The 'War Trade' Favours Further Pound / Dollar Weakness

- Written by: Gary Howes

Image © Adobe Images

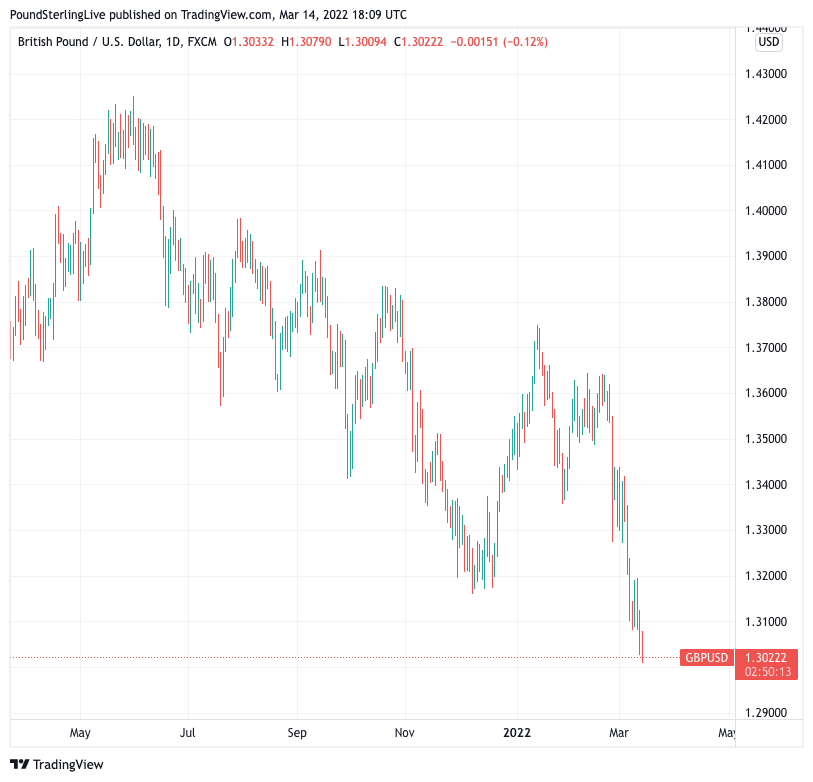

Pound Sterling looks set to break below the psychologically significant $1.30 level prod the midpoint of a long-term trading range near 1.28, according to new analysis.

The Pound to Dollar exchange rate has fallen significantly during the course of the Ukraine war and further losses look likely for as long as fighting continues and global and UK economic growth rates are downgraded.

"Although GBP/USD has yet to trade below 1.30, we were last through the level in November, the prospect of a collapse in UK real disposable incomes, impacting discretionary spending point towards GBP/USD heading towards the mid-point of the 2018-2020 trading range, (1.1412-1.4377), at 1.2894," says Jeremy Stretch at CIBC Capital Markets.

The Pound would nevertheless find some momentary relief if a ceasefire to hostilities in Ukraine is agreed.

Ukrainian presidential advisor Mikhail Podolyak said on Monday that the negotiations between Russia and Ukraine have ended but are to be resumed on Tuesday.

"A technical pause has been taken in the negotiations until tomorrow. For additional work in the working subgroups and clarification of individual definitions. Negotiations continue," he said.

In a video address released on Tuesday, President Zelensky says there is an "approaching peace for Ukraine." However, the address offered no new details on why this might be.

Should peace remain elusive, an extension of Sterling downside against the Dollar and most other currencies is possible.

"Financial markets have turned into one gigantic ‘war trade’ in recent weeks. Politics has overshadowed economics, with most assets driven entirely by the conflict in Ukraine. This phenomenon is on full display today after negotiators on both sides signalled progress in the latest peace talks and kept the door open for a ceasefire soon," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

Above: GBP/USD has been trending lower since May 2021, with little to suggest the move is over.

- GBP/USD reference rates at publication:

Spot: 1.3042 - High street bank rates (indicative band): 1.25836-1.2674

- Payment specialist rates (indicative band): 1.2922-1.2948

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Pound to Dollar exchange rate started 2022 at 1.3529 but is now at 1.3030 at the time of writing. The high for the year was at 1.3749, reached on January 13.

That Ukraine and Russia continue to talk is supportive of risk, but the 'red lines' drawn by both sides look too difficult to blend into a compromise.

For instance Russia wants Ukraine to cede Crimea while also ceding Luhansk and Donetsk. For its part, Ukraine said it would not cede an inch of territory.

"A diplomatic solution that brings a rapid end to the war seems unlikely at this stage.2 As such, we think that the commodity/terms of trade shocks that have hit global markets are likely to persist as sanctions and broader tensions may take substantial time to unwind," says a weekly currency research note from Barclays.

As long as anxieties persist and peace is elusive, the Pound is likely to struggle and the Dollar find a steady bid.

"The USD is simply king in G10," says a note from JP Morgan's spot trading desk in London. "EUR and GBP remain bottom of the pile for us."

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

From a technical standpoint, JP Morgan says 1.30 will likely provide some round number support but 1.2850 is really the next area of strong technical support.

"Resistance resides at 1.3120/25 with 1.3190/00 above," says JP Morgan.

The week ahead will also see both the Federal Reserve and Bank of England update monetary policy, with both set to raise interest rates by 25 basis points.

"The perk to sterling from monetary policy divergence against its rivals is expected to narrow with the Fed all but certain to raise rates by 25 basis points Wednesday," says Joe Manimbo, a foreign exchange analyst at Western Union.

This therefore looks to be a neutral development from a relative policy perspective, so markets will instead be looking at what guidance regarding future rate hikes is offered.

There are 178 basis points of hikes expected from the Fed in 2022, while the number from the Bank of England stands at 134.

The central bank that can push expectations higher faster than the other would likely see its currency benefit.

"Markets are already pricing in four rate increases over the next three meetings, which is a tall bar for the BoE to overcome. This doesn’t leave much scope for sterling to benefit from monetary policy this week," says Hadjikyriacos.