the Dollar. (Set your FX rate alert here).

The European gas market has entered crisis mode after German gas transportation operator Gascade earlier today said exit flows at the Mallnow metering point on the German border dropped to zero after earlier flowing at 2,190,136 kilowatt-hours per hour (kWh/h), the data showed.

The International Energy Agency says in their latest gas market review the share of Russian gas (including LNG) meeting total EU demand rose from 30% in 2009 to 47% in 2019.

The strong LNG inflow in 2020, amid global oversupply, depressed the share of Russian gas to around 40%, says the report, adding it stayed at a similar level in 2021, driven by Gazprom’s own strategy of reducing short-term sales to the bloc, despite spare supply capacity being available and high revenue potential on the export markets.

This strategy appears to be in play once more: the Yamal shutoff comes a day after gas prices spiked on news of industrial action due to take place in Norwegian gas fields.

Strikes over pay began on Tuesday and could cut the country's gas output by almost a quarter and exacerbate supply shortages in the wake of the Ukraine war.

About 15% of Norway's oil output could also be cut by Saturday, according to a Reuters calculation based on the plans of union members to gradually escalate their action over the coming days.

Norway is Europe's second-largest energy supplier after Russia.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks